How to split travel expenses with friends

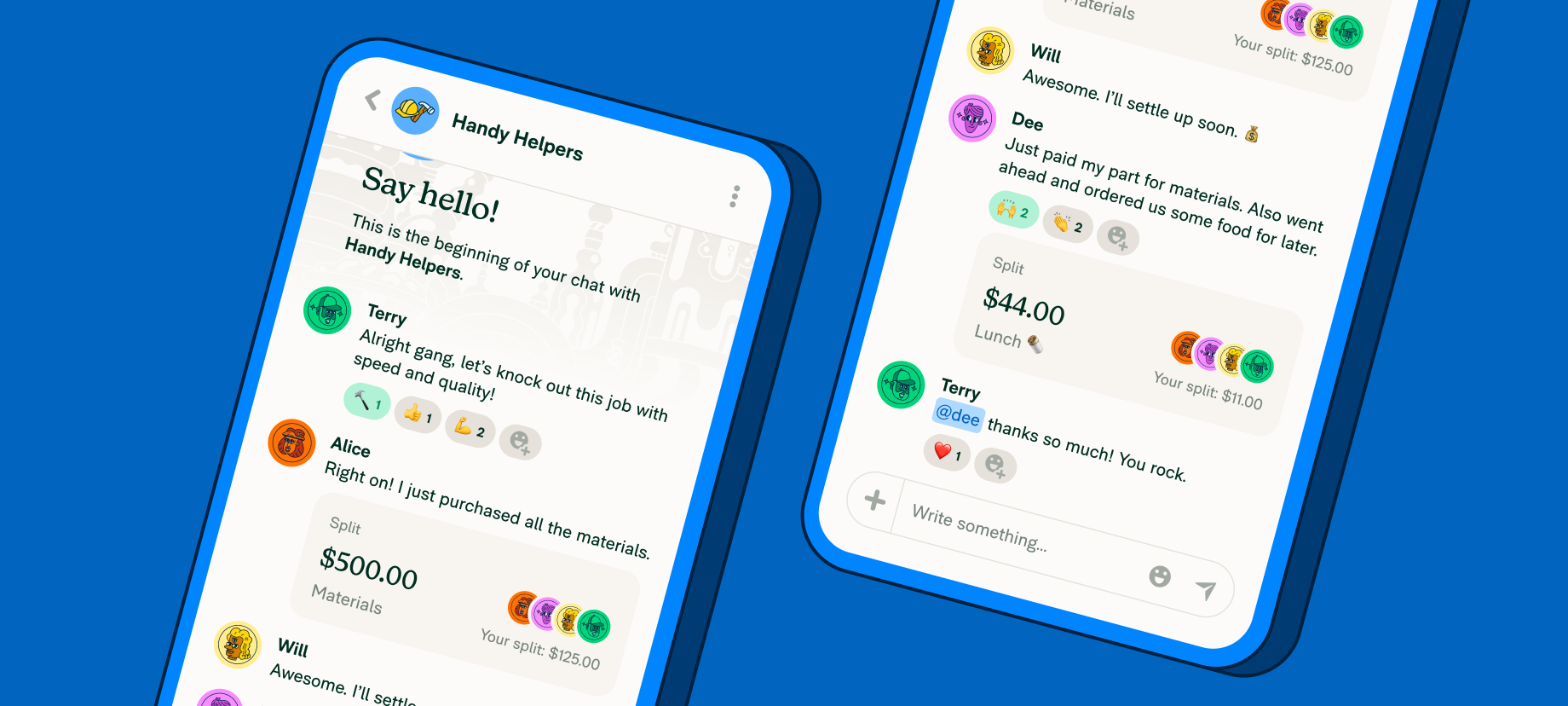

Managing travel expenses with friends can turn memorable trips into a numerical nightmare. With everyone tracking expenses in their own way, lost receipts and differing expenses can lead to confusion and disagreements. In this guide, we'll explore tools and tips for how to split travel expenses with friends, as well as answer some frequently searched questions to avoid awkward conversations with friends, so you don’t dread the settling-up moment.