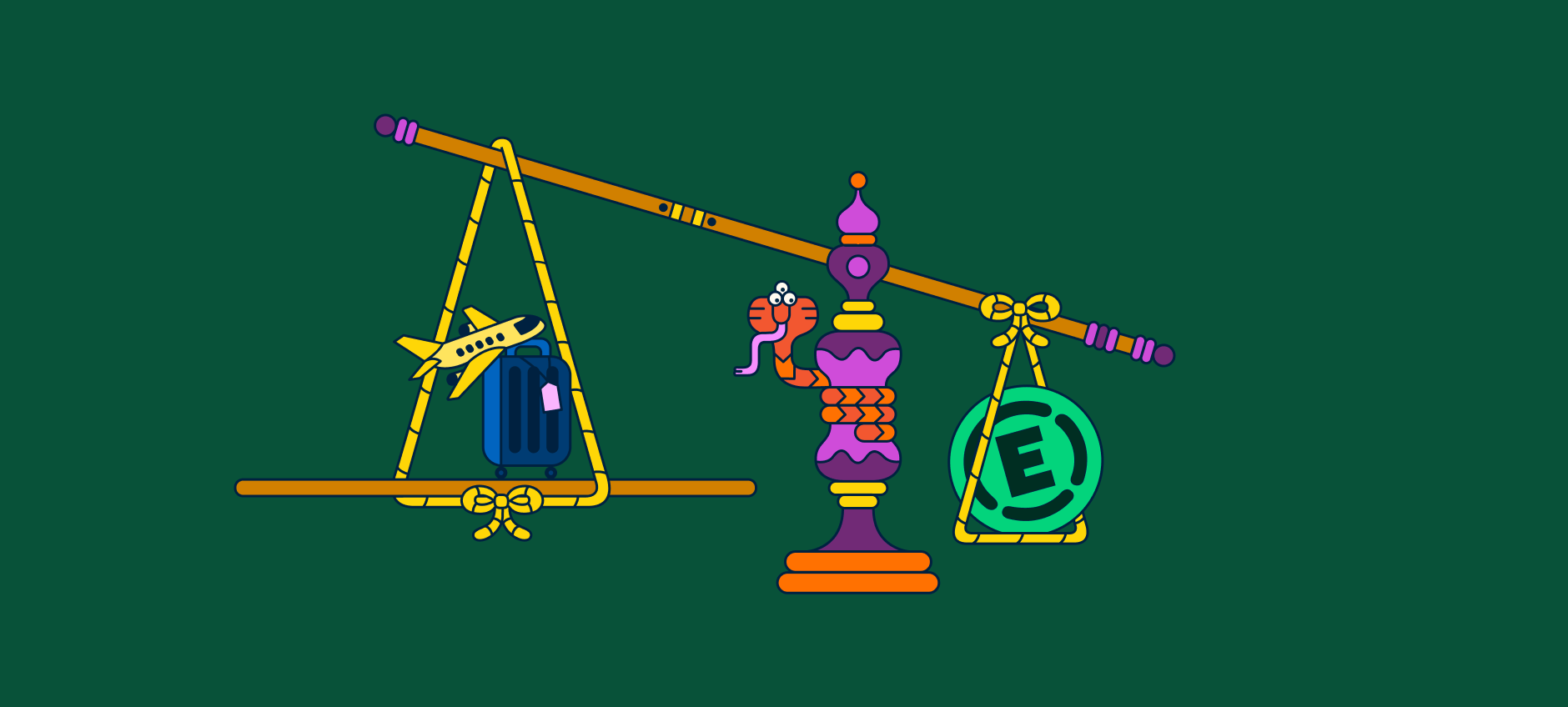

Expensify Travel vs Brex Travel: Complete comparison 2026

This comprehensive comparison of Expensify Travel vs. Brex Travel breaks down what each platform offers, what real users say, and which solution might be the perfect fit for your specific business needs.