Expensify + Sage integration

Streamlined expense reporting and financial management

Cut through the clutter with Expensify’s Sage Intacct expense management integration – a one-stop shop for streamlined expense reporting and financial management.

Key features

Sage Intacct Dimensions sync

Integrate with Sage Intacct's core dimensions, including classes, departments, and projects - plus user-defined dimensions (UDDs) for a truly tailored experience.

Corporate card support

Effortlessly integrate your team's corporate cards, streamline reporting of non-reimbursable expenses, and get instant insights into company spending.

Next-day ACH reimbursement

After reports are approved, employees get their money back the very next day, and all data, including reimbursements, are synced automatically.

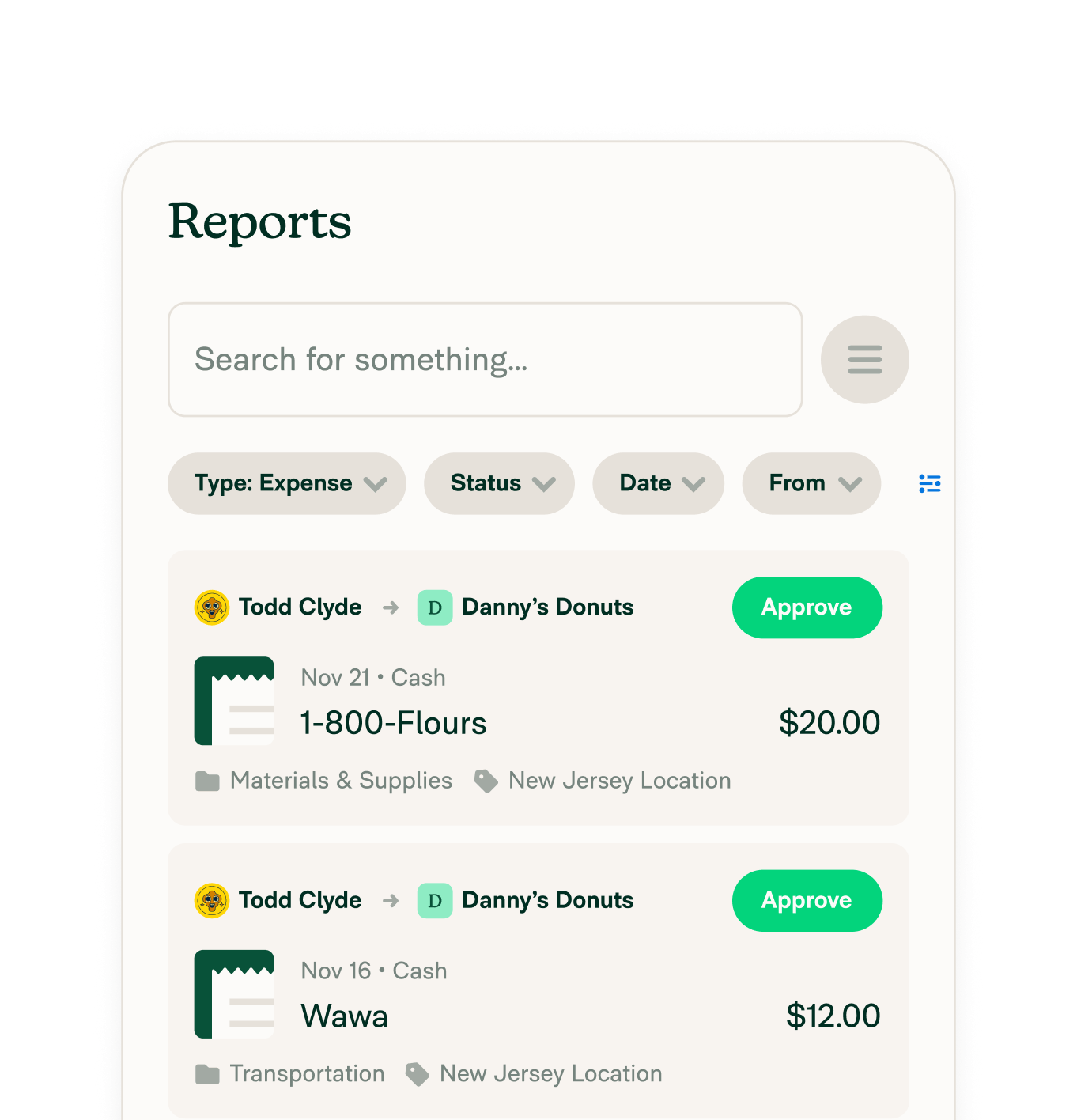

Realtime expense reports

Our expense reports help ensure employee expense records are coded accurately and submitted on time, giving admins better visibility into company spend.

How it works

Connecting Expensify to Sage Intacct is straightforward and powerful. Once set up, expenses sync automatically for faster reporting and month-end close:

-

Configure Sage Intacct for integration

Create a Web Services user (user-based or role-based), enable required permissions, and activate modules like Time & Expenses and Customization Services.

-

Upload the Expensify package

Download the Expensify integration package from your Workspace and import it into Sage Intacct to establish the backend connection.

-

Connect and customize in Expensify

Enter your credentials in Expensify to finalize the connection. Then choose how expenses export (as reports or vendor bills) and sync custom dimensions from Intacct automatically.

Benefits

Simple synchronization

Seamlessly sync your expense reports with Expensify’s Sage Intacct integration, ensuring efficient back-office operations.

Precision in expense categorization

Expenses are automatically coded according to your Sage Intacct Dimensions, providing accuracy in every financial entry.

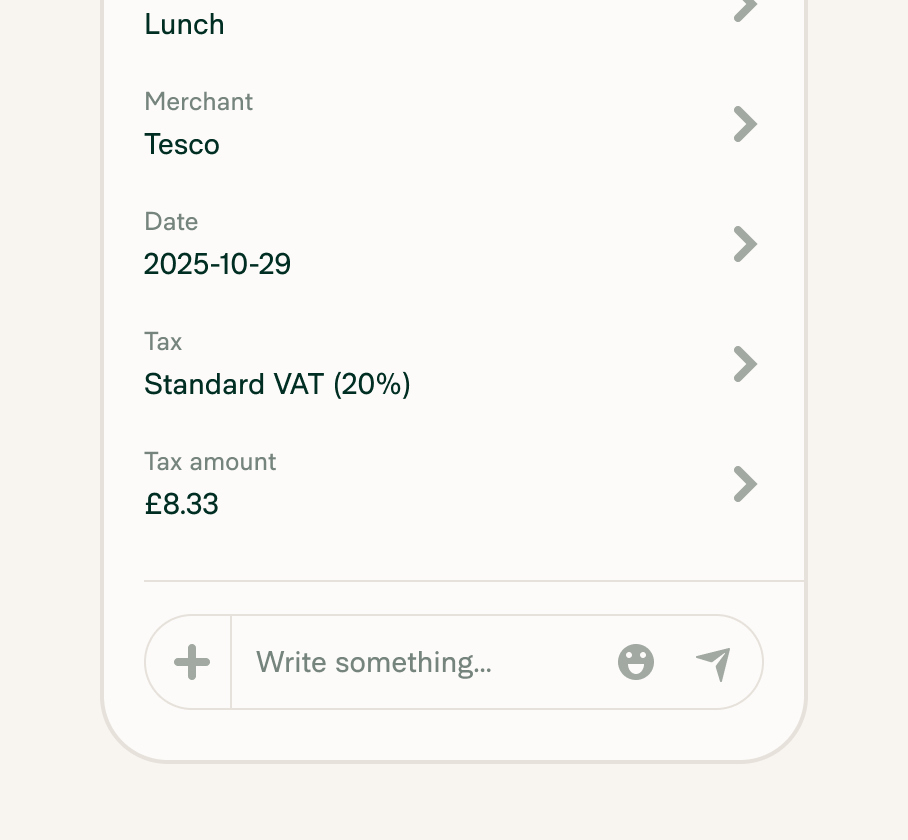

Native tax tracking

Expensify pulls your VAT and GST tax codes from each Sage Intacct entity and applies them automatically.

FAQs

-

Sage Intacct is a comprehensive, cloud-based financial management platform that automates your most essential processes, reduces your reliance on spreadsheets, and gives you greater visibility into your realtime business performance. All of this empowers you to spend less time on accounting and more time growing.

-

The difference between Sage Accounting and Sage Intacct is that Sage Accounting primarily serves small businesses with cloud-based accounting tools, while Sage Intacct offers a broader range of financial management capabilities – ideal for larger companies wanting to manage more complex accounting processes.

Expensify's Sage Intacct integration leverages these advanced features to ensure every financial process is automated, streamlined, and secure, giving you some time back

-

Yes, Sage provides an expense module to track and manage employee expenses. However, when integrated with Expensify, businesses can unlock a deeper level of convenience and control. Expensify integrations offer features like realtime reporting, swift reimbursements, and unmatched security, enhancing the capabilities of Sage's native expense module.

-

Yes, very much so! In fact, Expensify has the special designation of "Sage Intacct Recommended Solution" on the Sage Intacct Marketplace. This is due to Expensify's extensive and powerful integration with Sage Intacct.

-

Yes, if you have a multi-entity setup in Sage Intacct, you will be able to select in Expensify which Sage Intacct entity you want to connect each workspace to.

-

Yes, Dimensions like department, location, class, project, customer, and even user-defined Dimensions that can be pulled from Sage Intacct into Expensify are supported. This allows users to tag their expenses with specific details for accurate financial reporting within the Expensify platform.

-

Yes, our Sage Intacct integration supports native VAT and GST tax. Enabling “Tax” in the integration will import your native tax rates from Sage Intacct into Expensify.

Sage Intacct is a trademark of Sage Group plc or its affiliates. This information was prepared by Expensify and is solely the responsibility of Expensify. Sage Group plc does not control or guarantee the accuracy of any content provided by Expensify.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial