Expensify Visa® Commercial Card

Expensify Visa® Commercial Card

The corporate card to own for February 2026

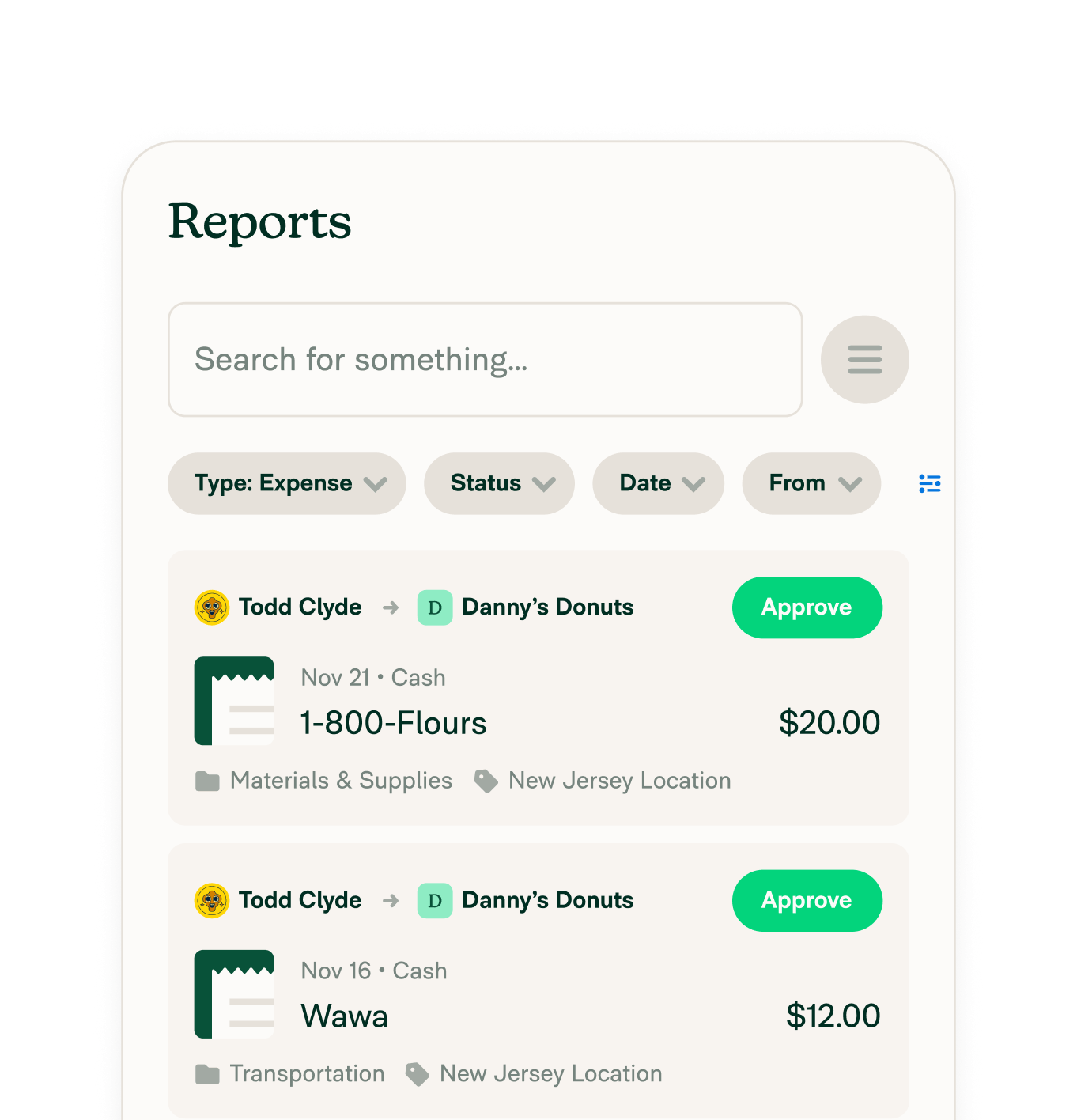

Whether your salesperson is grabbing coffee on a business trip or your CTO is paying the monthly Amazon Web Services bill, you can use the Expensify corporate card to automatically import and account for all your company’s expenses without lifting a finger, with features like:

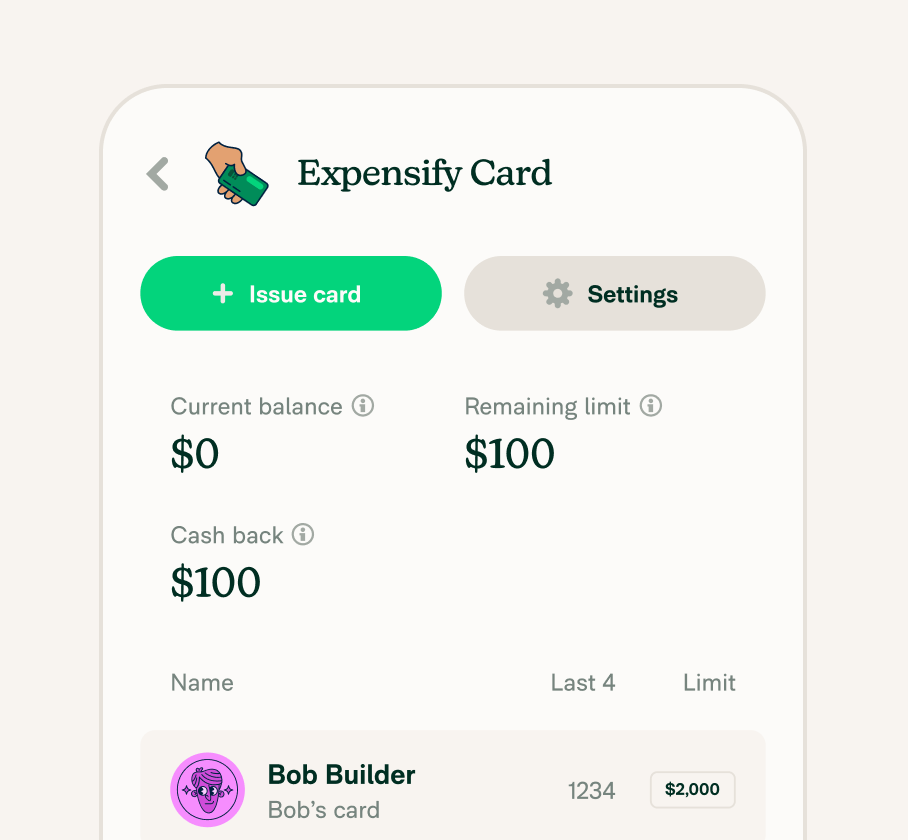

Up to 2% cash back for US cards

Smart

Limits

eReceipt

coverage

Tax

compliance

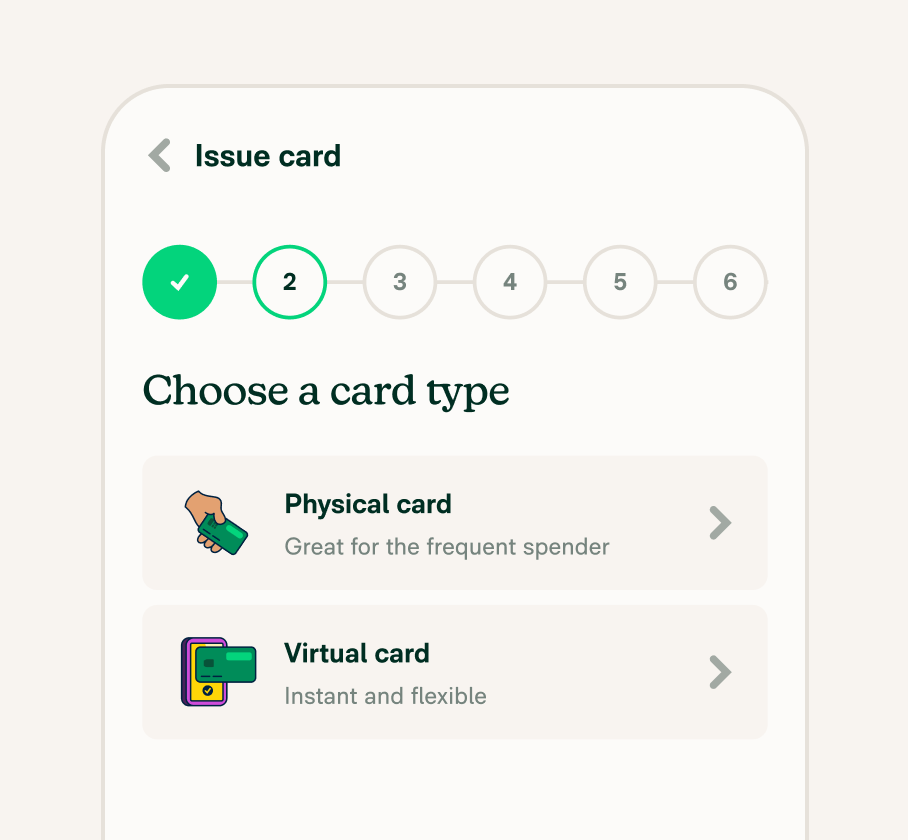

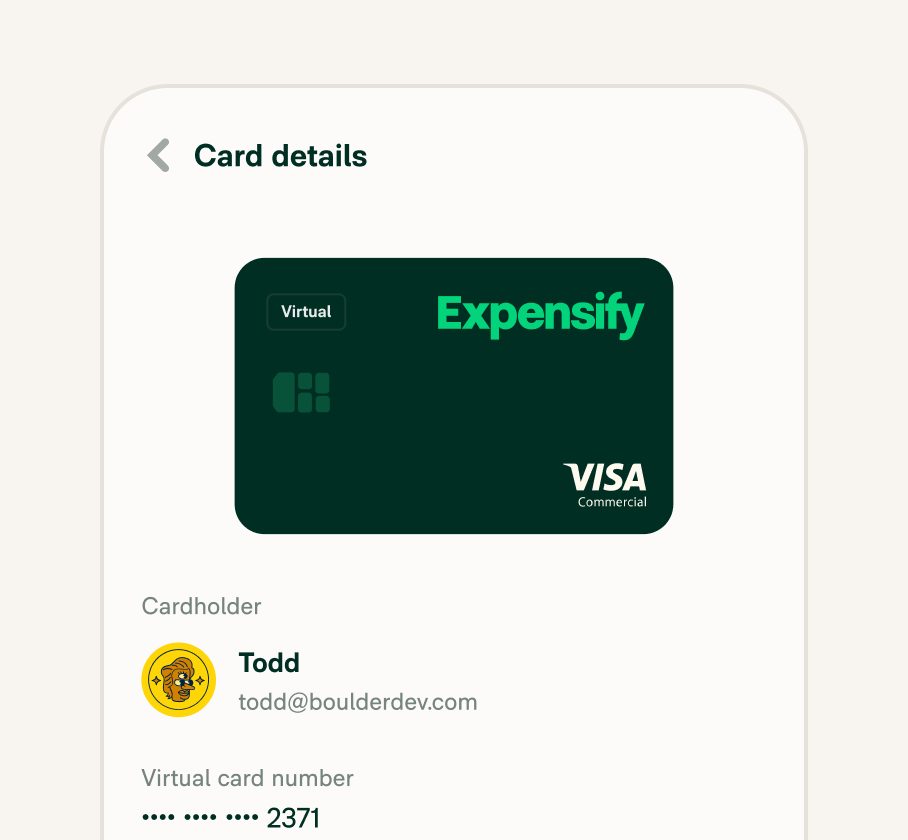

Unlimited virtual cards

Immediate transaction sync

Just swipe (or tap!) your Expensify company card, and your expenses are done—it’s that simple.

Explore the Expensify Visa® Commercial Card

The Expensify Card scales easily from small business owners and their employees to global enterprise companies and their teams. That means it’s built for everyone in between, too, such as accountants and their clients, real estate agents, construction workers, law firms, nonprofits, and startups. No matter what you do, the Expensify Card helps you keep personal and business expenses separate so you’re ready for tax season.

Get started in minutes

Application and setup only take a few minutes. Your virtual card will be available immediately, and your physical card will arrive in a few days.

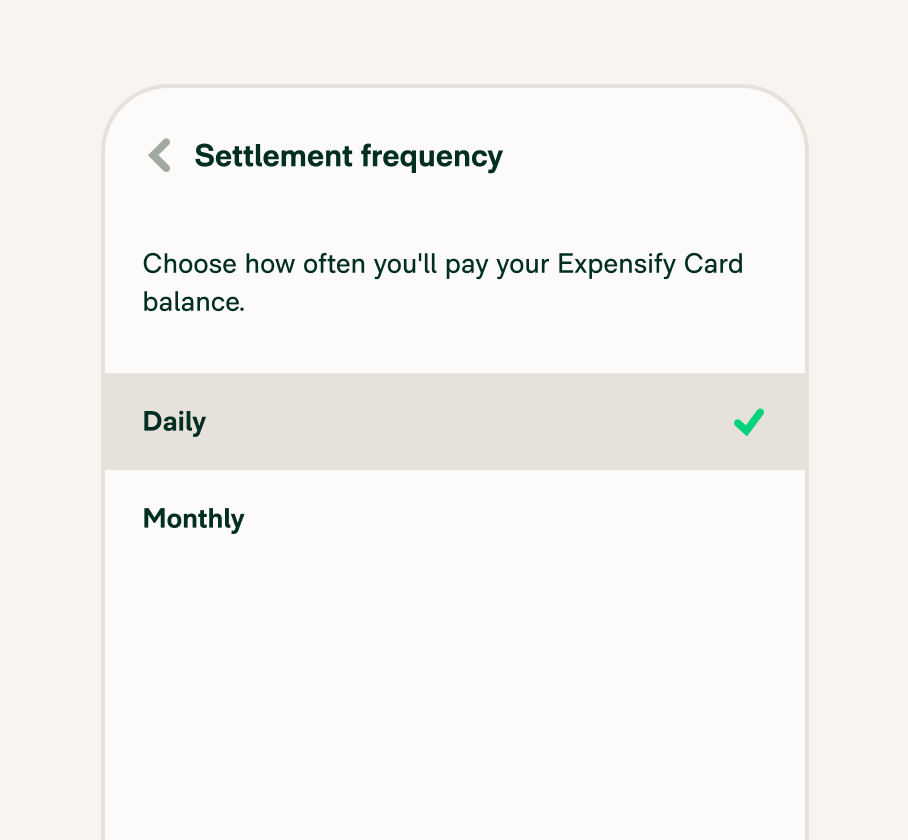

Settle up monthly or daily

Decide whether to settle your Expensify Card payment monthly or daily. Employees can only spend what’s in your business bank account.

Enjoy an unbreakable connection

The card is an extension of the Expensify app, so transactions sync immediately and reliably.

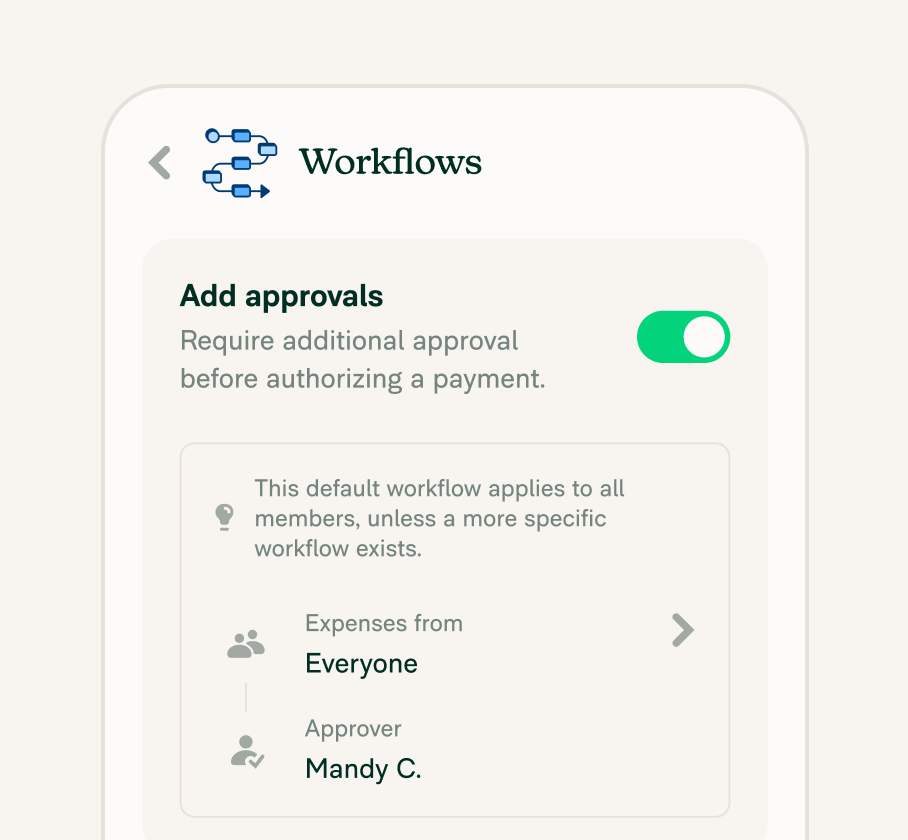

Ensure realtime compliance

Purchases run through our Rogue Agent Detection system and against your custom workspace rules to ensure compliance and protect your company from fraud.

Get up to 2% cash back

Get 1% cash back with every swipe — no minimums necessary — and 2% back if you spend $250k+/month across cards. Applies to US purchases on US cards only.

Save 50% on your Expensify bill

Save 50% on your monthly Expensify bill when you use the card for at least half of your organization’s monthly purchases.

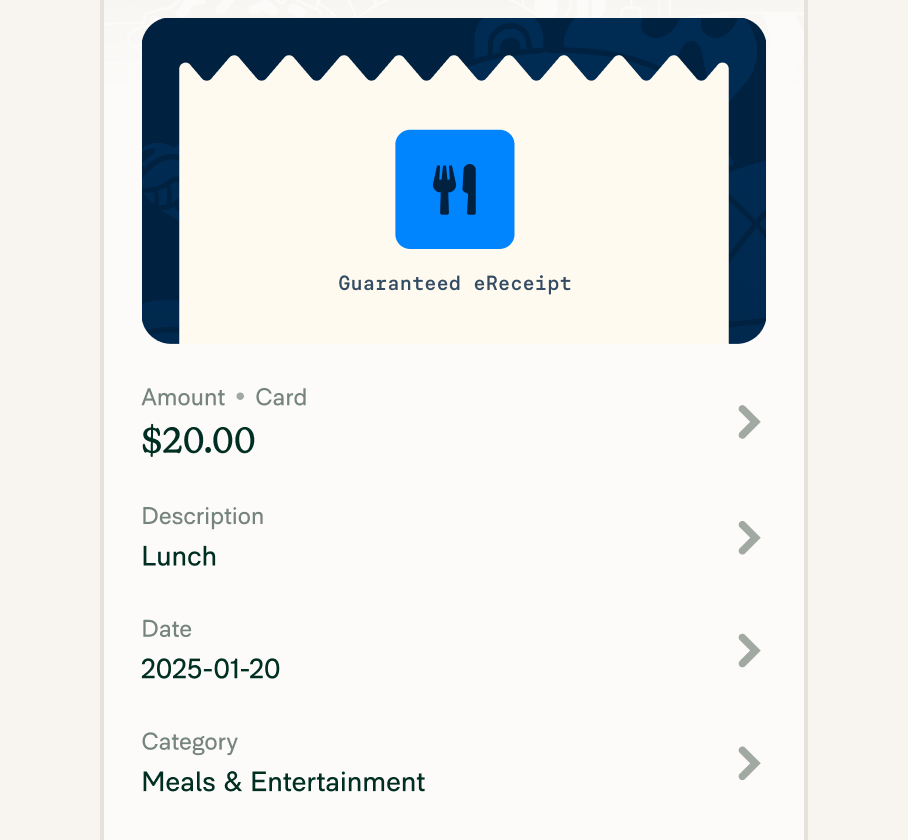

Ditch paper receipts

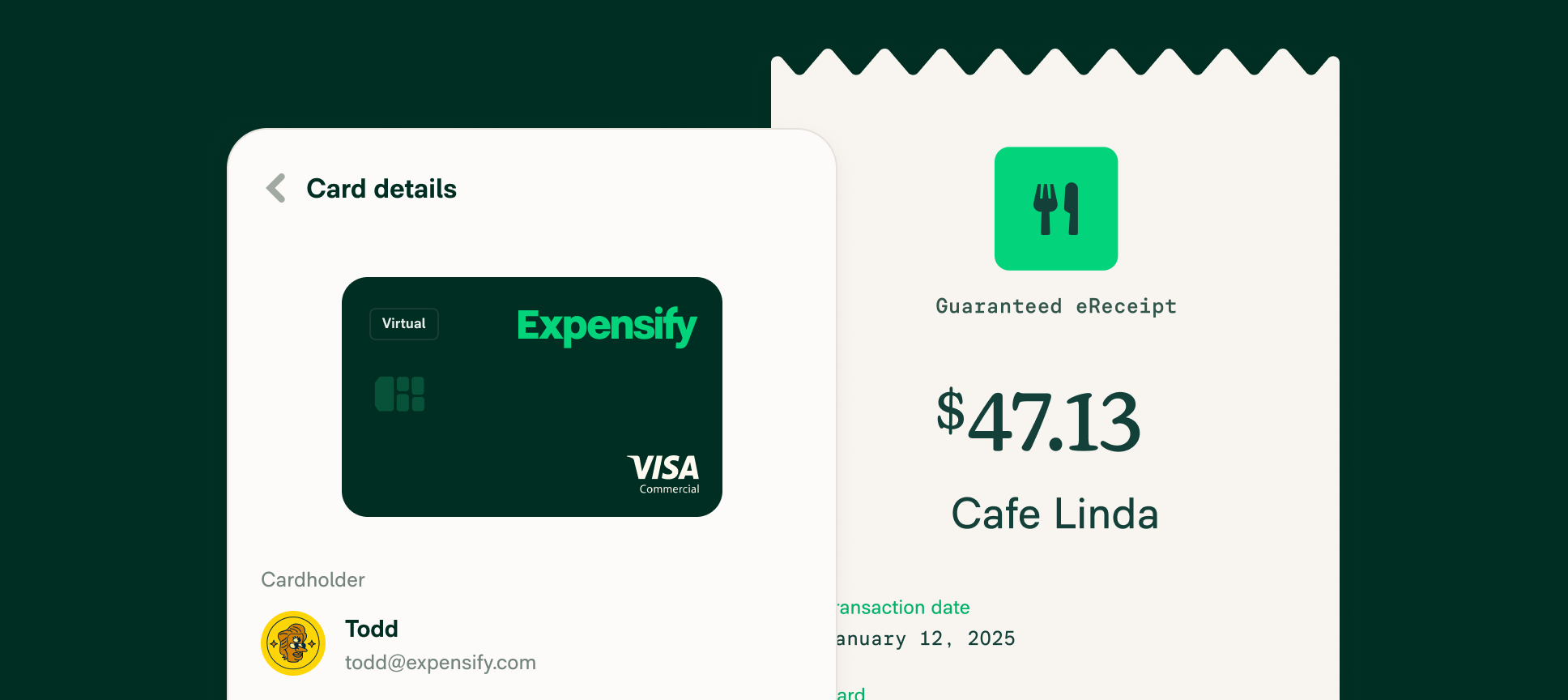

Most card purchases automatically generate a digital, IRS-compliant eReceipt so your team rarely needs to scan physical receipts.

Accountants get revenue share

ExpensifyApproved! accountants receive a 0.5% revenue share on their clients' Expensify Card spend (US purchases only). This revenue share can be kept by the accounting firm or passed along to their clients as cash back.

Case study

“Moving from our other bank and getting Expensify cards into the hands of employees was super easy. I also love how simple it is to adjust credit limits and the auto reconciliation with the daily settlement.”

Learn how Suncommon manages their company spend and saves company time by leveraging the the Expensify Card.

FAQs

-

There are no fees or costs associated with the Expensify Card — everything is already included in your current active pricing.

-

There’s no commitment required with the Expensify Card, and you can cancel cards at any time.

-

No, there is no interest when using the Expensify Card, as there is no ability to carry a balance.

-

It doesn’t! The Expensify Card will never have an impact on your personal credit score.

-

Cardholders can suspend their cards instantly when they detect suspicious activity or lose them. Upon receiving a request, Expensify handles disputes on fraudulent charges directly. Additionally, Expensify is looking out for you from the beginning, performing sophisticated transaction monitoring and automatically notifying you if there’s suspicious activity.

-

By providing our own card feed, we're able to give customers a true realtime experience where receipt images can automatically merge with bank transactions that immediately download into the user’s account.

-

Your Expensify Card can be used at most merchants where Visa is accepted.

-

We use the same bank account you've already configured in Expensify for reimbursements to debit the full balance owed monthly or daily. In other words, you don't need to do any extra work.

-

A corporate card like the Expensify Card is similar to a business debit card but with functionality tailored toward employee expense tracking, admin controls, and other compliance settings.

A corporate card only uses what’s in the bank account it’s connected to, and owners and administrators of the account are able to set limits for those who have also been issued cards connected to the account.

-

It’s pretty simple to qualify for the Expensify Card. You just need to be a registered business with a business bank account in the U.S.

Want more details? Check out our help page for how to set up the Expensify Visa® Commercial Card for your company.

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.