Financial Services

Expense tracking that adds up

Automate client-related expenses and keep your general ledger clean with Expensify. Built for modern firms that value speed, accuracy, and audit-ready records.

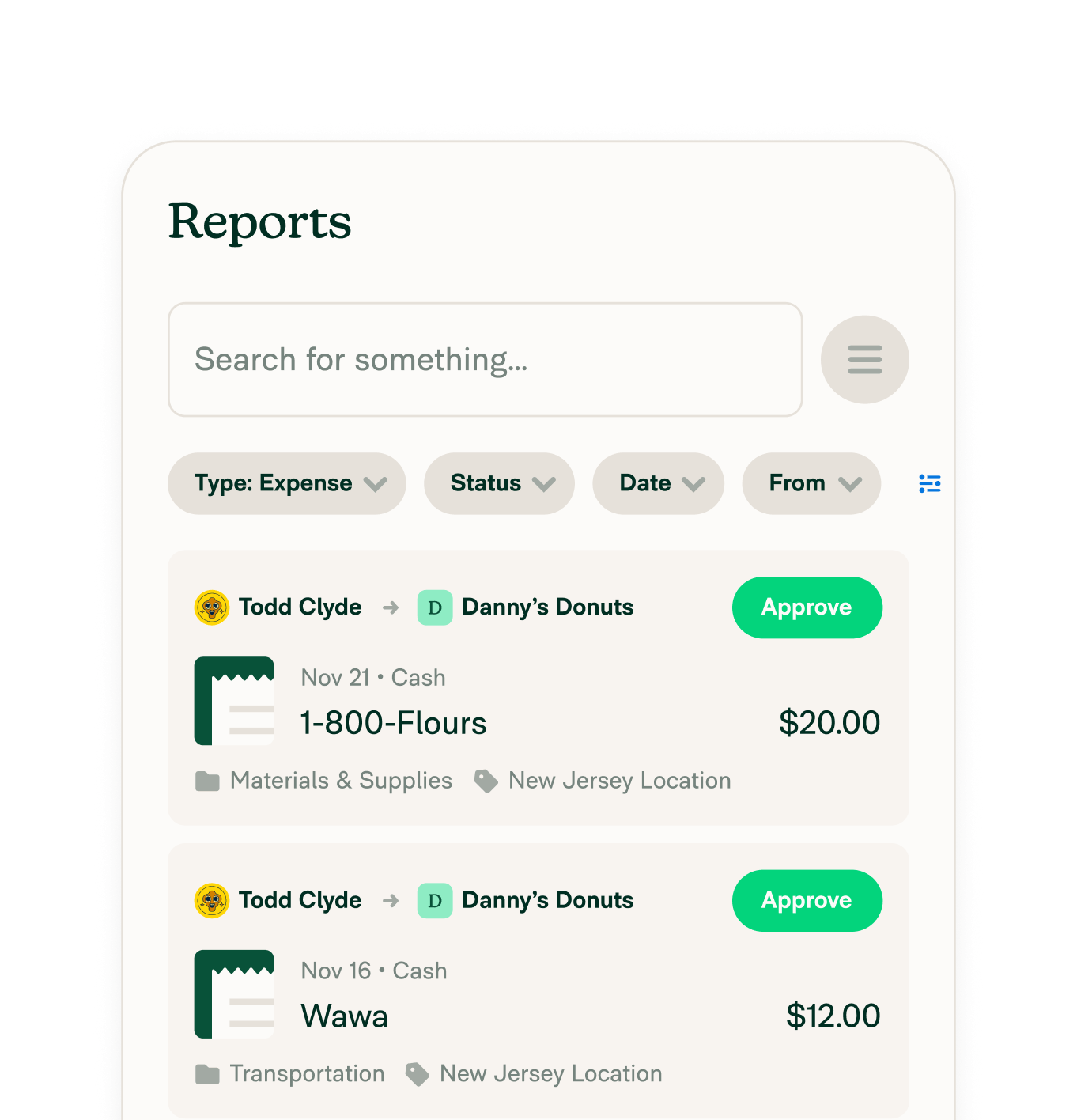

Realtime expense visibility

Secure card controls

Audit-ready reporting

Bring your own cards

Built for financial services

Maintain SEC, FINRA, and audit-ready records

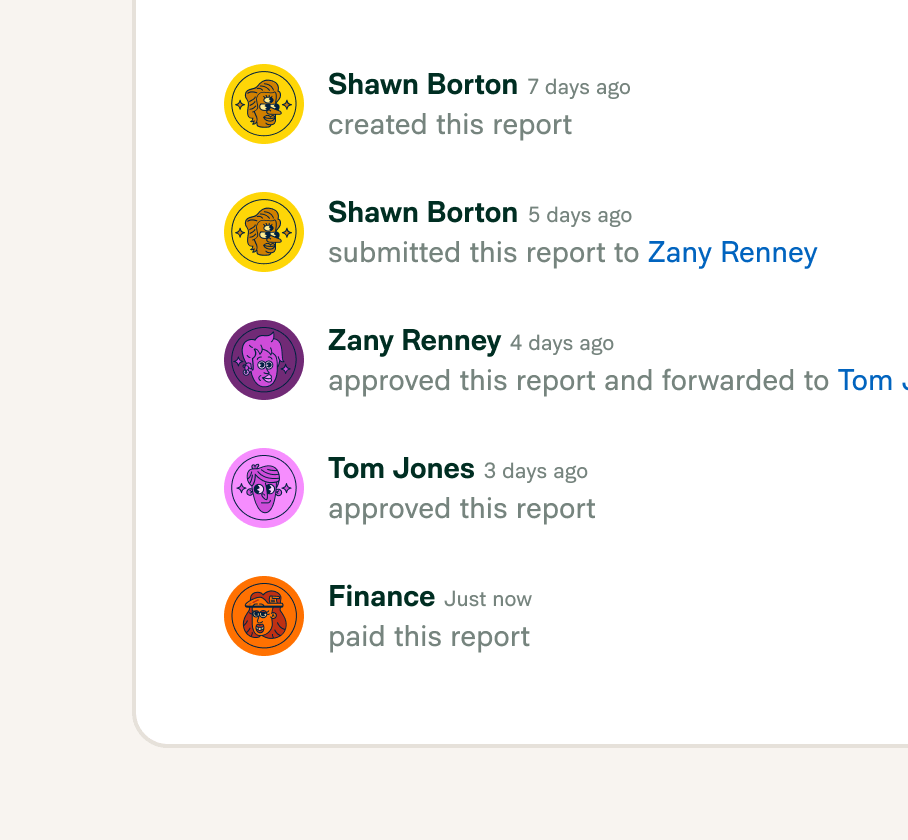

Navigate complex regulations with ease. Expensify helps financial firms maintain a fully auditable record of expenses that supports SEC and FINRA requirements. Capture receipts, apply policies, and route approvals with clear audit trails, all synced to your general ledger for smooth reconciliation.

Empower advisors on the go

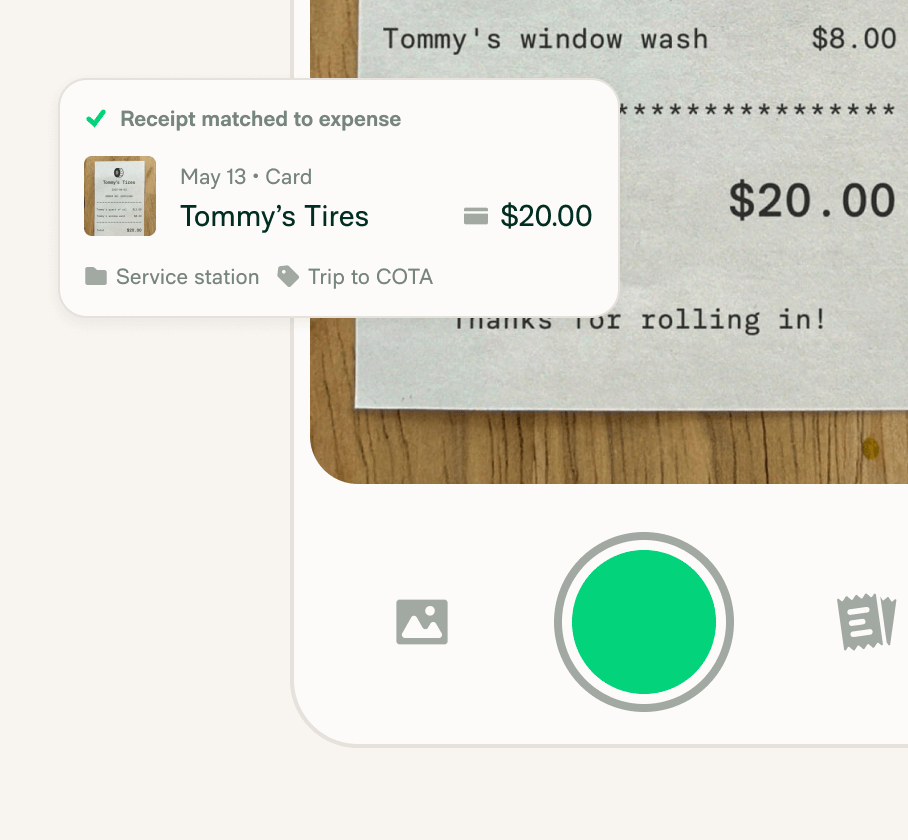

Make life easier for traveling financial advisors with mobile receipt capture, automatic expense categorization, and 24/7 access to reports and approvals.

Support secure, client-friendly operations

Issue the Expensify VisaⓇ Commercial Card or bring your own cards (BYOC) from more than 10,000 banks worldwide. Set spend limits, control access, and ensure compliance with every transaction.

Simplify month-end close

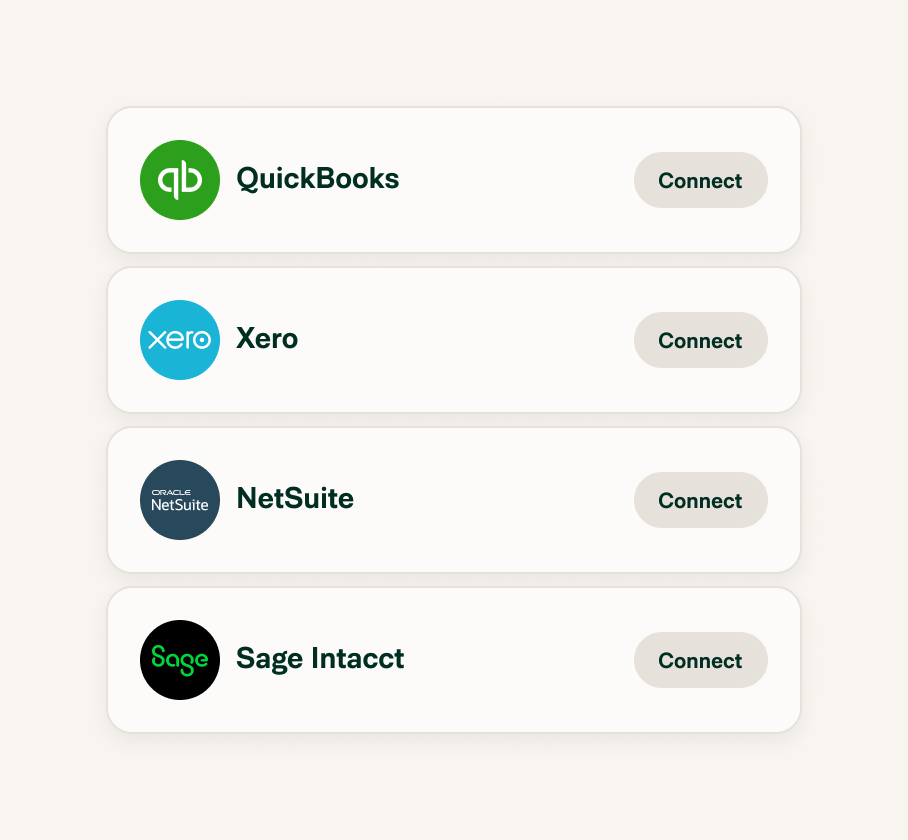

Expensify integrates with software used in finance – including QuickBooks, NetSuite, Xero, and Sage Intacct – to eliminate manual entry and reconcile firm-wide spending faster.

FAQs

-

Financial services firms typically rely on accounting platforms like QuickBooks or NetSuite, CRM systems, and spend management software like Expensify to improve visibility and simplify reporting.

-

Financial advisors often choose software like Expensify to manage reimbursements, automate reporting, and maintain SEC-compliant audit trails. As one of the best expense management software platforms for financial advisors, Expensify streamlines everything from mileage tracking to month-end reconciliation.

-

Use expense tracking software for financial services that automates receipt collection, tags expenses by advisor or client, and syncs directly to your ledger, all in realtime.

-

Expensify lets you tag expenses by advisor, client, fund, or department. This improves organization, accuracy, and compliance.

-

Yes, many financial planners still use Excel for budgeting, forecasting, and reporting. However, spreadsheets require manual data entry and are prone to errors. Expensify is a secure alternative that automates expense tracking and integrates with accounting software for financial advisors.

-

Hedge funds need precise, auditable records to manage operational costs and investor reporting. Expensify provides expense tracking software for hedge funds that simplifies expense tracking, automates approvals, and syncs seamlessly with your accounting stack, ideal for lean teams managing high volumes of transactions.

-

Financial advisors often manage expenses submitted by clients or staff for compliance, billing, or tax purposes. With Expensify, clients can easily capture and submit receipts, while advisors tag expenses by account, apply firm policies, and export clean data to accounting software like QuickBooks or Xero. This ensures accurate records without the manual follow-up.

-

Wealth management firms often issue company cards to partners and staff. Expensify syncs transactions from firm credit cards, matches them to receipts in realtime, and categorizes expenses for seamless reconciliation – no spreadsheets or manual matching required.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial