Track Expenses

Track Expenses

Expense tracking made easy with Expensify

Expense tracking made easy with Expensify

Track expenses for business faster, smarter, and easier with Expensify. Whether you’re a freelancer, independent contractor, sole proprietor, or small business owner, Expensify makes it simple to scan receipts, log expenses, and stay organized for tax season – all in one app.

SmartScan receipt capture

Mileage tracking

Auto expense categorization

Integrated accounting tools

IRS-compliant reports

Multi-currency support

Manually tracking expenses eats up your time and leaves room for errors.

Expensify’s built-in expense tracker keeps your records clean, categorized, and ready for tax time – with zero spreadsheets and zero guesswork.

Smarter tracking, bigger deductions

The easiest way to maximize deductions is to track your expenses in realtime.

Expensify lets you scan receipts, log mileage, and record expenses right from your phone via the mobile app, making it simple to separate personal and business spend.

Add notes, categorize expenses, and collaborate with your accountant – built to keep your finances clear and your tax prep stress-free.

Scan and save every receipt

Snap a photo of any receipt, forward to receipts@expensify.com, or text 47777 for automatic scanning.

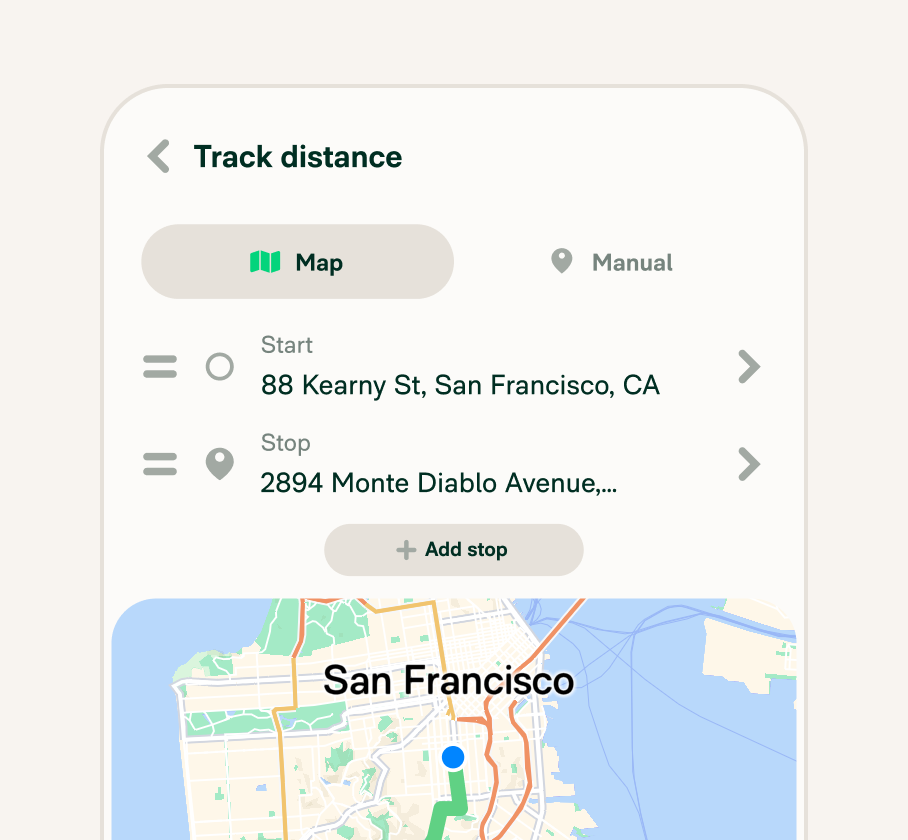

Log mileage on the go

Record business travel by entering your start and end points, and Expensify calculates the mileage at the current IRS rate.

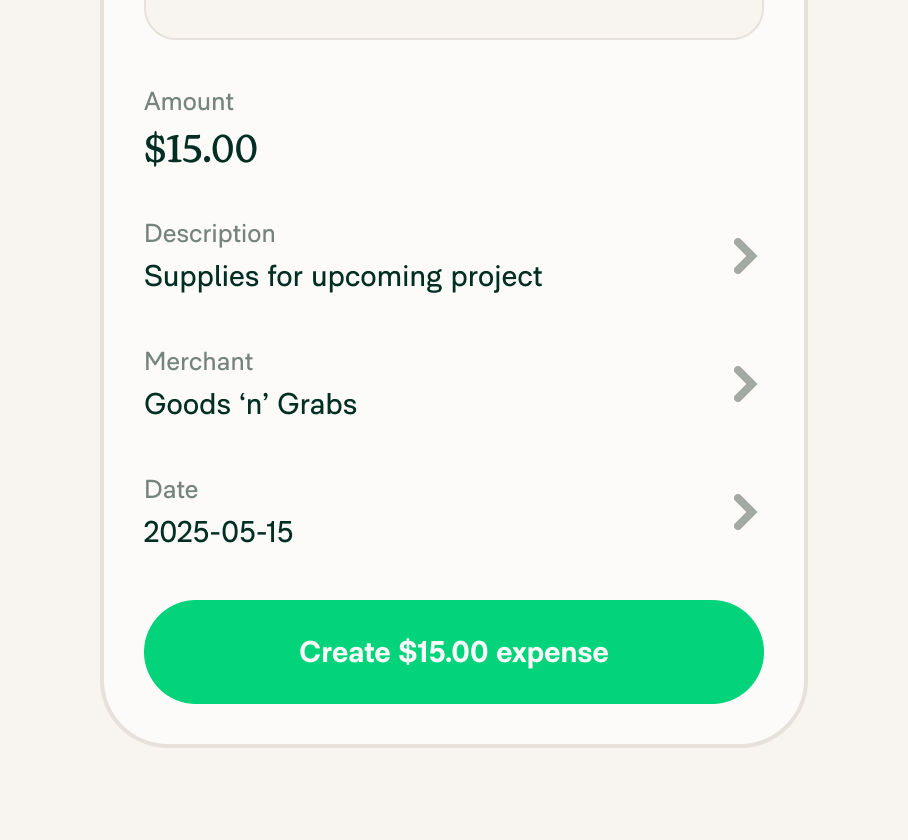

Manually add expenses

No receipt? No problem. Quickly log any business expense manually, including cash payments or digital transactions.

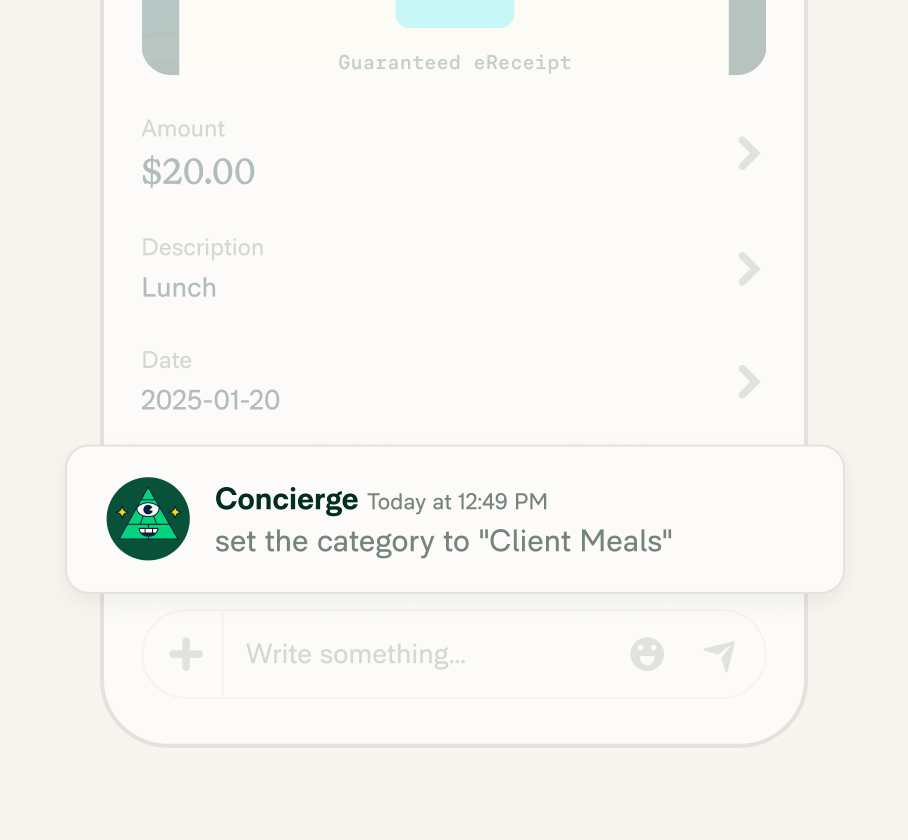

Auto-categorize transactions and simplify tax preparation

Expensify tags and categorizes expenses automatically, keeping your records organized and tax-ready, so you can focus on running your business, not sorting receipts.

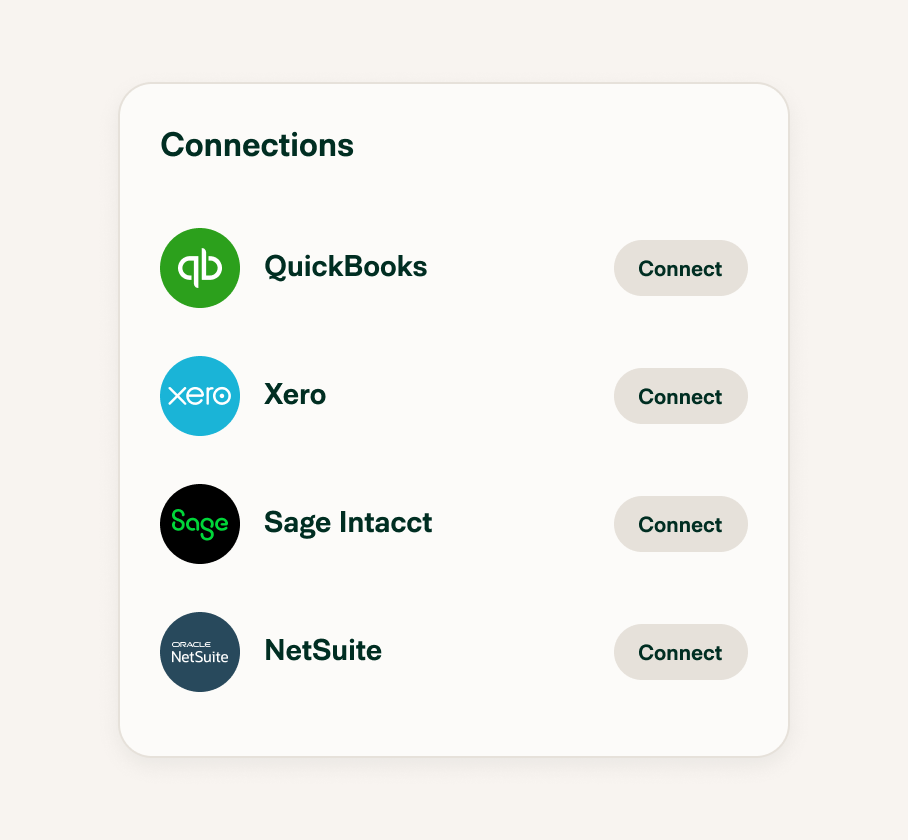

Invite your accountant or integrate with accounting tools

Add your accountant to your workspace for realtime access to expense data – no back-and-forth emails or document chasing. Additionally, seamlessly sync with tools like QuickBooks, Xero, and NetSuite to keep your books up to date automatically.

Track in any currency

Expensify supports global currencies, making it easy to record business expenses no matter where you work or travel.

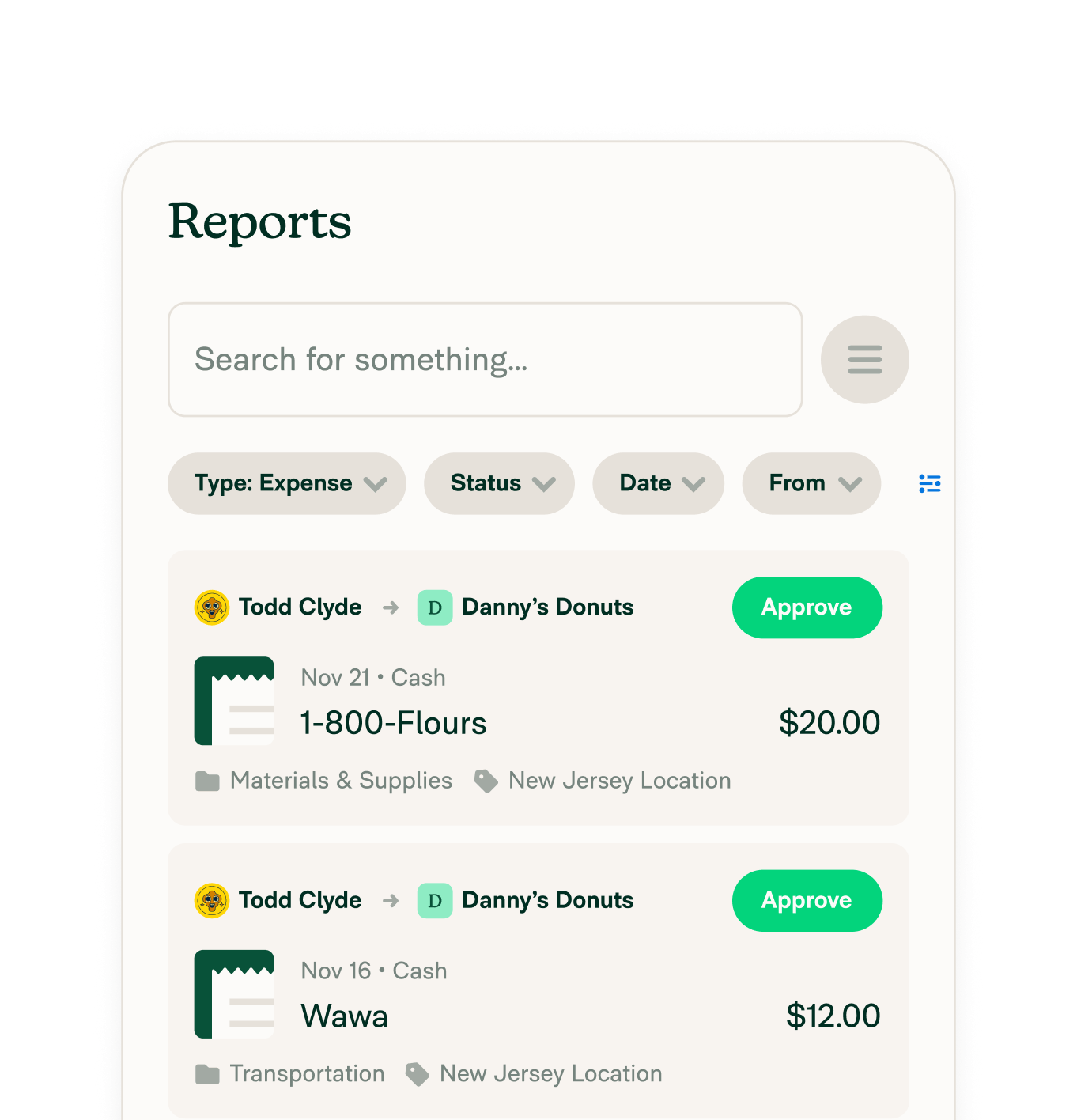

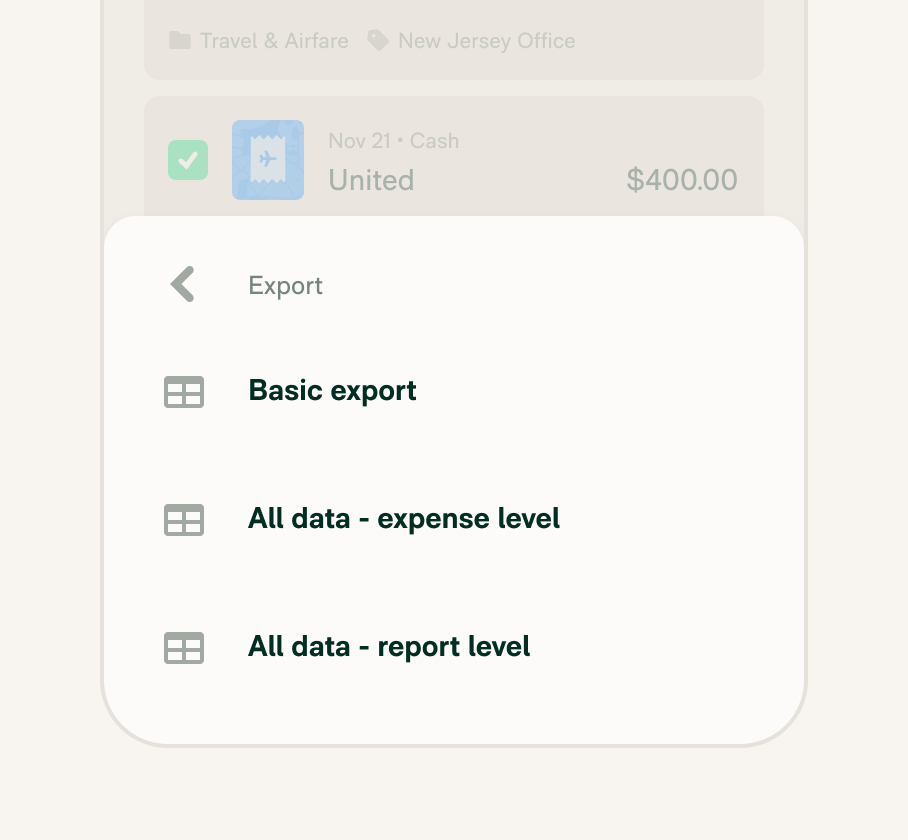

Export detailed, IRS-compliant reports in seconds

Create polished, IRS-compliant expense reports in seconds, ready for tax filing or audits.

Stay audit-ready

All your expense data is securely stored, categorized, and easy to access, giving you peace of mind year-round.

FAQs

-

To track expenses for tax deductions, consistency is key. You can manually record purchases in a spreadsheet or use a business expense tracker app to categorize and store receipts digitally.

-

For self-employed folks, various options range from Excel spreadsheets to automated expense tracking apps and software. The key is choosing an option that fits individual needs and managing expenses as easily as possible.

-

The best way to track business expenses is to use a business expense tracker app that captures expenses in realtime, categorizes them, and integrates with accounting software for seamless tax preparation.

-

Absolutely! A thorough record of a tracker's business expenses can maximize your tax refunds by ensuring all deductible expenses are accounted for and verified.

-

Maintaining an expense tracker helps you stay organized, prevents missed deductions, and can make the tax filing process much smoother. Plus, it's useful for budgeting and financial planning year-round, no matter what you plan to spend your money on.

-

The 50/30/20 rule is a budgeting strategy that suggests allocating 50% of your income to needs such as rent, 30% to wants such as entertainment, and 20% towards savings

Make tax season easier with Expensify. Track every expense, stay organized, and get ahead of tax time faster, smarter, and easier.

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.