Insurance

Simplify insurance expense tracking

For agents and adjusters, Expensify makes it easy to track spend, reimburse fast, and stay audit-ready with zero admin overload.

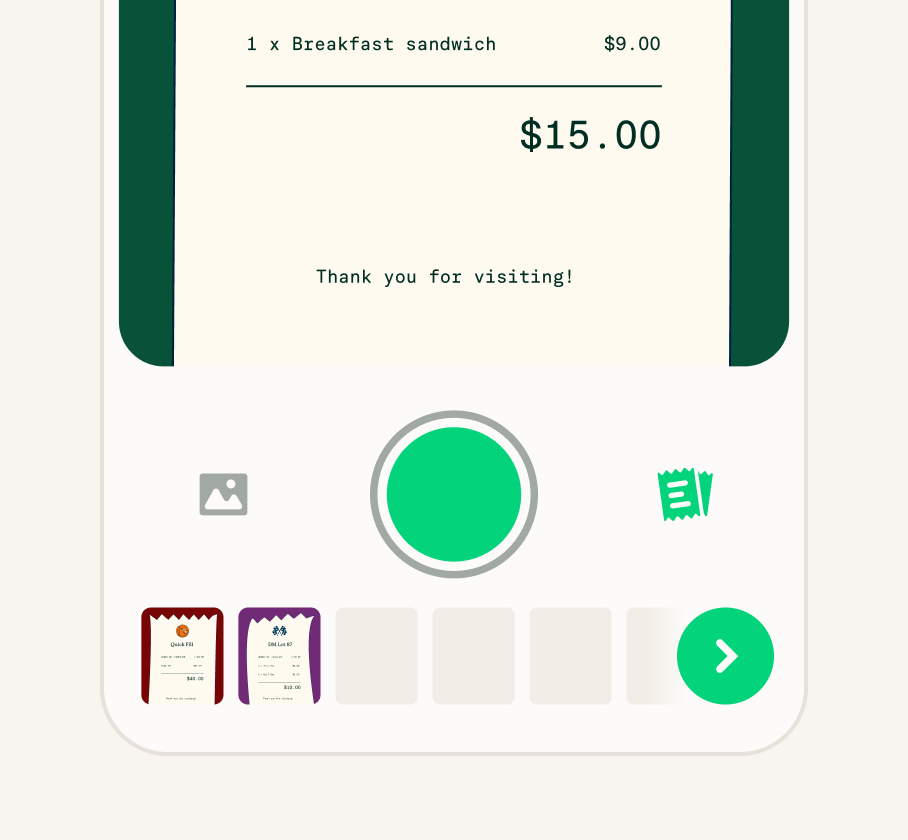

Al-powered receipt capture

Policy-based spend tagging

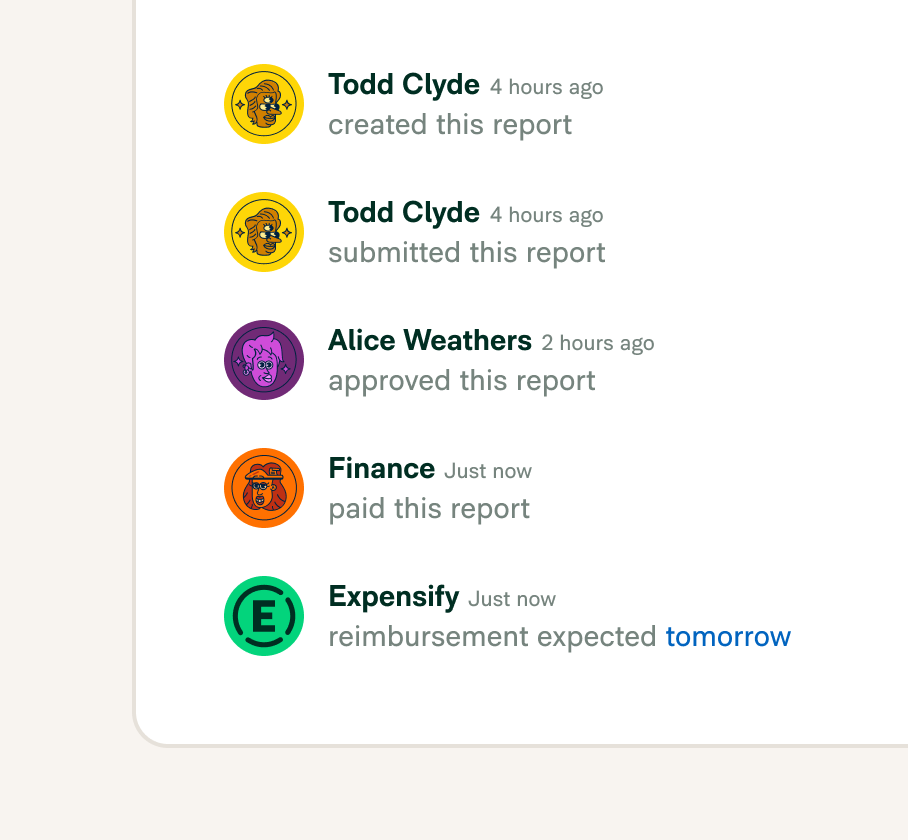

Next-day reimbursements

Seamless accounting sync

Built for insurance expense tracking

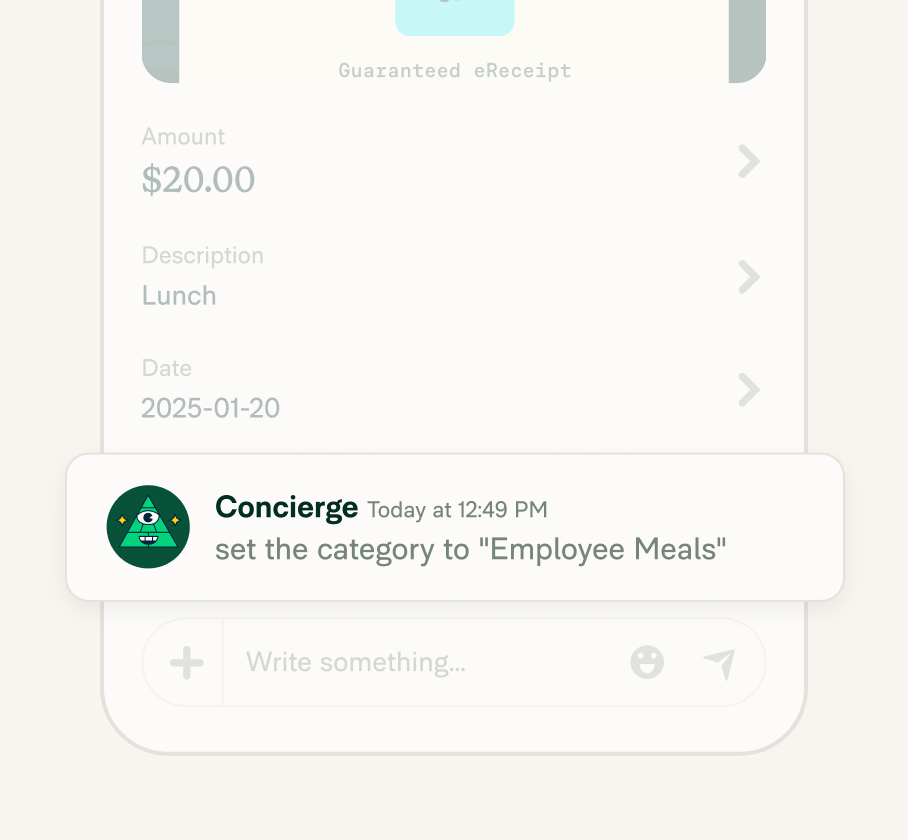

Reduce manual reviews with Expensify AI

Ditch manual review. Expensify’s Concierge AI helps automate expense workflows by categorizing expenses, applying policy rules, and flagging out-of-policy spend, thereby reducing errors and speeding up approvals.

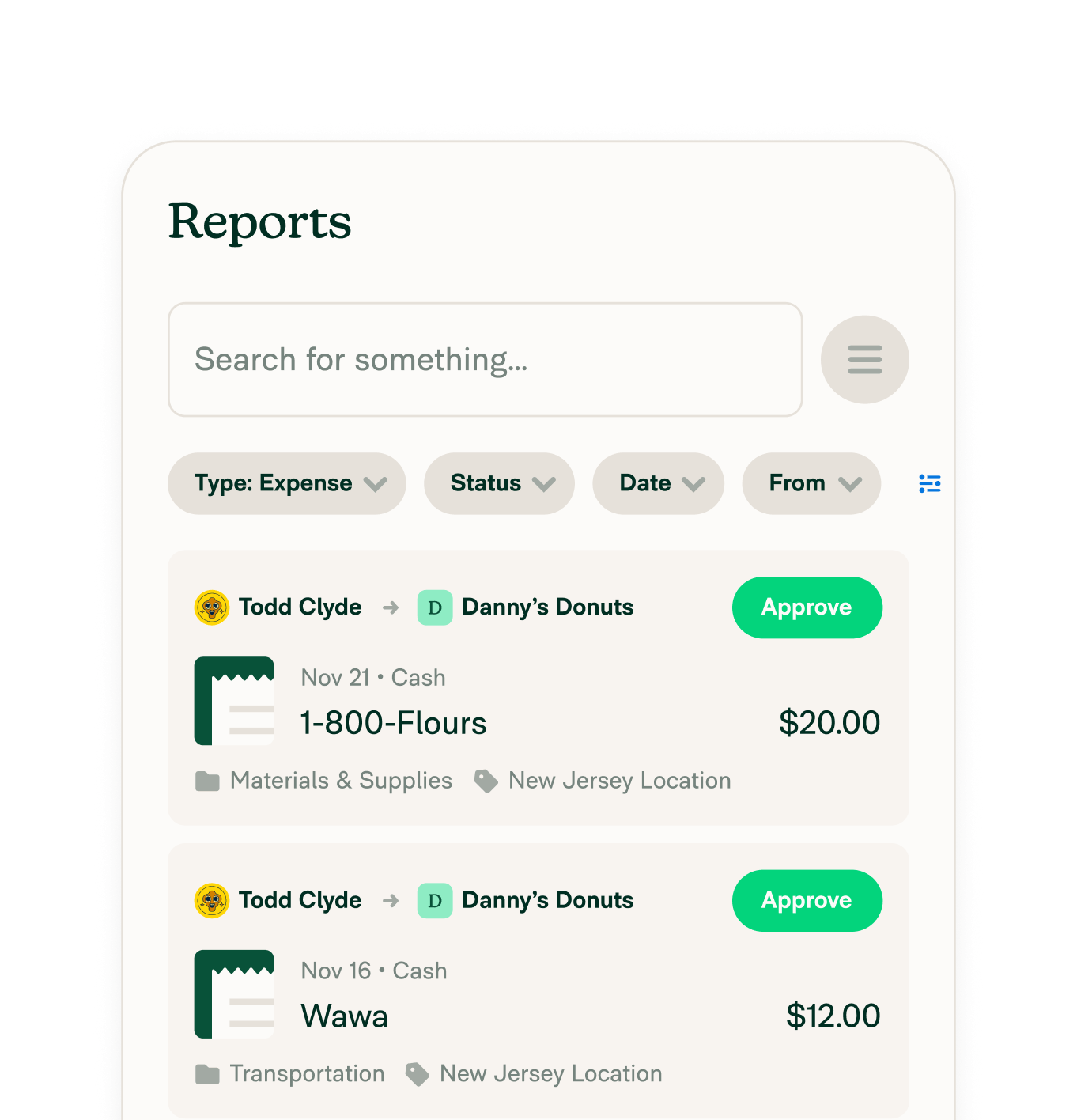

Track agent and adjuster expenses in real time

Whether in the office or out in the field, agents can snap receipts on the go and submit expenses instantly, even in offline mode. Approvals and reimbursements happen fast, keeping your operations agile.

Simplify audits and compliance

Maintain clean, audit-ready records with detailed digital receipts, customizable approval workflows, and ledger-sync for full visibility – no paper-chasing required.

Work with your cards and tools

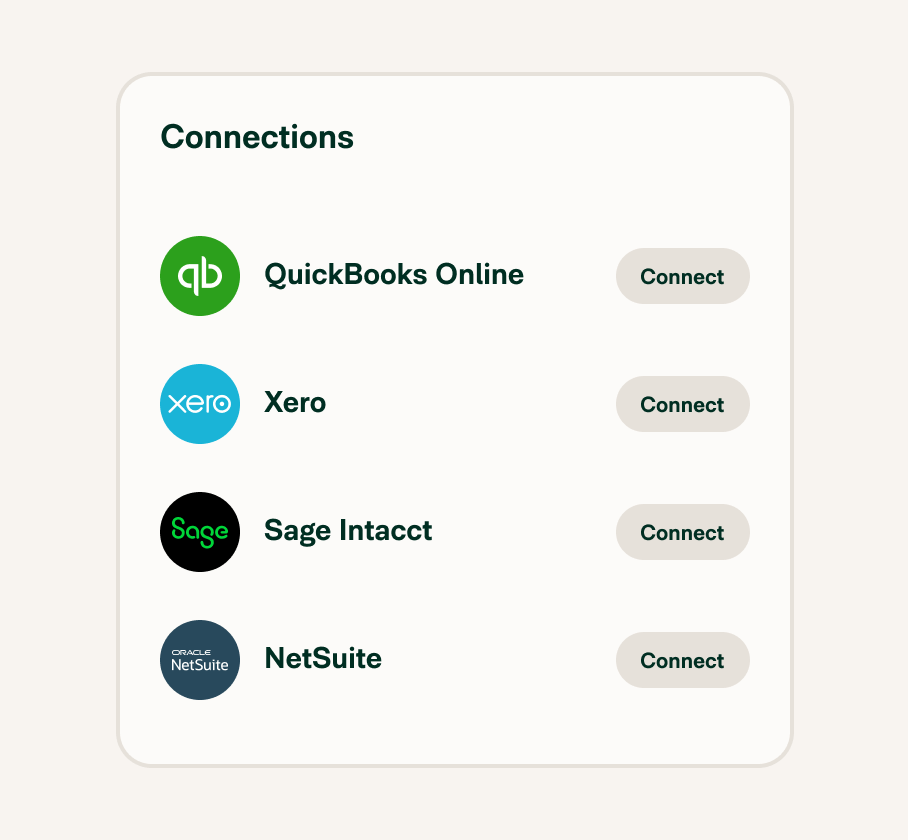

Issue Expensify VisaⓇ Commercial Cards or connect your firm’s existing credit cards. Expenses are automatically categorized, reconciled, and exported to integrated tools like QuickBooks, NetSuite, Xero, or Sage Intacct.

FAQs

-

Insurance companies typically incur expenses such as claims payouts, employee salaries, IT infrastructure, agent commissions, regulatory fees, and travel or marketing costs. Tracking these across departments and roles is essential for compliance and profitability.

Using an automated solution like Expensify helps ensure each cost is categorized and reconciled correctly in your financial reports.

-

Expense factors refer to the cost drivers associated with running an insurance business, from underwriting operations to customer acquisition and claims management. Managing expenses like these efficiently can improve the company’s combined ratio and overall financial performance.

Tools like Expensify give finance teams realtime visibility into spending trends and budget deviations.

Expensify handles receipt capture, categorization, and reconciliation, making it easier to keep property expenses organized and audit-ready.

-

A typical expense ratio (operating expenses ÷ net premiums earned) varies by line of insurance. For property and casualty insurers, an expense ratio around 25–30% is generally considered healthy. Keeping administrative costs low while maintaining service quality is key, and automation can help improve that balance.

-

Insurance companies often use statutory accounting principles (SAP), which prioritize solvency and regulatory oversight, alongside GAAP for broader reporting.

Accurate expense tracking is critical in both frameworks to ensure timely financial reporting, audit compliance, and transparency. Expensify helps streamline and document all employee spend in a secure, auditable format.

-

Operating expenses in the insurance industry include day-to-day costs like salaries, commissions, rent, IT systems, licensing fees, marketing, and travel expenses. These costs support underwriting, policy servicing, claims processing, and sales.

Efficient expense tracking ensures that operating costs stay within budget and are properly allocated, especially for firms aiming to optimize their expense ratio.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial