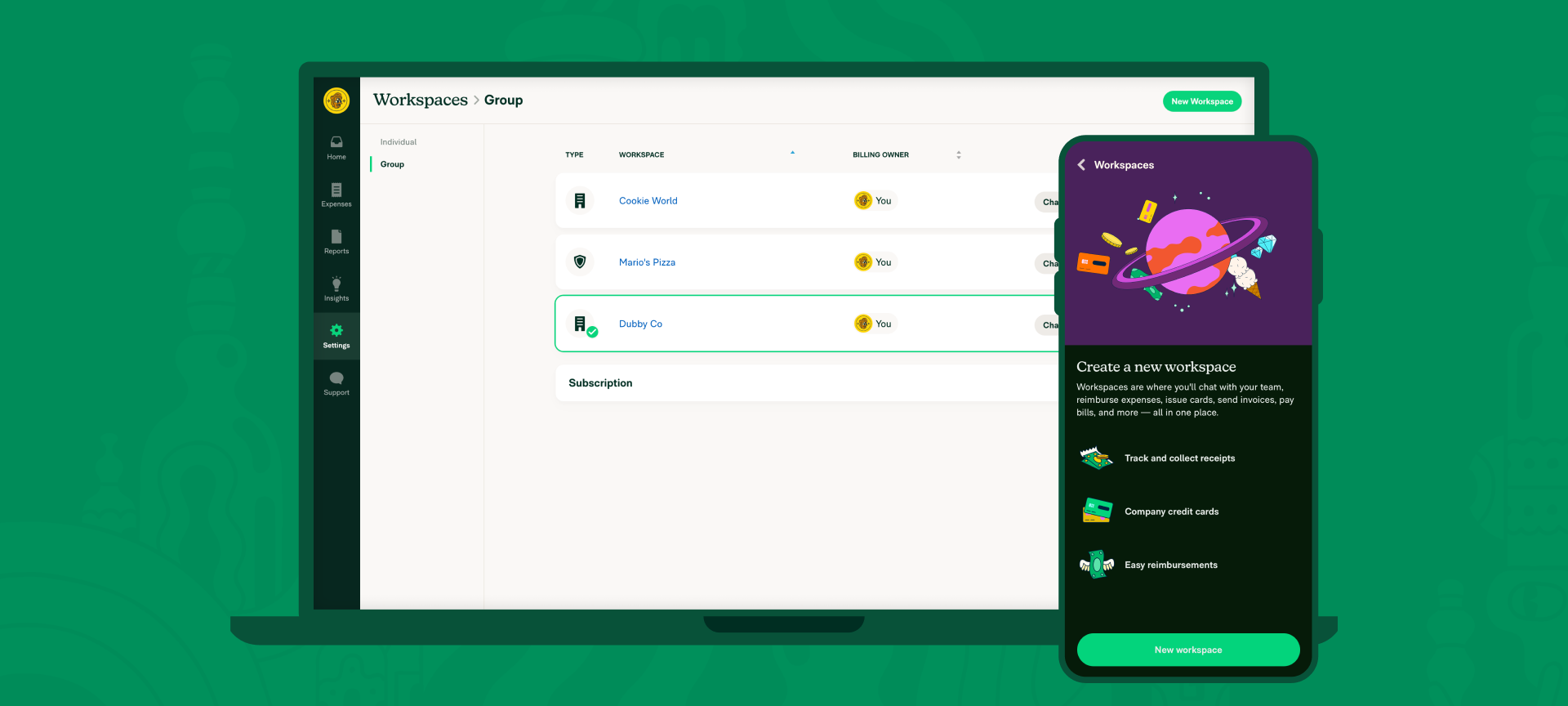

New Expensify progress update

We’ve been testing pieces of New Expensify functionality here and there – mainly at conferences this year – in order to gather feedback and make improvements. Pretty standard stuff. But what’s not even close to average is what we’re building. I’ll tell you all about it in this post.