Travel Expense Reimbursement

Travel Expense Reimbursement

Travel expense reimbursement with Expensify

Travel expense reimbursement with Expensify

Business travel is stressful enough – getting reimbursed shouldn’t be. Expensify makes it faster, smarter, and easier to track travel expenses, submit reports, and get paid back without the hassle.

Receipt

scanning

Automated mileage tracking

Smart spending limits

Fast reimbursements

Corporate card reconciliation

IRS-compliant rates

No more scrambling for receipts or chasing down reimbursements. Expensify’s travel expense tool simplifies every step, from the moment you book your trip to when you get paid back.

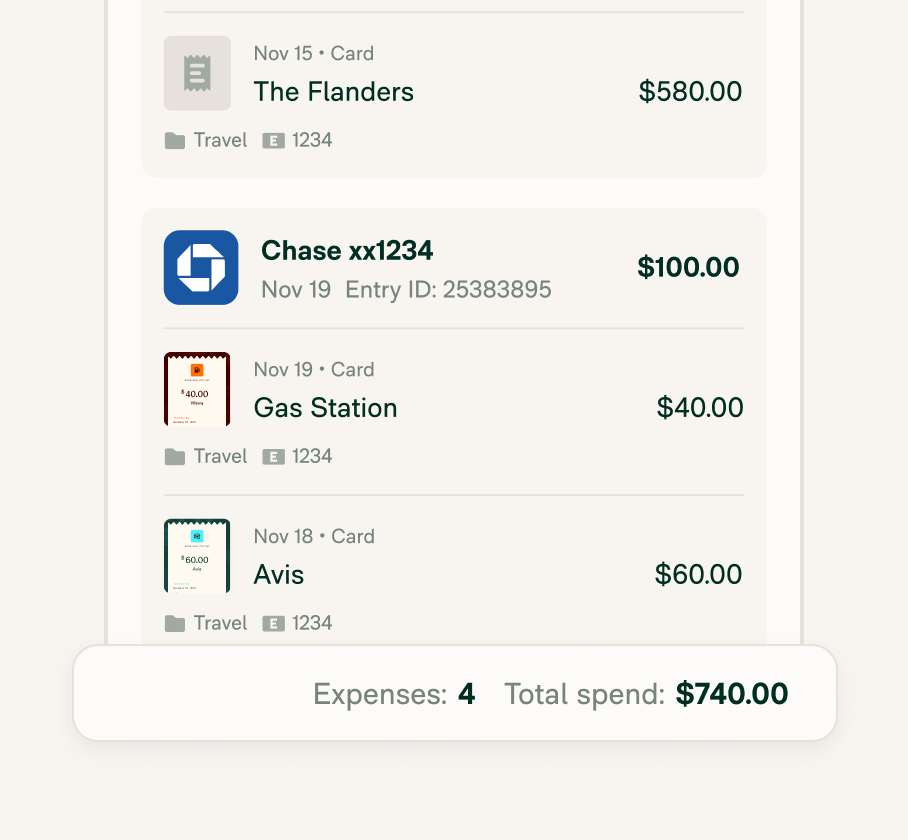

Track every dollar spent – all in one place.

Faster, smarter, easier travel reimbursements

Travel expenses can pile up fast: flights, hotels, meals, rideshares, and more. Expensify makes it simple to track everything, apply your company’s travel reimbursement policies, and submit expense reports on the go.

Using personal funds or a company card? Expensify keeps your expenses organized and your reimbursements moving.

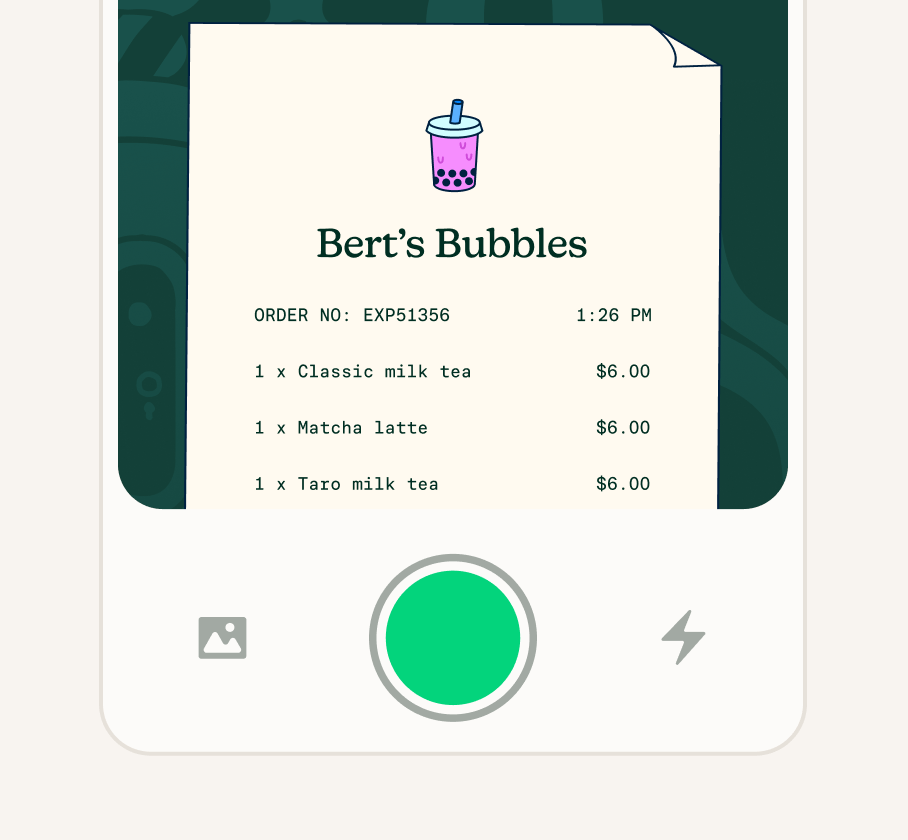

Snap receipts on the go

Capture and categorize receipts in seconds by snapping a photo, forwarding to receipts@expensify.com, or texting 47777 (US numbers only).

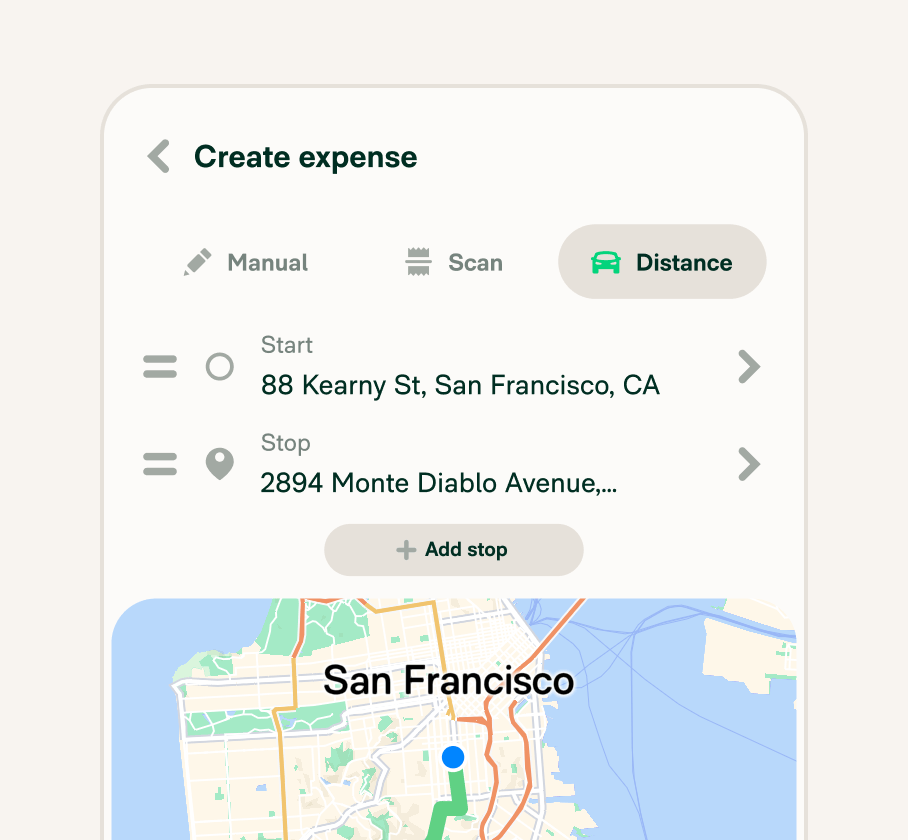

Track mileage easily

Log business miles (or kilometers!) right in the app, and let Expensify calculate the mileage reimbursement using up-to-date IRS rates or your company’s custom policy.

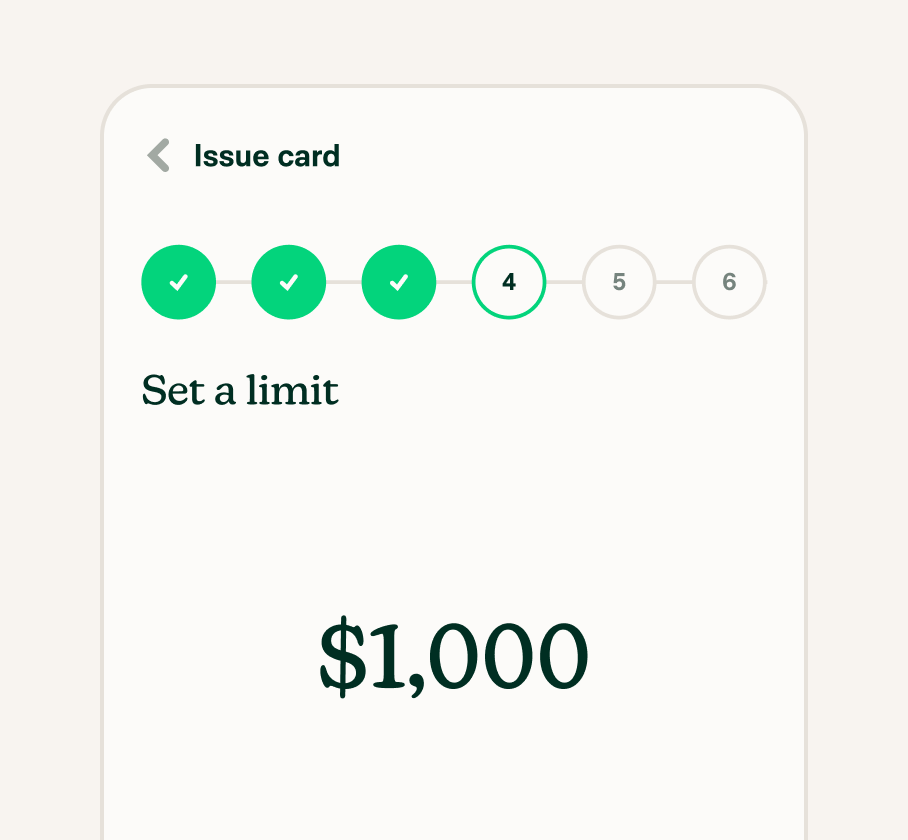

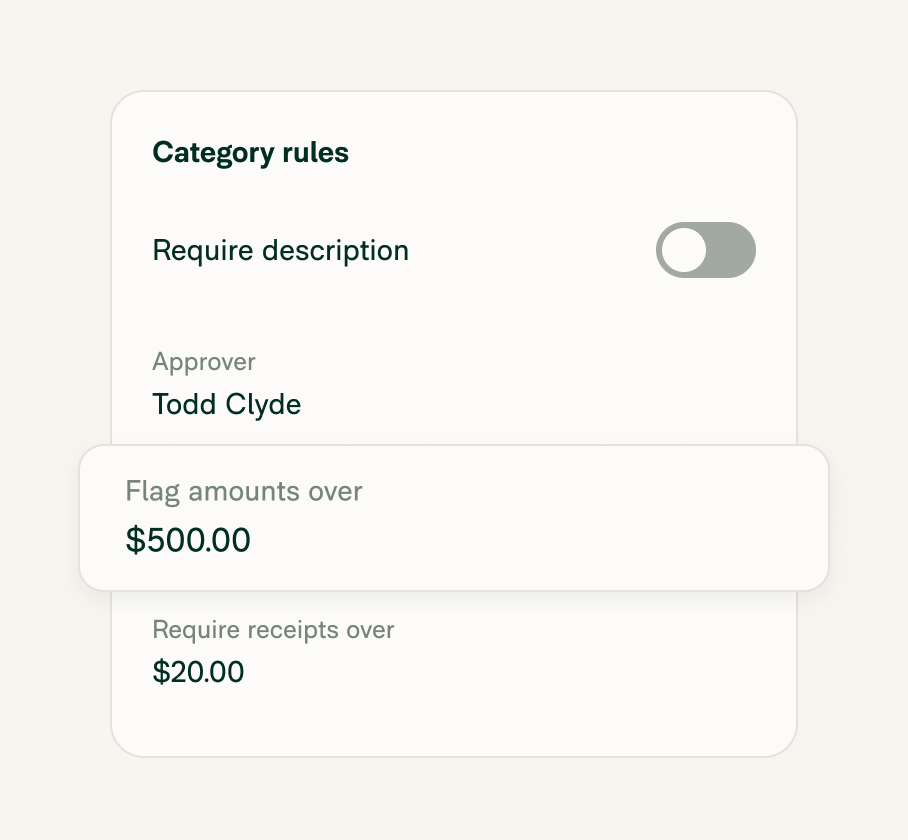

Enforce spending limits

Set Smart Limits on the Expensify Card to control travel spending before it happens, keeping budgets tight and compliant.

Streamline corporate card reconciliation

Company card purchases flow directly into Expensify, making it easy to reconcile travel expenses without extra effort.

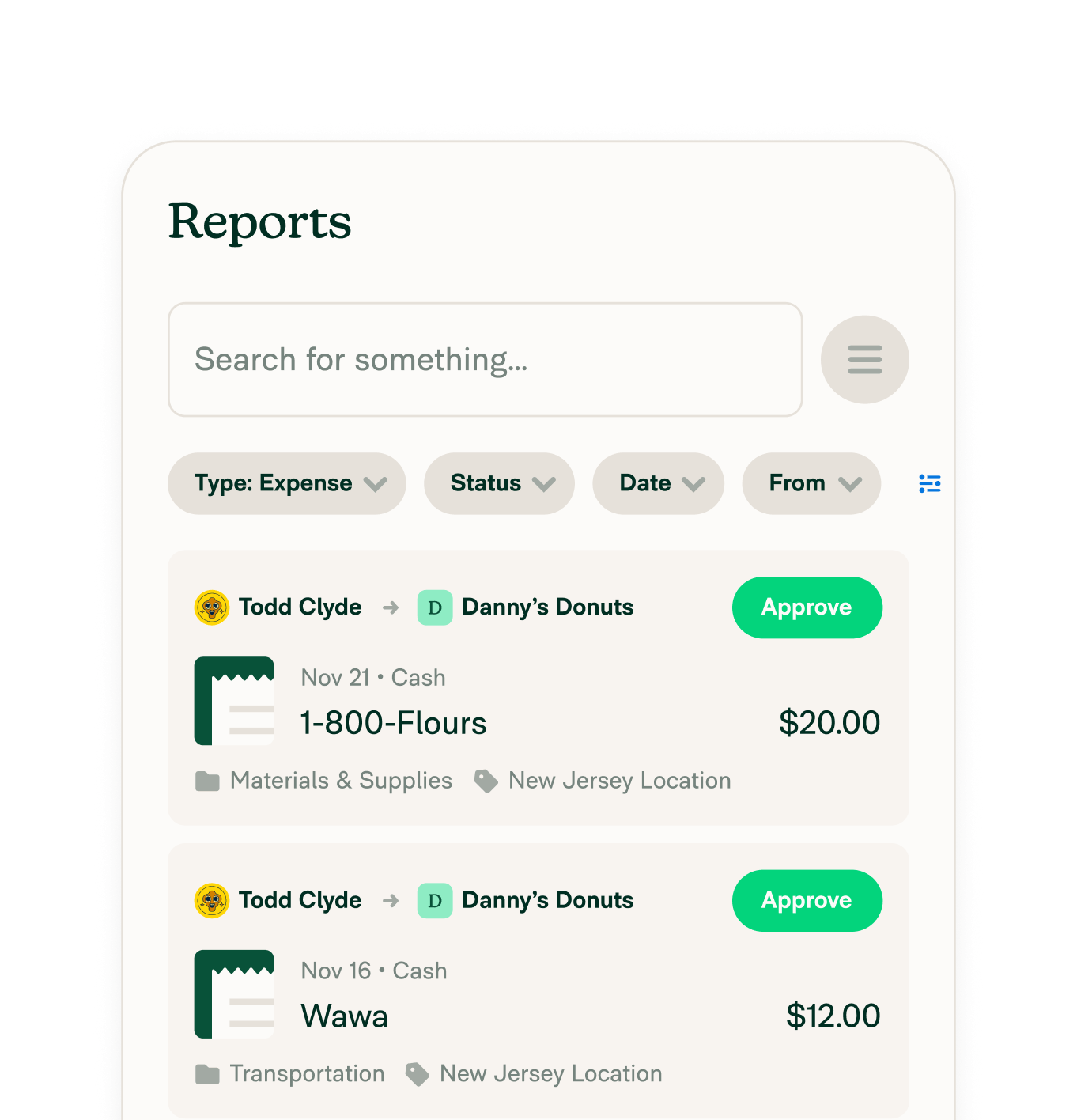

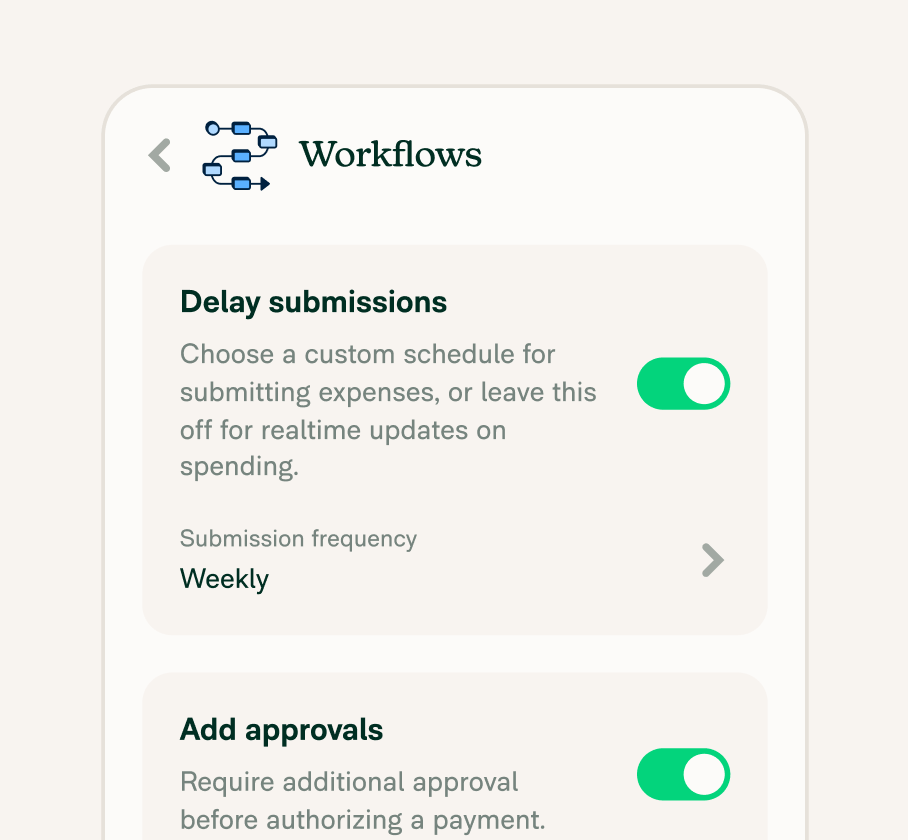

Automate expense reporting

Expenses are matched, coded, and grouped into reports automatically. Submit with a single tap when your trip is done.

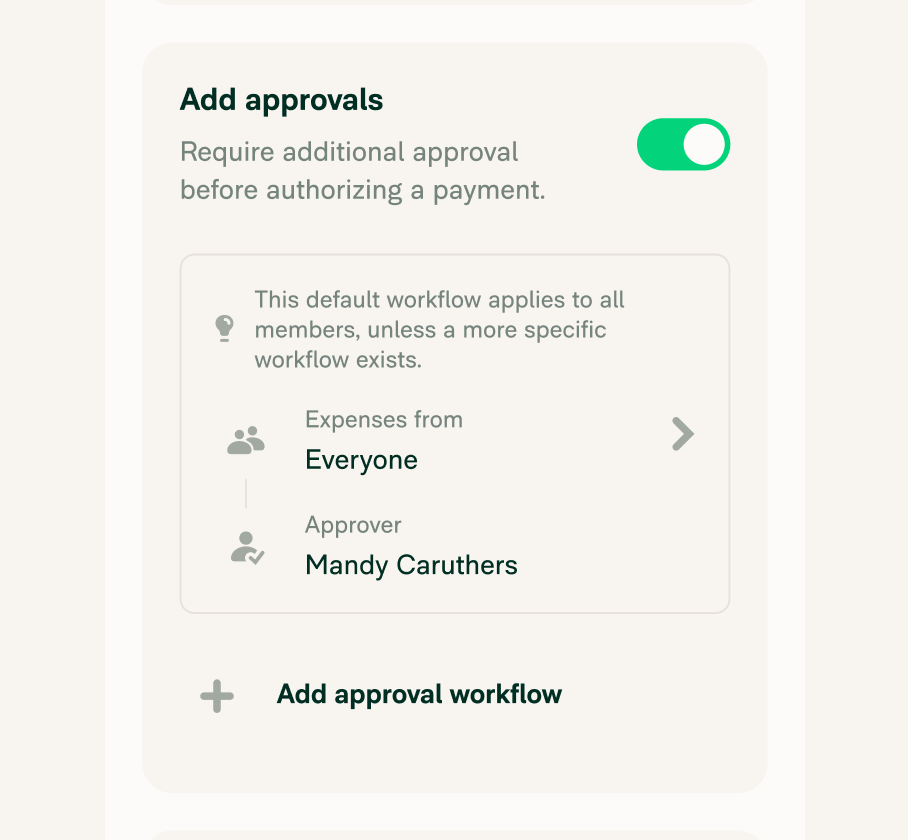

Customize reimbursement policies

Apply your company’s specific reimbursement rules, from per diem rates to expense categories, with built-in flexibility.

Speed up reimbursements

Expensify sends reports to the right approvers instantly, and with ACH or integrated payments, employees get reimbursed in record time.

Stay audit-ready

All travel expenses are documented, categorized, and stored securely, making audits and compliance checks painless.

FAQs

-

Travel expense reimbursement is the compensation process for employees who incur out-of-pocket expenses during business travel. Now, what are travel expenses? They include accommodation, transportation, meals, and other miscellaneous expenses related to business travel.

In the corporate world, reimbursing travel expenses promotes fairness, talent retention, and accurate financial reporting. Essentially, it recognizes that employee travel expenses should be reimbursed timely.

-

The IRS (Internal Revenue Service) has specific rules regarding employee travel reimbursement. Employers can offer employees travel reimbursement for business-related expenses, such as transportation, lodging, meals, and other incidental costs incurred while on travel for work purposes.

Note that expenses must be considered ordinary and necessary for the employee's job. If the reimbursement meets the requirements specified by the IRS, it is generally tax-free for the employee. Cha-ching! It’s recommended that employees maintain records such as receipts, invoices, and travel itineraries to be reimbursed.

Whether you’re an employee or an employer, review the specific rules and guidelines the IRS provides to stay compliant.

-

It’s pretty simple to request to be reimbursed for your business travel expenses. Follow these steps to make sure you get your money back:

Gather all documentation related to your business travel (flights, accommodation, meals, transport, etc.)

Complete a reimbursement form (if provided by your employer or organization) or write a travel expense reimbursement letter.

Submit your documentation and form to the department that handles reimbursements.

And if you have an Expensify plan or the Expensify Corporate Card, you can skip the paperwork and let the app do all the work for you.

-

Short answer: Yes, they can.

Here’s the deal. Whether travel expenses get reimbursed depends on a company’s specific policy. If an expense goes over per diem limits, doesn’t have prior approval, or is missing required documentation, the company can legally say no to reimbursement. In the U.S., there’s no federal law that forces companies to cover travel expenses unless it’s spelled out in an employment contract or required by state law (like in California, where employers must reimburse necessary business expenses).

Bottom line: Always check your company’s travel and expense policy so you know exactly what’s covered before you book that flight or hotel.

-

Generally speaking, travel expense reimbursement is not considered income for individuals. This protects employees from having an extra tax burden for doing their job. Of course, ensure you have followed the proper steps to request reimbursement and keep copies for yourself, just in case.

Reimburse travel expenses the easy way. Snap receipts, track mileage, and get reimbursed faster, smarter, and easier with Expensify.

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.