Bring Your Own Cards (BYOC)

Bring Your Own Cards (BYOC)

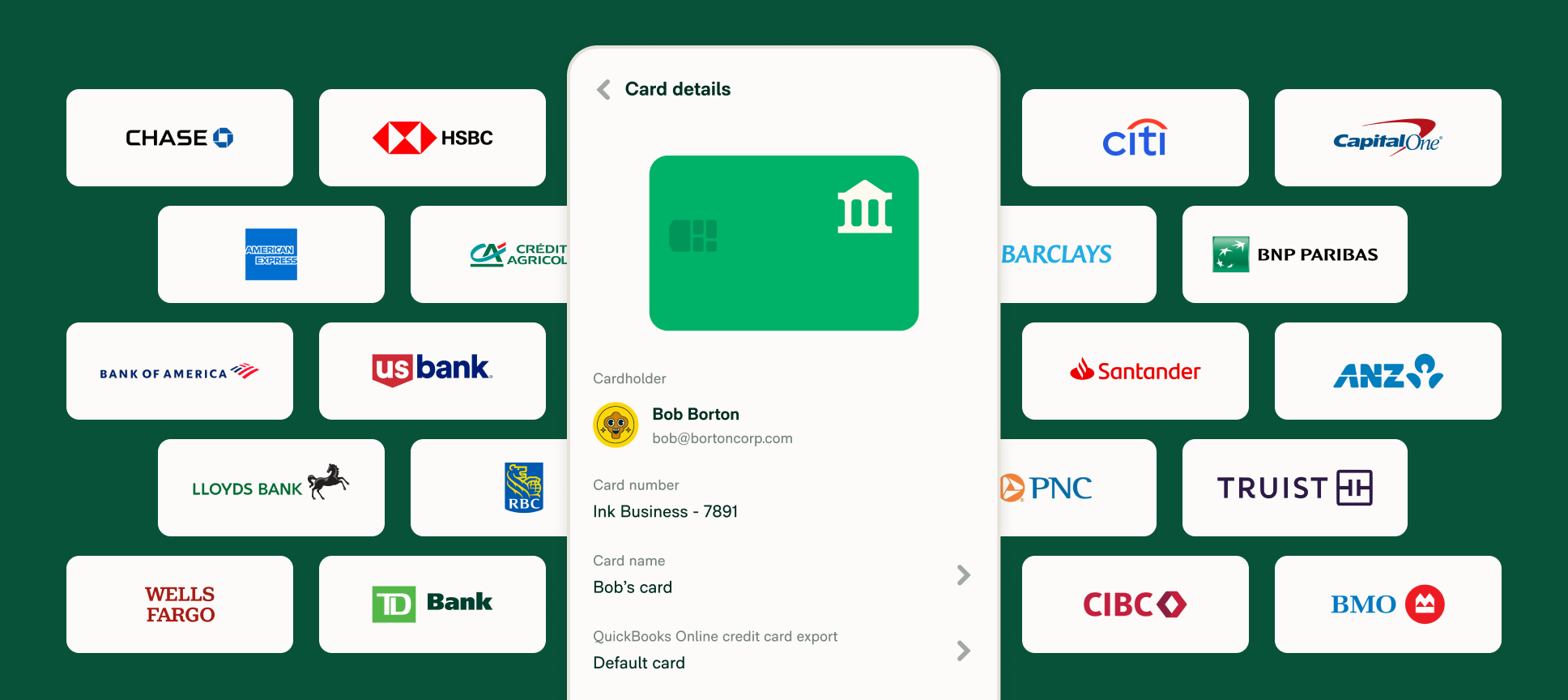

Link the cards you already have. From 10,000+ banks worldwide.

Link the cards you already have. From 10,000+ banks worldwide.

Connect cards from more than 10,000 banks worldwide and save 30+ hours/month with automatic transaction import, coding, receipt matching, and reconciliation.

10,000+ banks supported

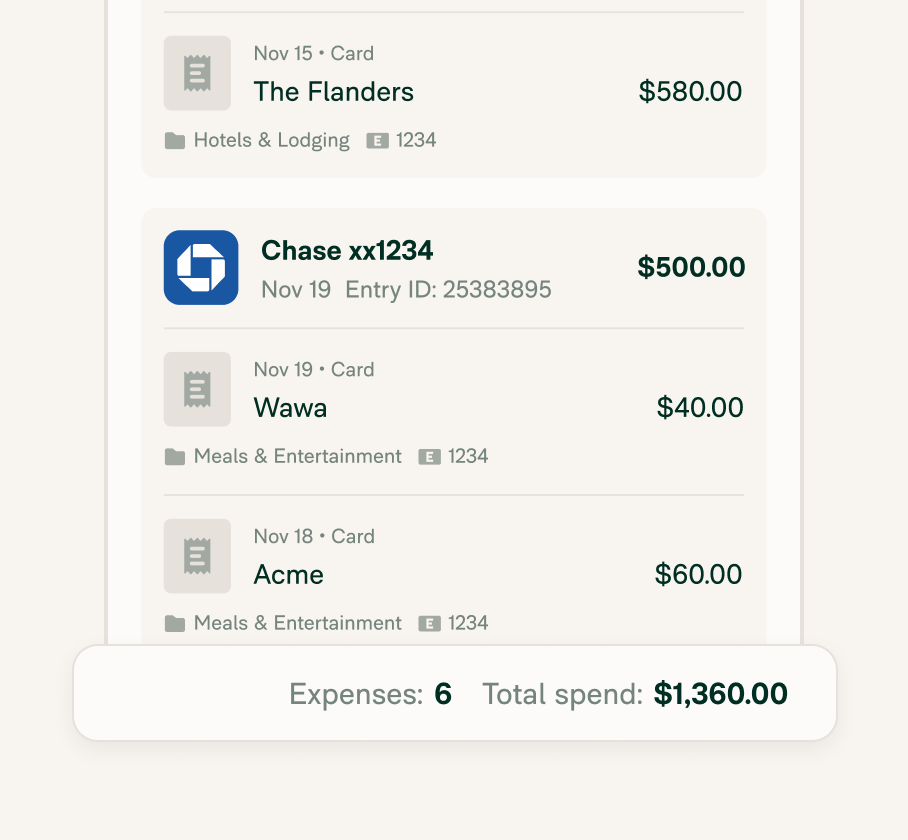

Realtime transaction sync

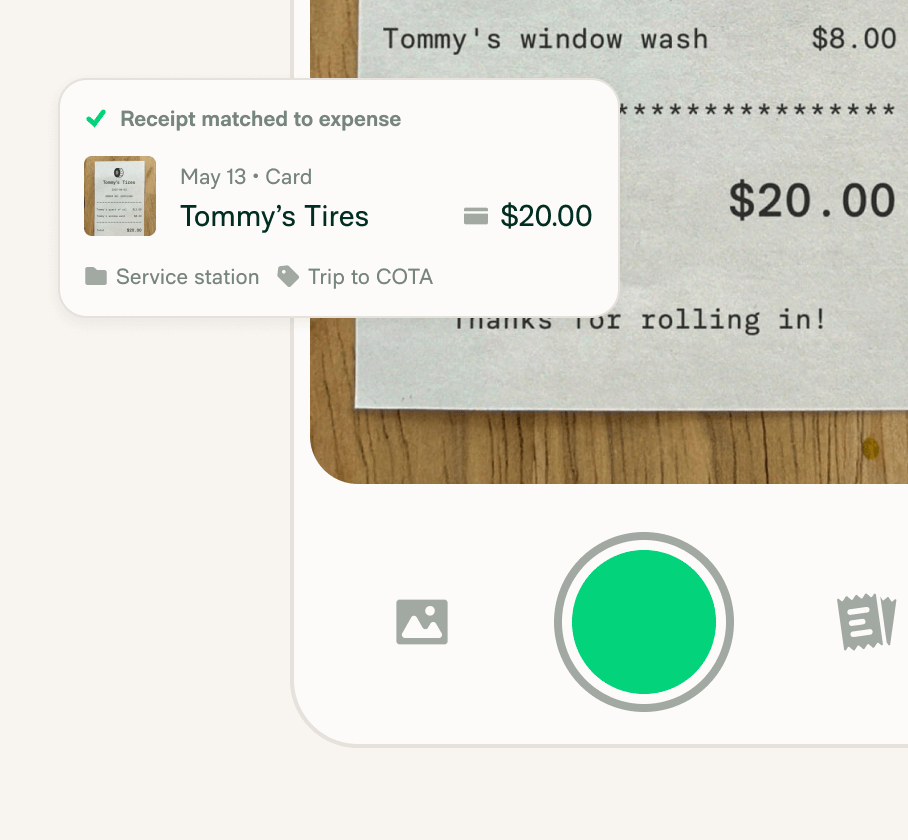

Auto receipt matching

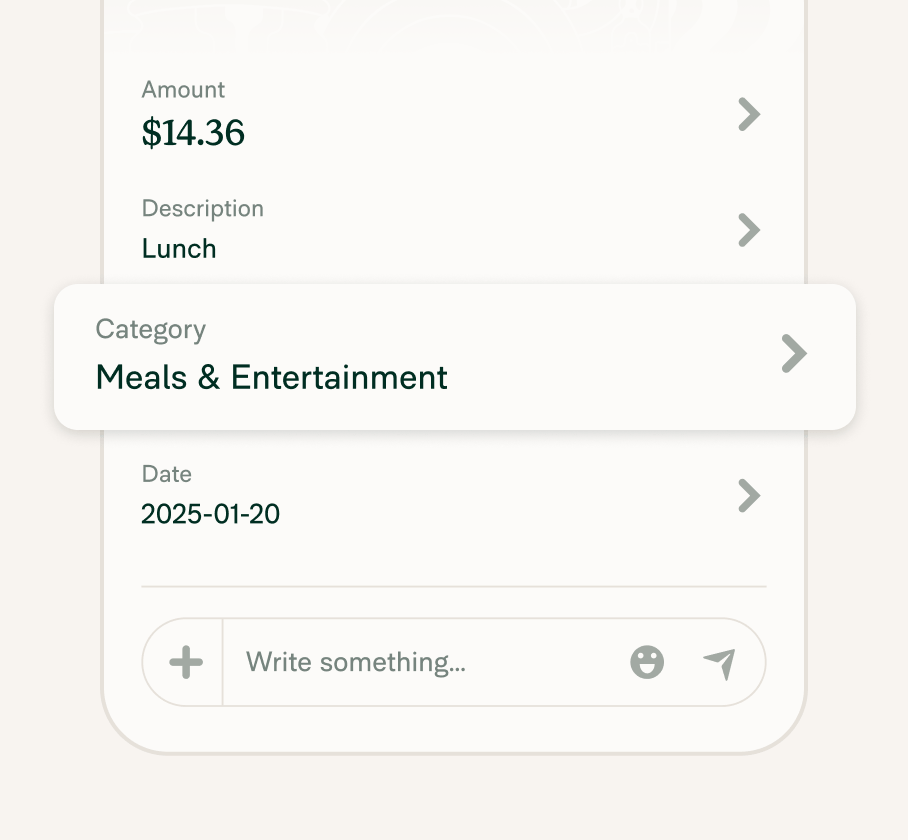

Auto categorization

Easy reconciliation

Built-in

security

Bring your own cards (BYOC) to Expensify so you can keep your points and your sanity. Just give us the receipts.

Keep your points. Skip the “switching tax.”

If you’ve already got company cards and just want to add spend controls on top, Expensify is perfect for you.

Competitors will make you switch cards so they can make money on every swipe. What that means for you:

Losing valuable points, perks, and loyalty rewards

Abandoning long-standing banking relationships and credit history

Reissuing physical and virtual cards to all employees

Remapping GL codes and resetting spend limits

Manually updating billing information across all your vendors

That’s what we call the “switching tax.” Such a hassle to fix what isn’t broken.

Link corporate cards from 10,000+ banks worldwide

You don’t have to switch corporate cards to use Expensify. Just connect what you already have.

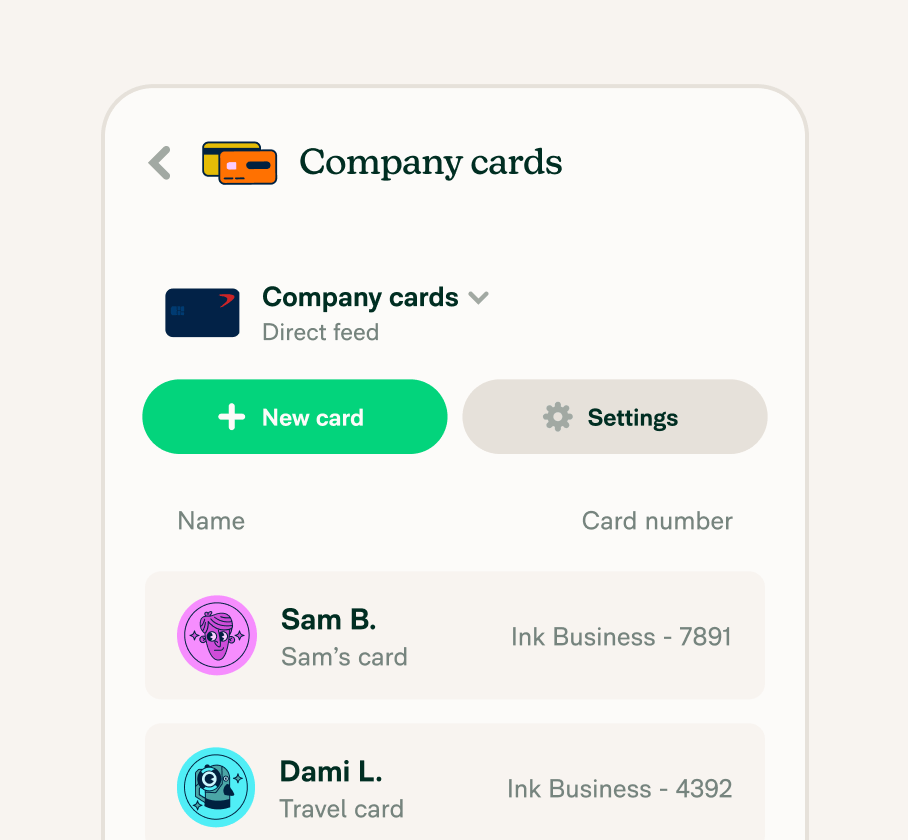

Set up in seconds

Connect and assign corporate cards to your employees in a few easy steps.

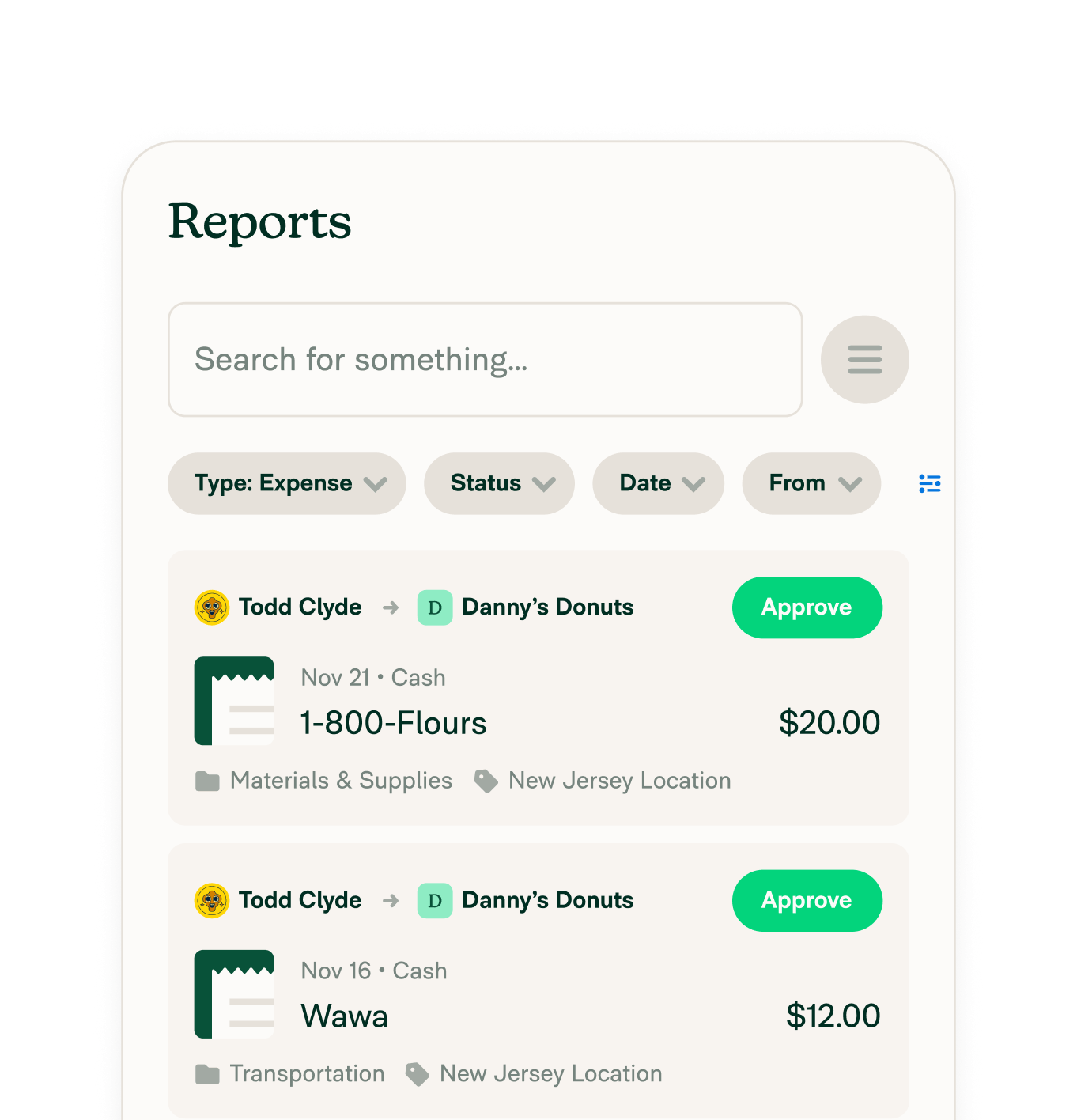

Realtime transaction sync

Transactions appear instantly in Expensify for faster submissions and approvals.

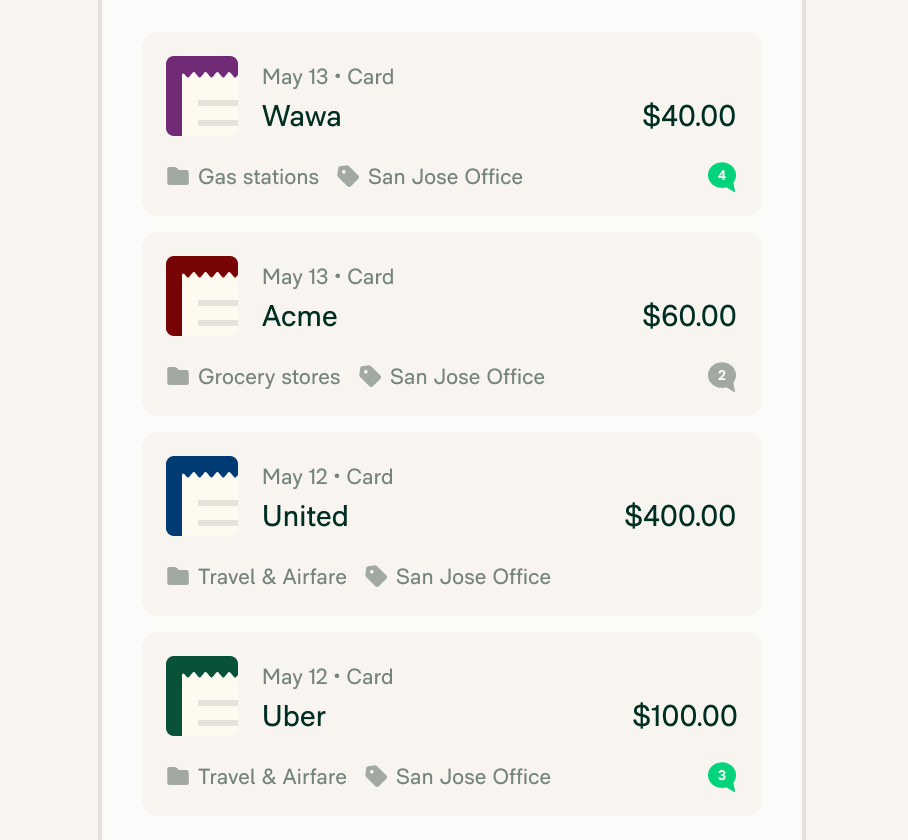

Automatic receipt matching

Expensify automatically attaches the right receipt to every card transaction.

Automated expense coding

Use default or custom categories, or connect your accounting package to auto-code expenses.

Easy reconciliation

Reconcile company card statements faster with complete visibility into every transaction and report.

Built-in security

Every card connection uses TLS with modern encryption, ensuring your data is safe end to end.

FAQs

-

Credit card import is the process of bringing credit card transaction data into a digital tool, such as a financial management platform, budgeting app, or accounting system. Software like Expensify make the process even easier by automatically importing all card expenses – personal or corporate, credit or debit – as long as you connect your bank account. By importing your credit card expenses, you can save hours of time each month on organizing and submitting your expenses for manager (or accountant) review.

-

Expensify has direct commercial feed connections with JPMorgan Chase, American Express, Citi, Capital One, Bank of America, and more.

-

Because requirements vary depending on your company’s needs, the best credit card for work expenses is often different across the board.

If your business already has a preferred company credit card program in place, that’s great! Expensify is card-agnostic, meaning that you can easily import any major card provider – whether it’s Chase, Bank of America, Wells Fargo, Citibank, American Express, Capital One, etc. – directly into our app. If you don’t have a card program yet, then check out the Expensify Visa® Commercial Card to further reduce any manual import friction.

-

The Expensify credit card import feature allows you to import personal, debit, and corporate credit cards into your Expensify account. We recommend importing any card you use for your business expenses.

If you use the Expensify Card, there’s no need to import your card feeds as your card automatically connects to your Expensify account.

-

If employees are uploading receipts into Expensify via SmartScan, email forwarding, or a receipt integration, importing their credit cards ensures an extra level of verification for any associated physical receipt. Expensify merges those transactions automatically for the user in order to minimize manual error.

By not importing credit card expenses directly into Expensify, an admin’s workflow may end up looking something like this:

Download statement at the end of the month.

Filter and prepare it in Excel (or somewhere else) before sending it to employees.

Employees code their expenses and add receipts manually.

Get that data back and prep it for import into your accounting system.

All of this is very clunky. With the Expensify credit card import feature, your card transactions will automatically appear in users’ accounts so everything flows in realtime instead of lumping into a big batch at the end of the month. With additional features like auto-categorization, expense rules, expense limits, and more, admins can reduce as much as 50% of employee time spent on expense management.

-

If you represent a bank, you can apply to become an ExpensifyApproved! Bank partner, which will help you provide a secure, reliable connection to Expensify. Learn more about how to become an Approved! Bank partner here.

-

Credit card import is incredibly easy to set up in Expensify. To import your credit card, navigate to Settings > Account > Credit Card Import and click Import Card/Bank to get started.

With Expensify, you can import your preferred personal, debit, and company cards without needing to switch card programs.

Get your credit card expenses under control with Expensify. Set up your card feed in minutes and automate expense tracking from swipe to report.

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.