Expense reports

Expense reports

Create, submit, and approve expense reports with Expensify

Create, submit, and approve expense reports with Expensify

Before Expensify, expense reports were a mess of receipts, spreadsheets, and missed reimbursements. Expensify changed the game – and it all started here.

Today, we’re still leading the way with the world’s easiest, smartest, and fastest expense reporting.

One-click report creation

Auto receipt matching

Realtime policy checks

Built-in approval workflows

Fast reimbursements

Accounting sync

Expensify was built to fix one of the most frustrating parts of work: expense reports. And we’ve been perfecting the process ever since.

“The best expense reporting experience you can have is to not have to do an expense report.”

Easier, smarter, faster expense reports – built for modern teams

Every expense you capture in Expensify automatically flows into a report. Receipts are matched, policies are applied in realtime, and approvals are triggered instantly. Reports file themselves, get reimbursed fast, and sync straight into your accounting system.

Whether you’re a team of two or 200, Expensify makes expense reporting a non-issue – so you can focus on what matters most.

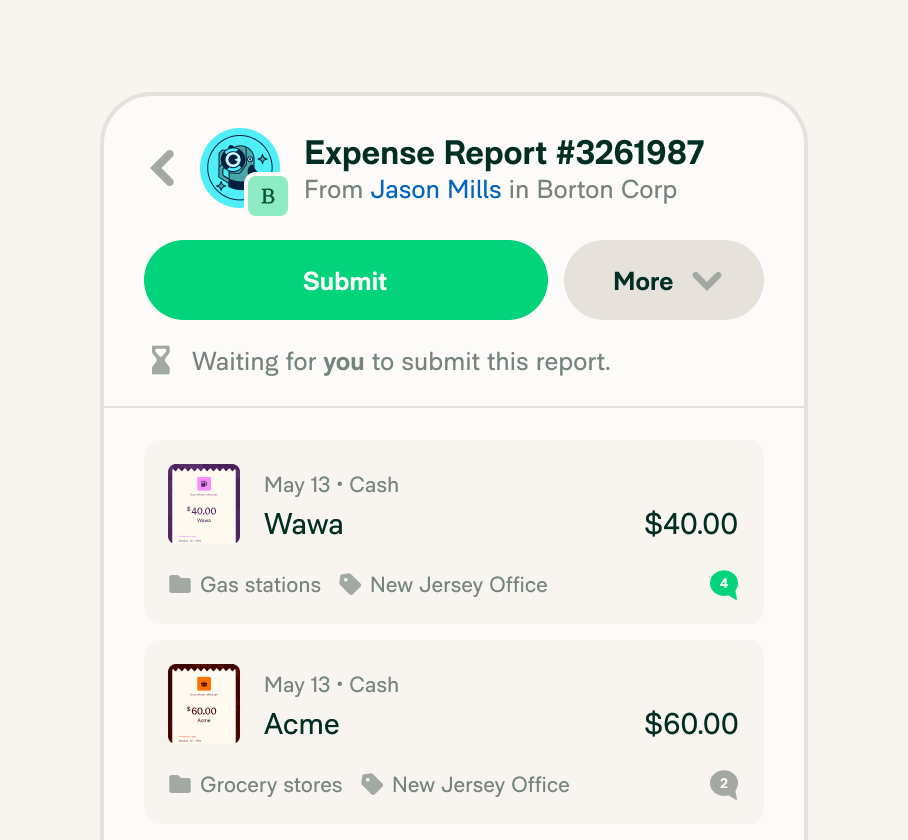

One-click report creation

Create and submit reports instantly – or let Expensify build them in the background as you go.

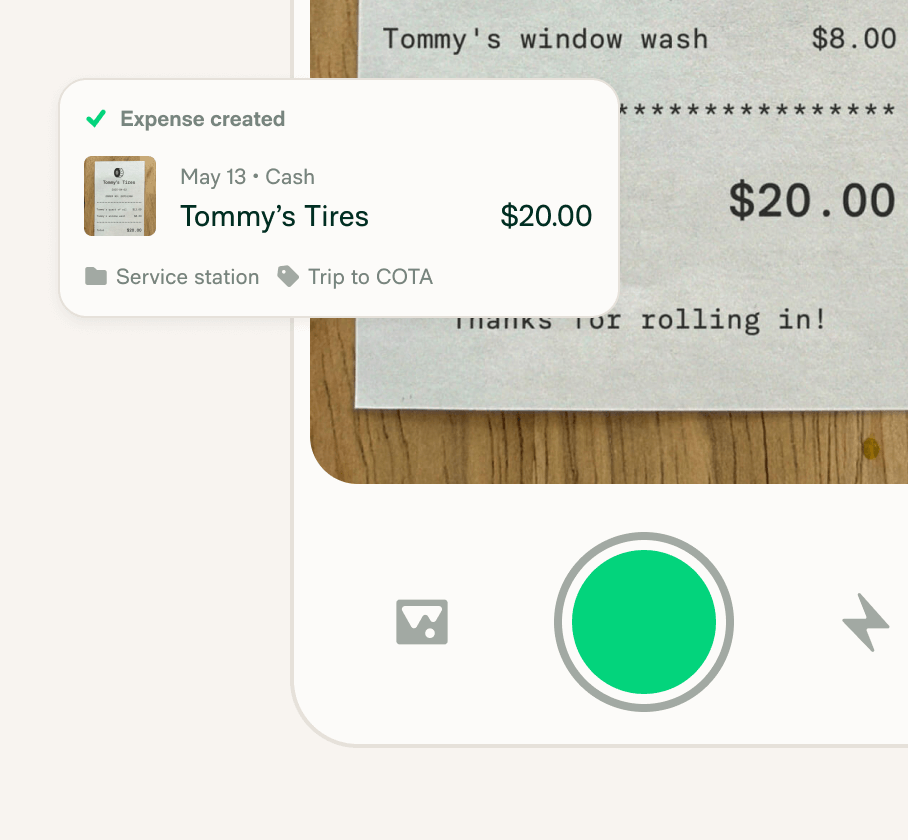

Automatic receipt matching

Snap a receipt, and Expensify matches it to the right transaction in seconds.

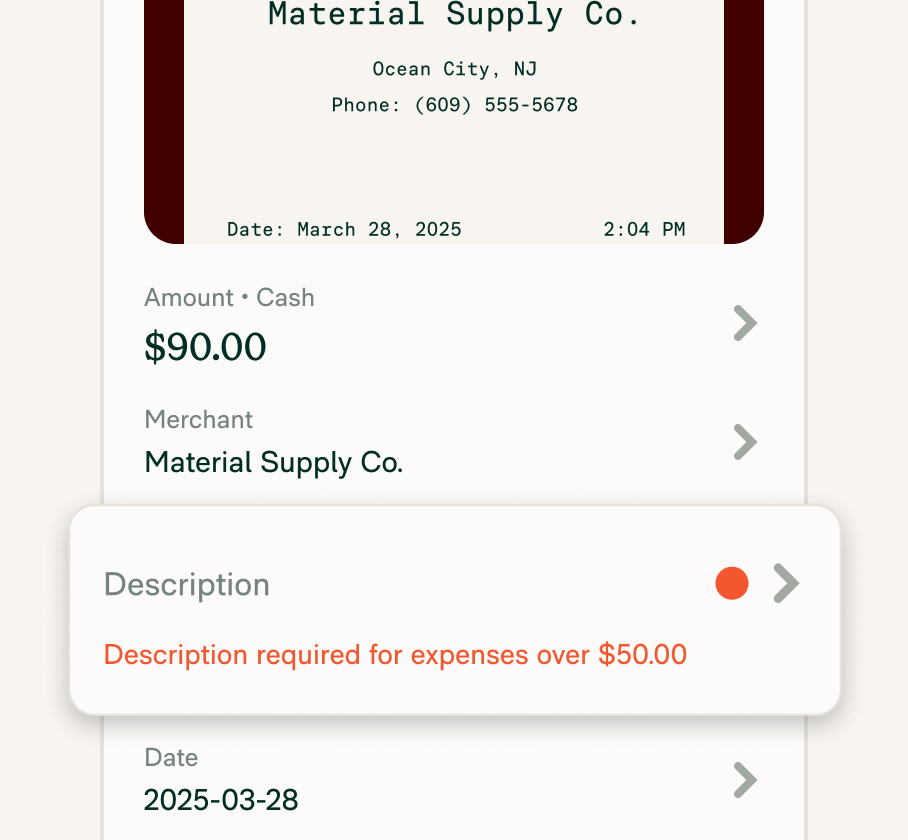

Realtime policy checks

Flag issues the moment they happen – not days later during reconciliation.

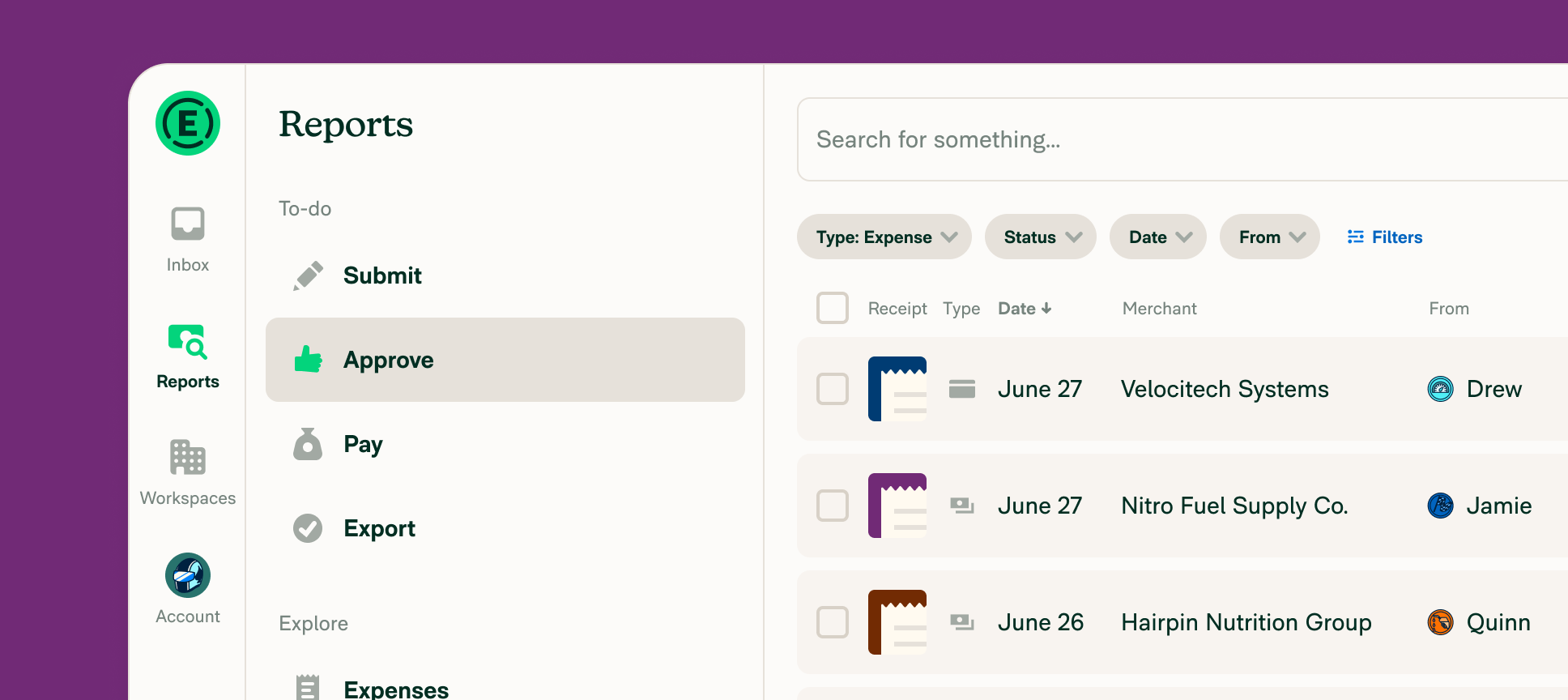

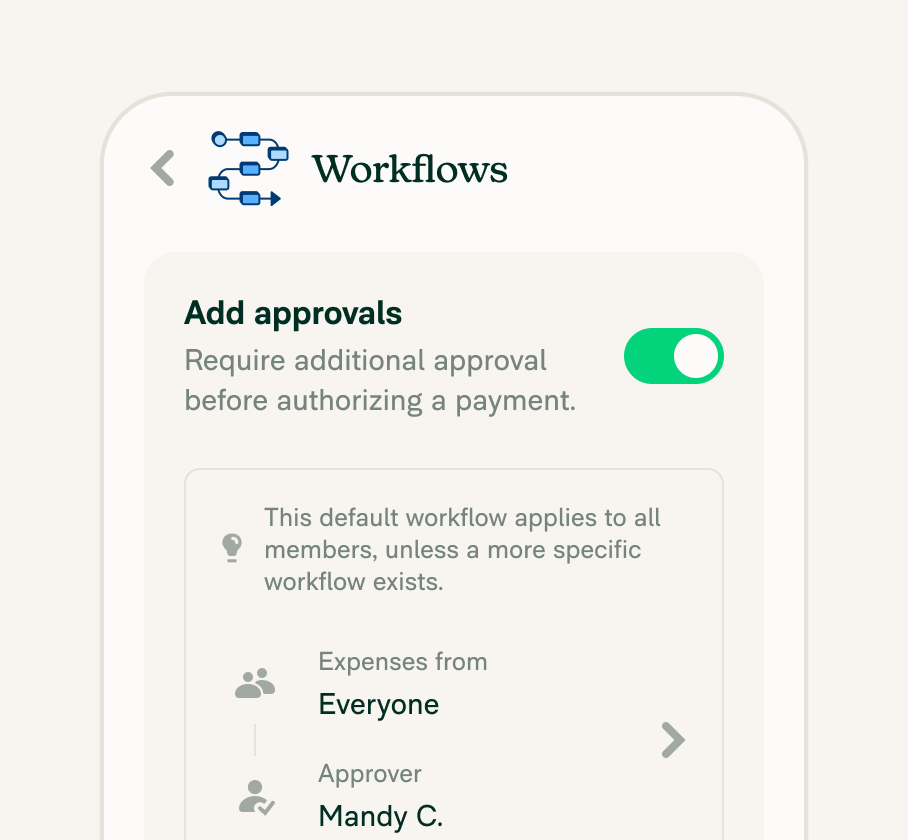

Built-in approval workflows

Route reports to managers or finance based on department, role, or amount.

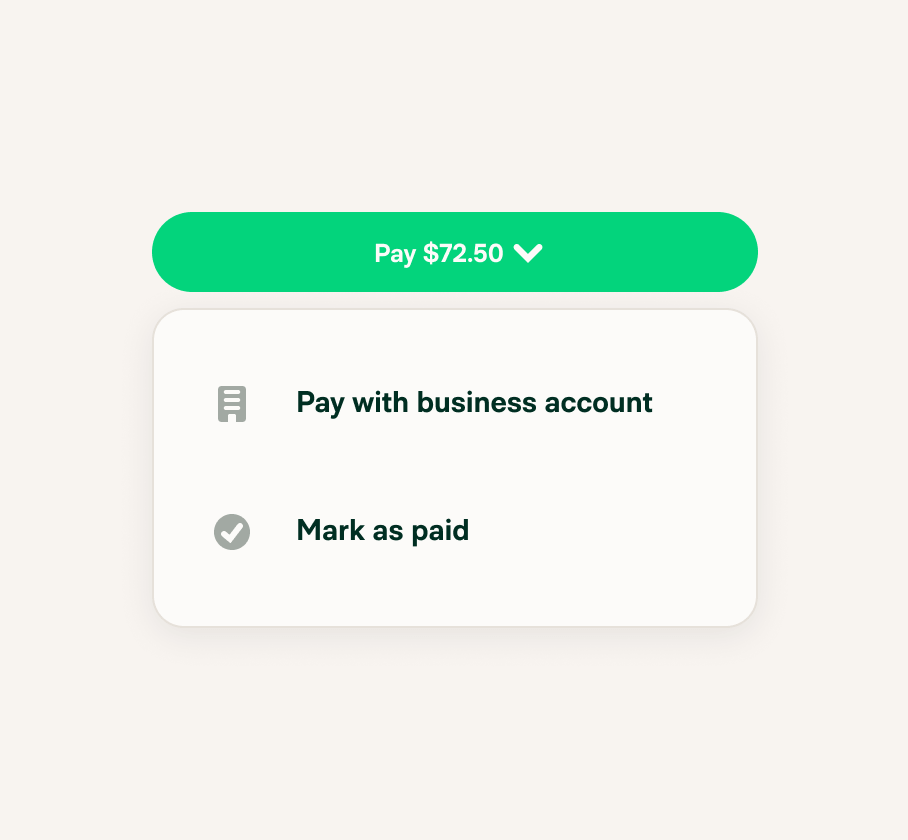

Fast reimbursements

Reimburse employees directly through Expensify – typically within 1–2 business days.

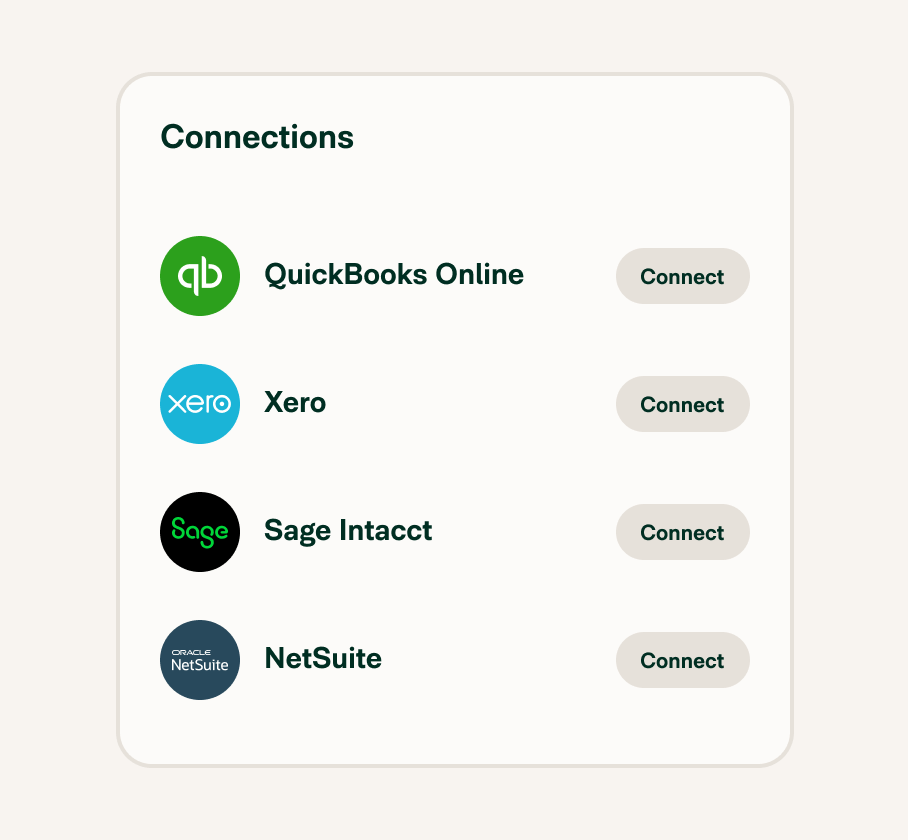

Accounting sync

Sync with QuickBooks, Xero, Sage Intacct, NetSuite, and more.

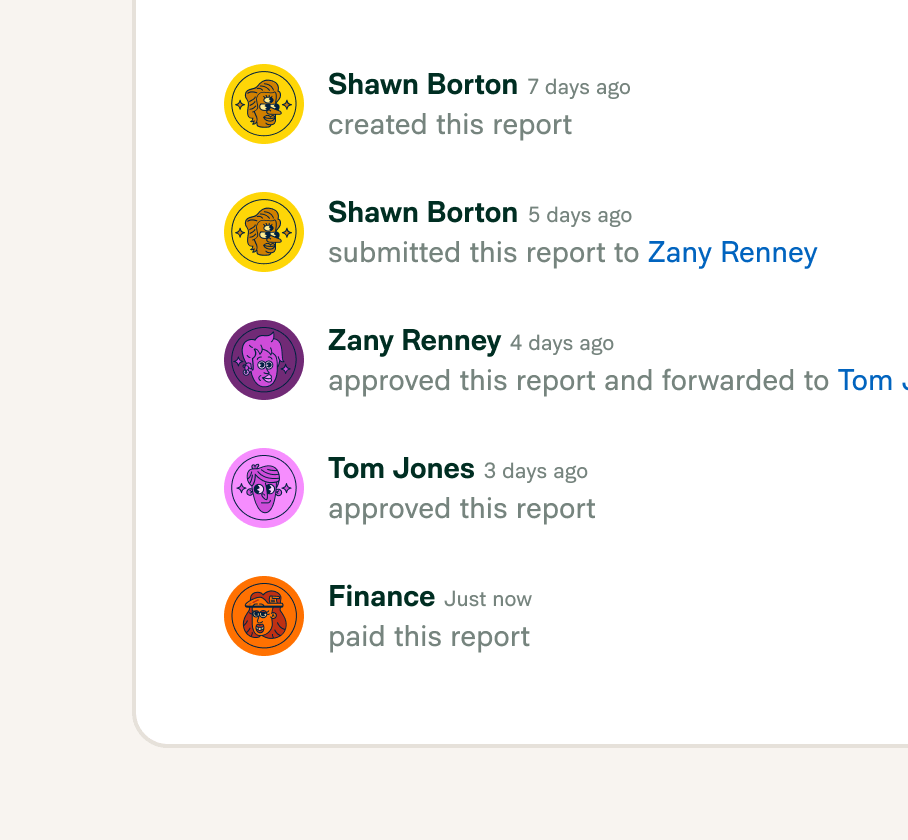

Audit-ready reporting

Full visibility into every action and approval – with a clean, compliant trail behind every report.

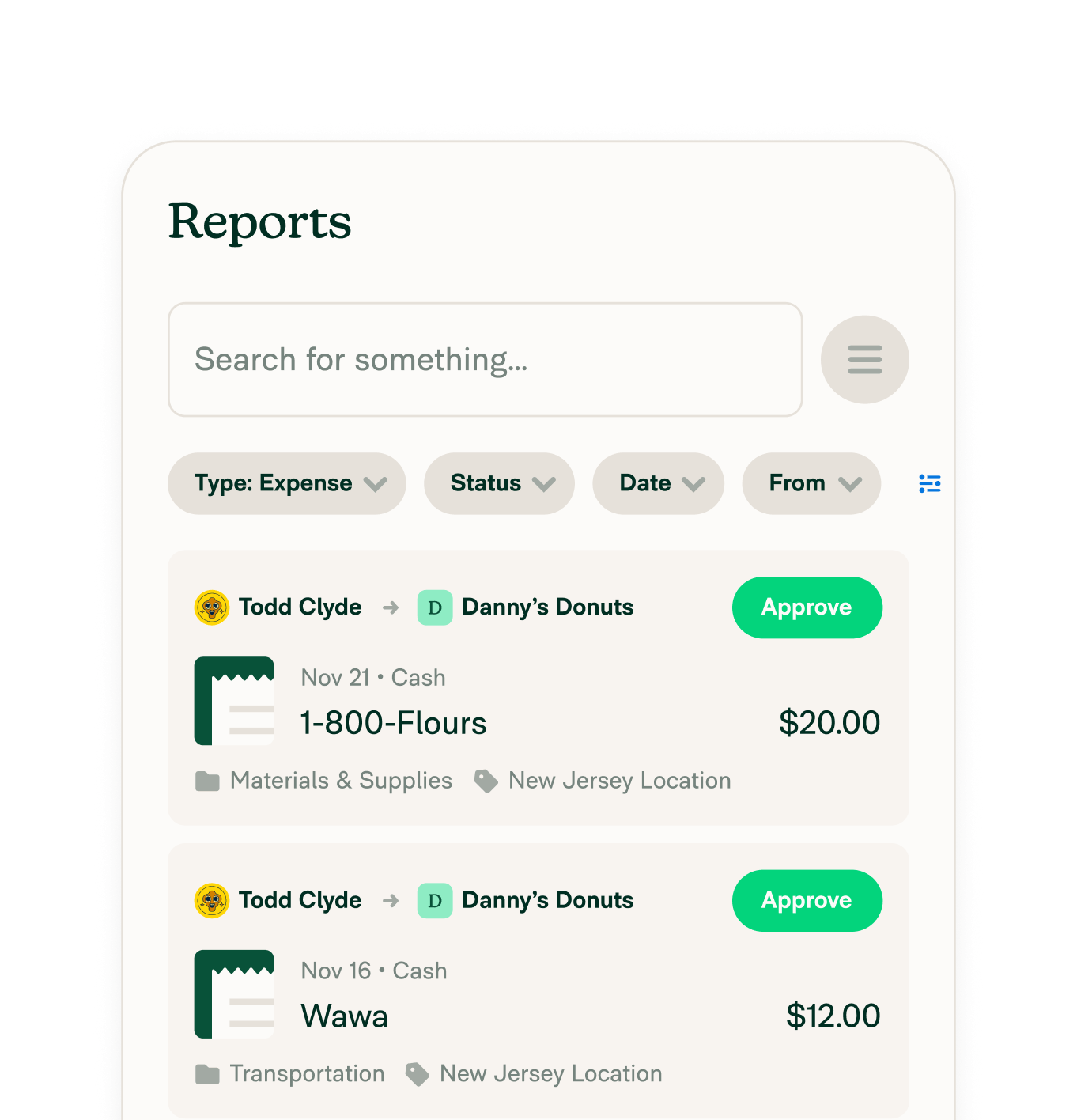

Mobile-first experience

Submit and approve from anywhere with the Expensify mobile app. Expenses don’t pile up because they’re handled in the moment.

FAQs

-

An expense report is an itemized list of business expenses an employee has made out of their own pocket on behalf of an organization. Once an expense report is filed, the organization can reimburse the employee accordingly.

For instance, an expense report created by an employee after a business trip might include rental car costs, ride sharing fees, airfare, hotel room rates, and more.

-

In an expense report, it’s important to include all relevant information to accurately track and report expenses. This includes the date of each expense, a detailed description of the expense, the amount spent, and any supporting receipts or documentation. Additionally, it can be helpful to categorize expenses based on different expense types (e.g., travel, meals, office supplies) for easier analysis and budgeting.

-

To make a simple expense report, start by gathering all relevant receipts and documentation for the expenses incurred. Then, use an expense reporting app to automatically organize and categorize the expenses. Finally, calculate the total expenses and submit the report for approval or reimbursement according to the company’s expense report policy.

-

An employee expense report is a document employees use to report and track their business-related expenses. It typically includes details such as the date, description, and amount of each expense, along with any supporting receipts or documentation. Employees submit their expense reports to their managers or the accounting department for review and approval, after which they may be reimbursed for the expenses incurred. Such reports help ensure that employees are reimbursed for legitimate business expenses and provide transparency and accountability in the company's financial processes.

-

Yes, it is generally recommended to include receipts for expense reports. Receipts serve as evidence of the expenses incurred and help validate the legitimacy of the expenses. They provide the necessary documentation to support and verify the accuracy of the reported expenses, which is important for both the employee and the company. Including receipts in expense reports promotes transparency, reduces the chances of fraudulent claims, and ensures compliance with company policies and tax regulations.

-

The time it takes to create an expense report can vary depending on several factors. Generally, employees need to gather all the necessary information, such as receipts and documentation, and accurately record each expense. This process could take anywhere from a few minutes to a few hours, depending on the complexity of the expenses and the level of organization. However, by using expense management software or mobile apps, employees can streamline the process and save time. These tools allow them to capture and categorize expenses in realtime, reducing the time required to create a comprehensive monthly expense report.

Expensify makes expense reports easy – the way they should’ve been all along. Get reimbursed faster, keep finance happy, and close the books without breaking a sweat.

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.