Small Business

Expense tracking that grows with you

Expensify helps small teams save time and reduce errors by automating receipts, reimbursements, and reports, all in one easy-to-use platform.

Bring your own cards

Track spending in realtime

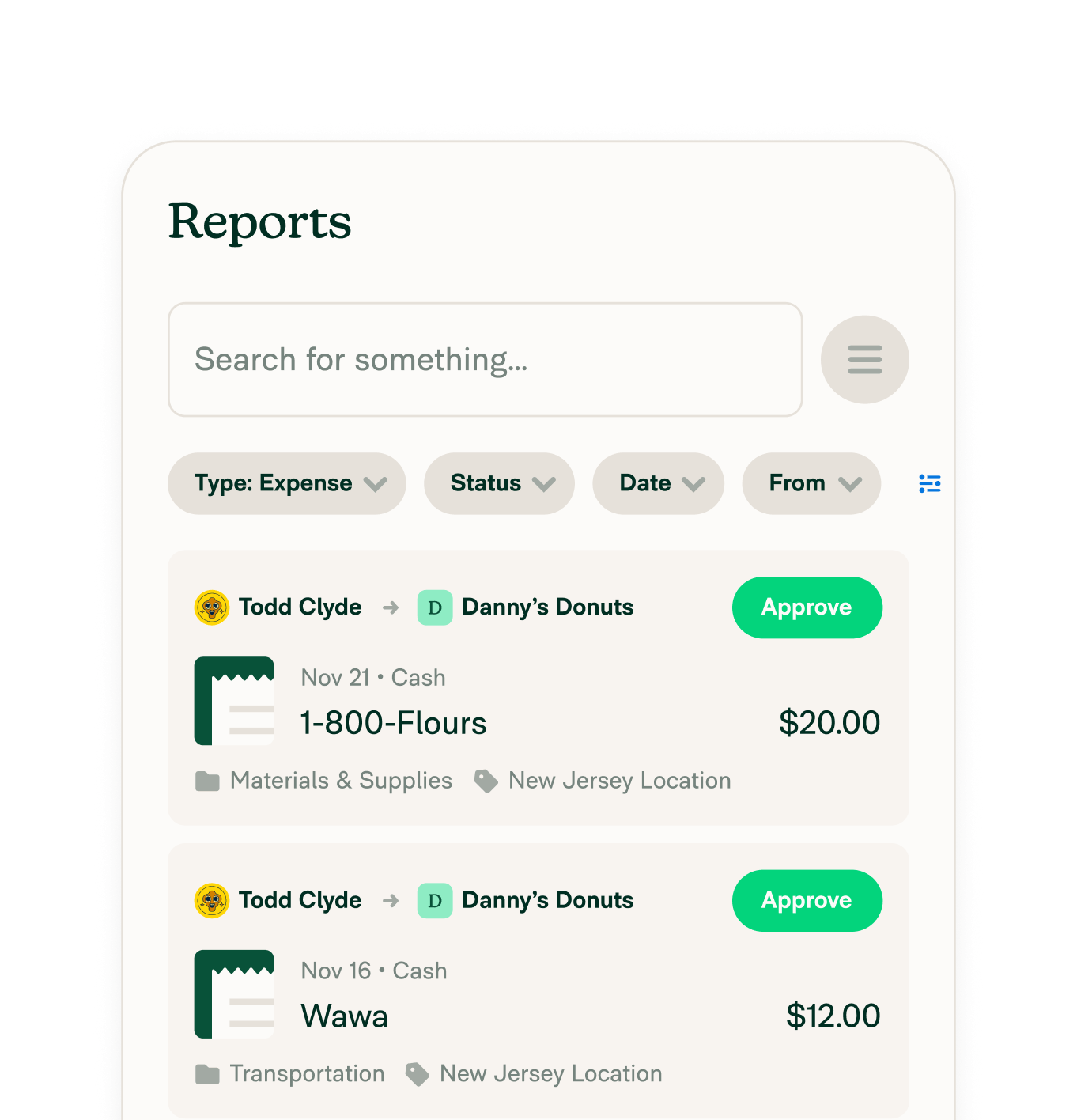

Automate reports & approvals

Reimburse teams the next-day

Built for small business expense tracking

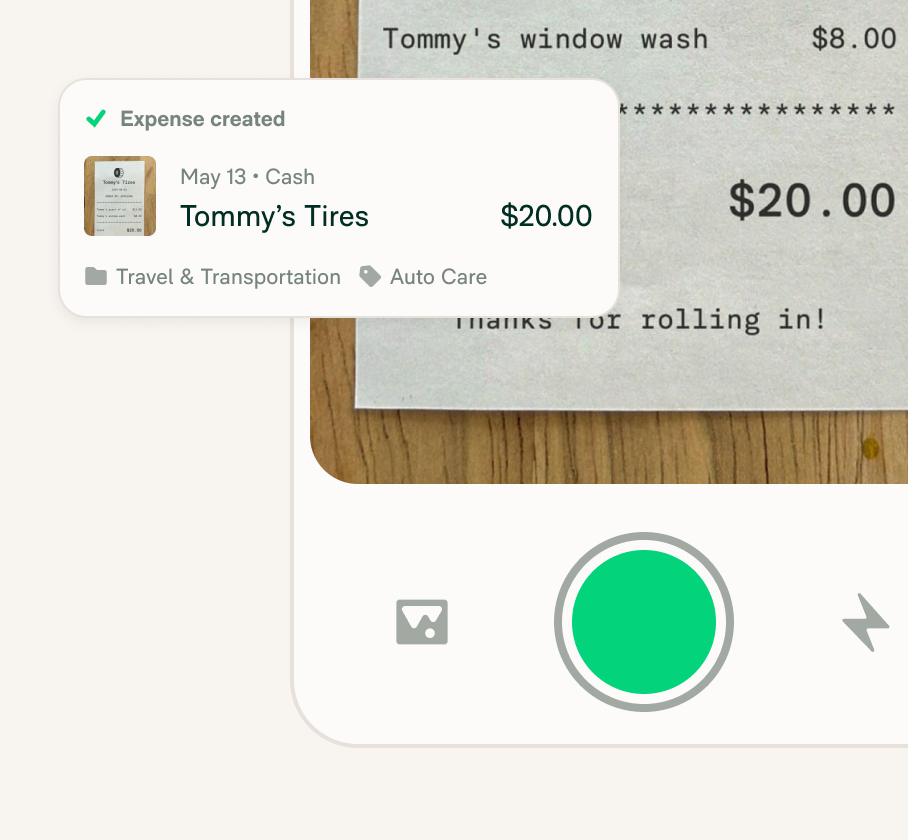

Automate expense tracking and claim hours back

Eliminate manual expense tracking, capture receipts with SmartScan, and organize spend with custom categories. No more spreadsheets or shoeboxes full of paper.

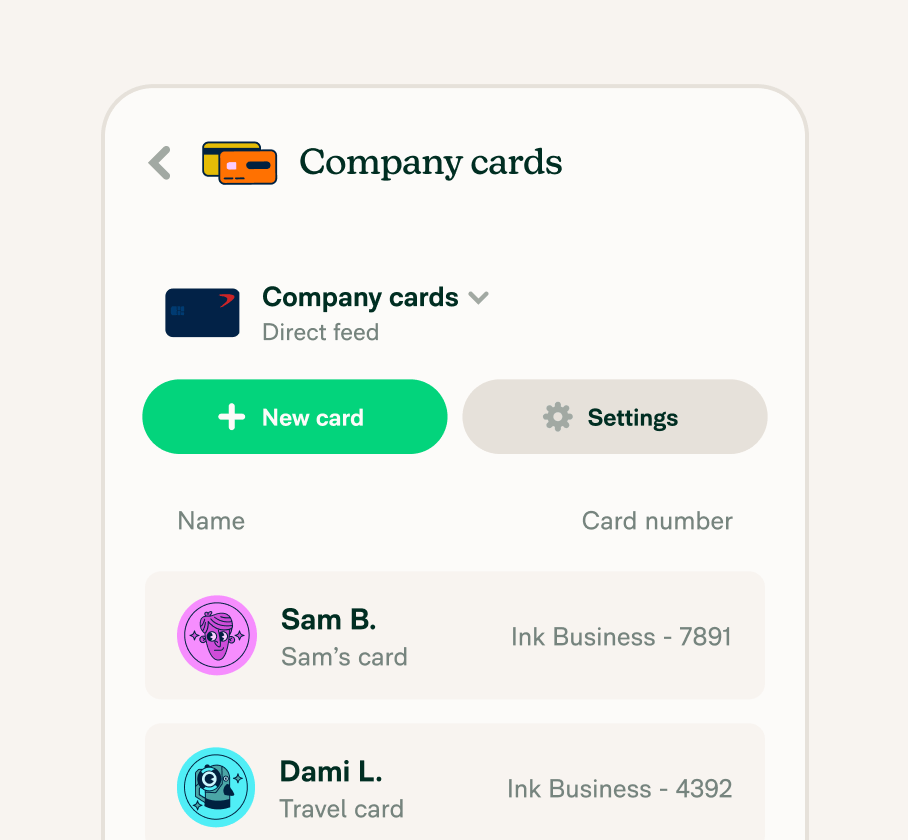

Integrate your corporate cards

Bring your own corporate cards (BYOC) to streamline expensing, reconciliation, and accounting. Or, use the Expensify VisaⓇ Commercial Card and earn up to 2% cash back.

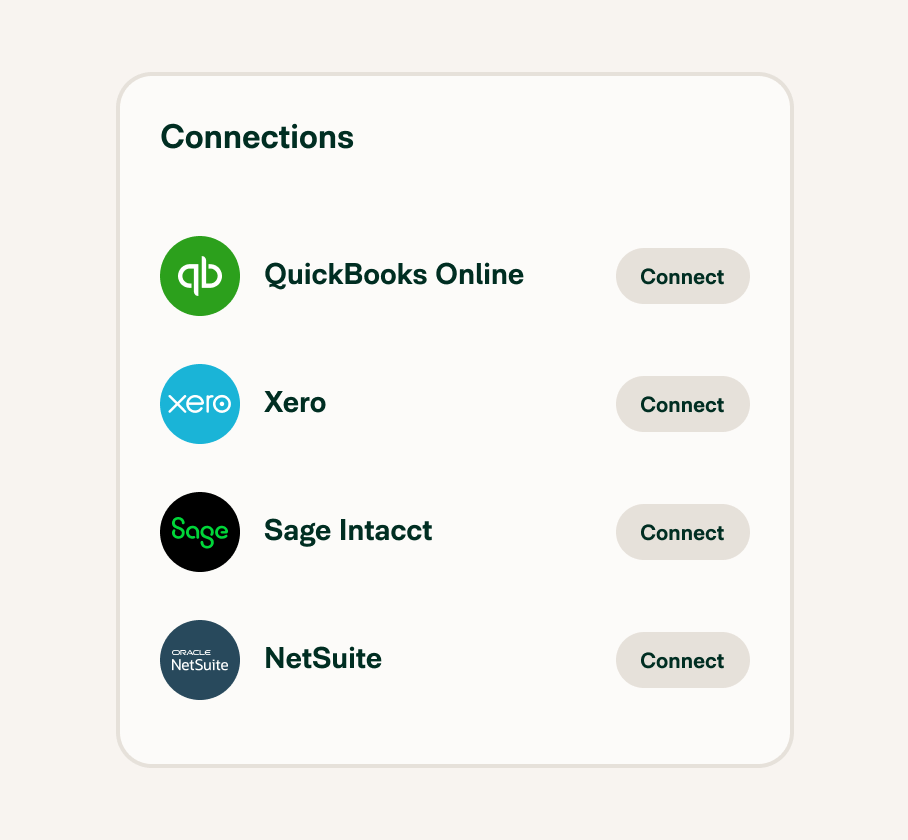

Sync with your ledger and stay audit-ready

Expensify integrates with tools like QuickBooks, NetSuite, Xero, and Sage Intacct for seamless reconciliation. Auto-categorized expenses and digital receipts keep your records clean, organized, and ready for tax time.

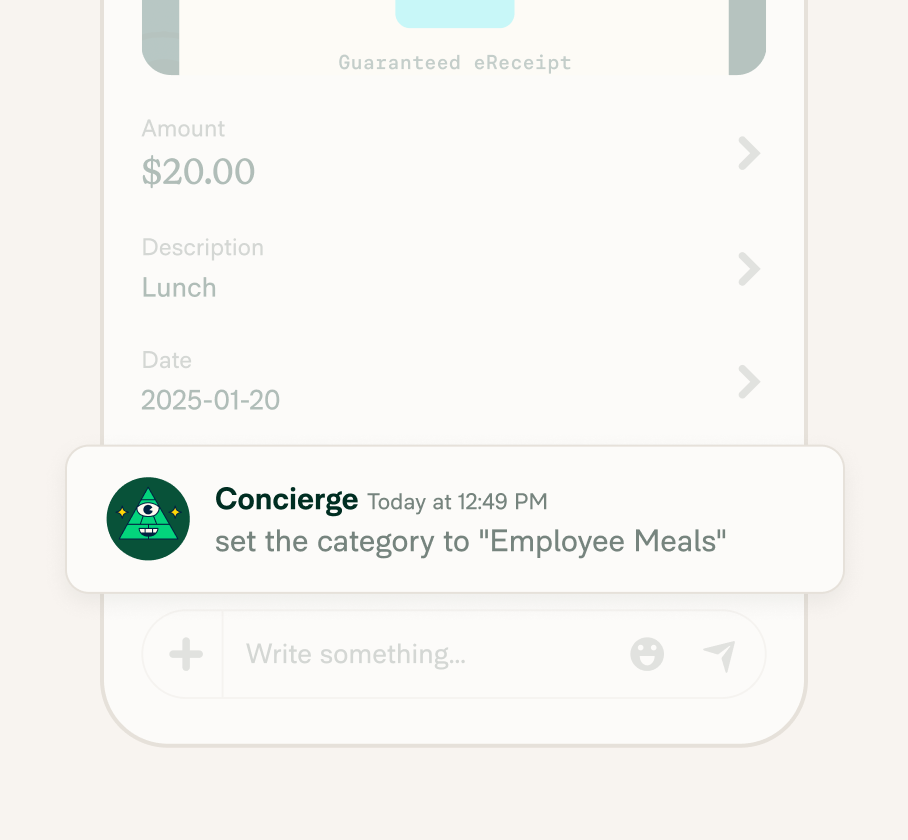

Let Concierge do the heavy lifting

Expensify’s built-in AI assistant, Concierge, helps you manage expenses with less effort. It auto-categorizes transactions, flags out-of-policy spend, and even follows text commands, saving time and preventing mistakes before they hit your books.

Case study

“If you're looking for a travel management platform, Expensify Travel makes compliance easier, improves user experience, and simplifies administration. Our team has been able to book confidently without the issues we faced with other providers. It just works—and that's all we need.”

FAQs

-

Without proper expense tracking for small businesses, it's easy to overlook spending, mismanage funds, and encounter difficulties when tax season arrives. Here's how some of these businesses might tackle expense tracking:

Manual spreadsheets: A common approach is the use of manual entry into spreadsheets. While cost-effective, it's labor-intensive and prone to human error, becoming more challenging as transaction volumes grow.

Shoebox method: Some entrepreneurs stick to the old-school method of tossing receipts into a box for "later" organization. But this lacks any form of efficient data retrieval or analysis, turning it into an arduous task when the need arises to audit or justify expenses.

Receipt apps: There’s a transition towards digitizing receipts using basic receipt apps. These apps make it easy to capture receipt information but fall short when it comes to advanced features. The best expense tracker for small businesses will have features like expense categorization, comprehensive reporting, and multi-user collaboration, which are crucial for managing business expenses effectively.

-

Small businesses can keep track of receipts by implementing a digital system that stores images of receipts along with the associated transaction details. This can often be done within an expense tracker app that allows the user to take a photo of the receipt, which is then automatically linked to the corresponding expense record.

-

According to the IRS, you don’t need a physical receipt for business expenses under $75, but you still need to document the expense’s date, amount, and purpose. That’s where expense software helps.

Expensify creates digital records for all expenses, including IRS-compliant eReceipts when using the Expensify Card, so your documentation is always up to standard.

-

Common deductible expenses include office supplies, marketing costs, travel, business meals, equipment, and software subscriptions. The IRS requires accurate records, so using small business expense management software like Expensify helps you stay organized and maximize write-offs.

Keep in mind that only business-related costs can be deducted, and proper documentation is essential.

-

LLCs can track expenses by using a dedicated expense tracker for small businesses that syncs with their accounting software. Expensify lets you tag expenses by category, assign them to specific projects or clients, and generate reports, all from a mobile app.

Separating personal and business finances is critical, so tools that automate and organize expenses help ensure LLC compliance.

-

Expensify is widely considered one of the best expense tracking apps for small businesses. It offers automatic receipt scanning, categorized expenses, mileage tracking, and integrations with QuickBooks, NetSuite, and other accounting tools. Its mobile-first design makes it ideal for business owners and employees who need to manage expenses on the go.

-

Expensify offers a free trial for new users, but ongoing access requires a paid subscription. For small teams or growing businesses, plans like Collect and Control provide advanced features like approvals, integrations, and policy enforcement.

-

Concierge is Expensify’s built-in AI assistant that helps automate the expense management process. It categorizes transactions, flags out-of-policy spend, and offers smart suggestions based on your company’s expense rules.

You can also interact with Concierge using simple text commands to create, edit, or submit reports, no clicks required. Think of it as your personal expense-tracking sidekick that saves time and reduces manual work.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial