How to track and manage miscellaneous expenses in 2026

It's month-end closing, and there's that familiar pile of receipts marked "miscellaneous" staring back at you. A twenty dollar office supply purchase here, a thirty dollar emergency software subscription there, and suddenly these small, seemingly random expenses are throwing off your entire expense report.

Sound familiar? You're not alone.

Miscellaneous expenses are those tricky costs that don't fit neatly into standard business categories. While individually small, they add up quickly and can create serious headaches during tax season if not tracked properly.

The good news? With the right approach and tools like Expensify's expense management system, managing these scattered costs becomes straightforward and stress-free, which is what we’ll address in this article.

Key takeaways

- Small businesses often lose financial control when miscellaneous expenses aren't categorized consistently, leading to inaccurate reporting and missed tax deductions.

- "Federal Taxes on Business Income" ranks as the fourth most critical problem for small businesses, with a quarter of small business owners considering it a critical issue.

- Poor visibility into miscellaneous spending makes budgeting harder and can mask important business expense patterns.

- Use realtime expense tracking with mobile apps to capture miscellaneous receipts as they happen, preventing end-of-month chaos.

- Expensify's SmartScan technology automatically categorizes miscellaneous expenses using machine learning, saving hours during monthly reconciliation.

Understanding miscellaneous expenses

Most small business owners know the frustration of trying to categorize that weird $20 purchase that doesn't fit anywhere obvious. These oddball expenses can quickly spiral into a messy catch-all category that makes financial reporting a nightmare.

What are miscellaneous expenses?

Miscellaneous expenses are business costs that don't easily fit into standard accounting categories like office supplies, business travel, or marketing. These expenses matter more than their small individual amounts suggest.

They represent about 15% to 20% of total business expenses for most small companies, yet they're often the least organized category in expense reports. Poor tracking of miscellaneous expenses can lead to missed tax deductions, inaccurate financial reporting, and frustrating audits.

The biggest challenge with miscellaneous expenses isn't their complexity but their variety. Unlike predictable categories like rent or insurance, miscellaneous expenses are unpredictable by nature. This makes them harder to budget for and easier to lose track of, especially when using manual expense tracking methods.

Common types of miscellaneous expenses

Understanding what qualifies as miscellaneous expenses helps create better tracking systems. Let's break down the most common types you'll encounter across different business structures.

Business-specific miscellaneous expense examples

These miscellaneous business expenses are pretty typical across most small companies and often fall outside standard accounting categories:

Office supplies and small equipment: Printer cartridges, desk organizers, batteries, or that emergency phone charger when the office runs out. These purchases happen sporadically but are essential for day-to-day operations.

Professional development materials: Books, online course fees, industry publications, or certification materials that don't warrant their own training budget category. These investments in employee growth often get buried in miscellaneous expenses.

Minor repairs and maintenance: Small fixes that don't qualify for major maintenance contracts, like replacing a broken chair wheel, fixing a squeaky door, or patching a small hole in the wall. These keep the workplace functional but happen irregularly.

Occasional software subscriptions: One-month trial subscriptions, temporary software access for specific projects, or small apps that aren't part of your core technology stack. Unlike regular software licenses, these are typically short-term needs.

Small business gifts: Thank-you gifts for clients, employee recognition items, or holiday gifts that fall below your formal gift policy threshold. These relationship-building expenses often don't have their own category.

Understanding what constitutes other miscellaneous expenses helps create better tracking systems and ensures nothing falls through the cracks during monthly reconciliation.

For small businesses using Expensify, creating sub-categories within miscellaneous expenses helps maintain organization while keeping reporting simple.

Personal business miscellaneous expenses for the self-employed

Self-employed professionals face unique challenges when categorizing expenses that blur the line between personal and business use. These costs often happen spontaneously and don't fit neatly into standard business categories, making them prime candidates for the miscellaneous bucket.

Home office supplies: Specialized pens, sticky notes, filing supplies, or small organizational tools that support your home workspace but aren't major furniture or equipment purchases.

Professional certifications: Annual certification renewals, exam fees, or continuing education requirements that maintain your professional standing. These are necessary but infrequent expenses.

Industry memberships: Professional association dues, chamber of commerce memberships, or trade organization fees that provide networking and learning opportunities but aren't marketing expenses.

Networking event costs: Registration fees for small networking events, business card printing for specific events, or name tags and materials for conferences you're attending rather than hosting.

How miscellaneous expenses work in real-world scenarios

Seeing how different businesses handle miscellaneous expenses in practice makes the concepts more concrete. The following scenarios illustrate common challenges and practical solutions across various business types.

Scenario 1: Self-employed creative freelancer or independent contractor

Situation: Maria runs a freelance graphic design studio from her converted garage in Portland. Between juggling three regular clients and chasing new projects, she's constantly buying digital assets that don't fit anywhere obvious in her budget.

Last month alone, she purchased a vintage script font for a coffee shop’s rebrand, a set of botanical illustrations for a wellness startup, and extra Shutterstock credits when a client suddenly needed "something more urban" for their campaign.

Examples of miscellaneous expenses:

Specialty font licenses for specific client aesthetics ($25-$75 each)

One-off design asset purchases like textures or icons ($10-$40 each)

Emergency stock photo credits when her monthly plan runs out ($8-$25 per image)

Color palette tools and design inspiration apps ($5-$15 monthly)

Solution: Maria tags each digital purchase with the client name and project code in her expense tracking. This way, she can bill back project-specific assets to clients while keeping her general subscriptions separate. She photographs receipts immediately using her phone – crucial since waiting until month-end means forgetting which vintage typeface went with which artisanal coffee client.

This client-specific tagging approach works well for most freelancers, independent contractors, and consultants who need to track project-based expenses for accurate billing and tax documentation.

Scenario 2: Small business IT consulting firm

Situation: James owns a five-person IT consulting firm that serves local businesses throughout the Sacramento area. His team handles everything from network setups to emergency troubleshooting, which means they're constantly dealing with unexpected expenses that don't fit neatly into categories.

Yesterday, one technician had to buy a specific cable adapter while on-site at a dental office, another picked up lunch for the team during an all-day server migration, and James himself paid for parking at three different client locations during a particularly hectic Tuesday.

Examples of miscellaneous expenses:

Emergency hardware purchases when something breaks mid-job ($15-$85)

Parking fees at downtown client locations ($3-$12 per visit)

Team meals during long troubleshooting sessions ($25-$60)

Temporary software licenses for specific client needs ($30-$150)

Coffee and snacks for all-night network migrations ($20-$40)

Solution: James organizes these scattered expenses using geographic and project tagging. Each team member uploads receipts immediately and adds notes about which client job required the expense. This detailed tracking helps him determine which costs are reimbursable to clients and ensures his team gets reimbursed quickly for out-of-pocket purchases. The memo feature becomes crucial for remembering why they needed that oddly specific Ethernet coupler six weeks later.

Understanding travel expense management helps small business owners like James handle the complexity of location-based miscellaneous expenses.

Scenario 3: Mid-market retail chain

Situation: A family-owned retail chain with fifteen stores across three states faces seasonal miscellaneous expenses that vary by location and time of year.

Examples of miscellaneous expenses:

Seasonal decorations and display materials ($50-$200 per store)

Emergency supplies when shipments are delayed ($25-$150)

Local advertising materials for store-specific events ($30-$100)

Small gifts for loyal customers during holidays ($10-$50 per store)

Solution: The company uses department codes for each store location and expense categories for different types of miscellaneous purchases. Store managers can even text receipts for immediate processing, which prevents losing important records during busy seasons. Monthly reports help identify which stores have higher miscellaneous expenses, allowing for better budgeting and identifying potential issues early.

This approach mirrors the success of Seasonal Magic LLC, where similar multi-location expense tracking improved both compliance and financial visibility for their business. Check out how using Expensify for all those pesky miscellaneous expenses saved them $23K in just one year.

“The after-sale and ongoing customer service Expensify provides really is second to none. There has not been a single time, whether with our Account Manager or the Concierge Service, where I have not been able to get an answer, or assistance [with] 'how to' [do something]. They are friendly, regardless of how silly the question might be.”

Tax considerations and deductibility

Proper tax treatment of miscellaneous expenses can significantly impact your business's financial health. Understanding deductibility rules and documentation requirements helps maximize legitimate deductions while ensuring compliance.

The big question: Are miscellaneous expenses deductible?

Most miscellaneous business expenses are tax-deductible, provided they meet IRS requirements for business necessity and ordinary use in your industry. The key is maintaining proper documentation that shows the business purpose and amount of each expense.

This is especially important because, according to the National Federation of Independent Business (NFIB) 2024 Problems and Priorities Survey, "Federal Taxes on Business Income" ranks as the 4th most critical problem for small businesses, with a quarter of small business owners considering it a critical issue.

Proper categorization and documentation of miscellaneous expenses can help reduce this tax burden through legitimate deductions.

Important note: For tax year 2026 and beyond, most miscellaneous itemized deductions for individuals are permanently disallowed under current U.S. tax law.

Documentation requirements

Keep receipts: Save every receipt, whether digital or physical

Note business purpose: Write why the expense was necessary for your business

Record details: Date, amount, and business context for each expense

Use digital storage: Cloud-based systems prevent lost documentation

The IRS requires "adequate records" that substantiate the amount, time, place, and business purpose of expenses.

Common deductible miscellaneous expenses

Office supplies under $50

Professional development materials

Business gifts under $25 per recipient per year

Minor repairs and maintenance

Necessary software subscriptions

What to avoid

Don't mix personal and business: Keep purchases separate when possible

Avoid vague descriptions: "Supplies" isn't specific enough for audits

Never estimate amounts: Always use actual receipts and amounts

Don't wait to document: Record the business purpose while it's fresh in your memory

Recent tax changes

Unreimbursed employee business expenses are not deductible for most employees in 2026. This includes common costs such as home office expenses, supplies, tools, and travel paid out of pocket. These deductions were previously suspended and are now permanently eliminated for most individual taxpayers, with limited exceptions for specific professions defined by the IRS.

Good news: Businesses can still deduct ordinary and necessary miscellaneous expenses when they are incurred for business purposes and properly documented, subject to standard IRS rules.

Tax rules can change over time, but this guidance reflects IRS regulations in effect for the 2026 tax year.

Best practices for tracking miscellaneous expenses

Establishing consistent processes for managing miscellaneous expenses prevents them from becoming a chaotic catch-all category. These proven strategies help maintain organization while ensuring accurate financial reporting.

Organization strategies

Create clear subcategories: Instead of dumping everything into "miscellaneous," create logical subcategories like "office supplies," "professional development," and "client gifts." This makes reporting clearer and helps identify spending patterns.

Set up consistent documentation:

Photograph receipts immediately using your phone's camera

Add memo notes explaining the business purpose

File them in a centralized digital system

Don't wait until later; context gets forgotten quickly

Tracking approaches

Track expenses in realtime: Log expenses as they happen rather than trying to recreate them from memory later. Mobile expense tracking apps make this process quick and convenient, even when you're away from your computer.

Establish spending thresholds: Decide what amount qualifies as "miscellaneous" versus worthy of its own category. Many businesses use $50 to $100 as the threshold, with anything above that getting a more specific categorization.

Review and maintenance

Schedule regular reviews: Set up weekly or monthly reviews of miscellaneous expenses to:

Catch any that should be recategorized

Identify spending patterns

Prevent the category from becoming meaningless

Monitor for new categories: If you're regularly spending on the same type of miscellaneous item, it might be time to create a dedicated category for it.

Learn more: How to categorize business expenses

Digital solutions for modern expense management

Technology has transformed how businesses handle scattered expenses, making automation and realtime tracking accessible to companies of all sizes. According to a 2022 Gartner survey, 80% of executives believe automation can be applied to any business decision, highlighting the growing trend toward automated solutions in areas like expense management.

For miscellaneous expenses specifically, Expensify offers several game-changing features that turn chaotic receipt management into a streamlined process.

Text receipts instantly

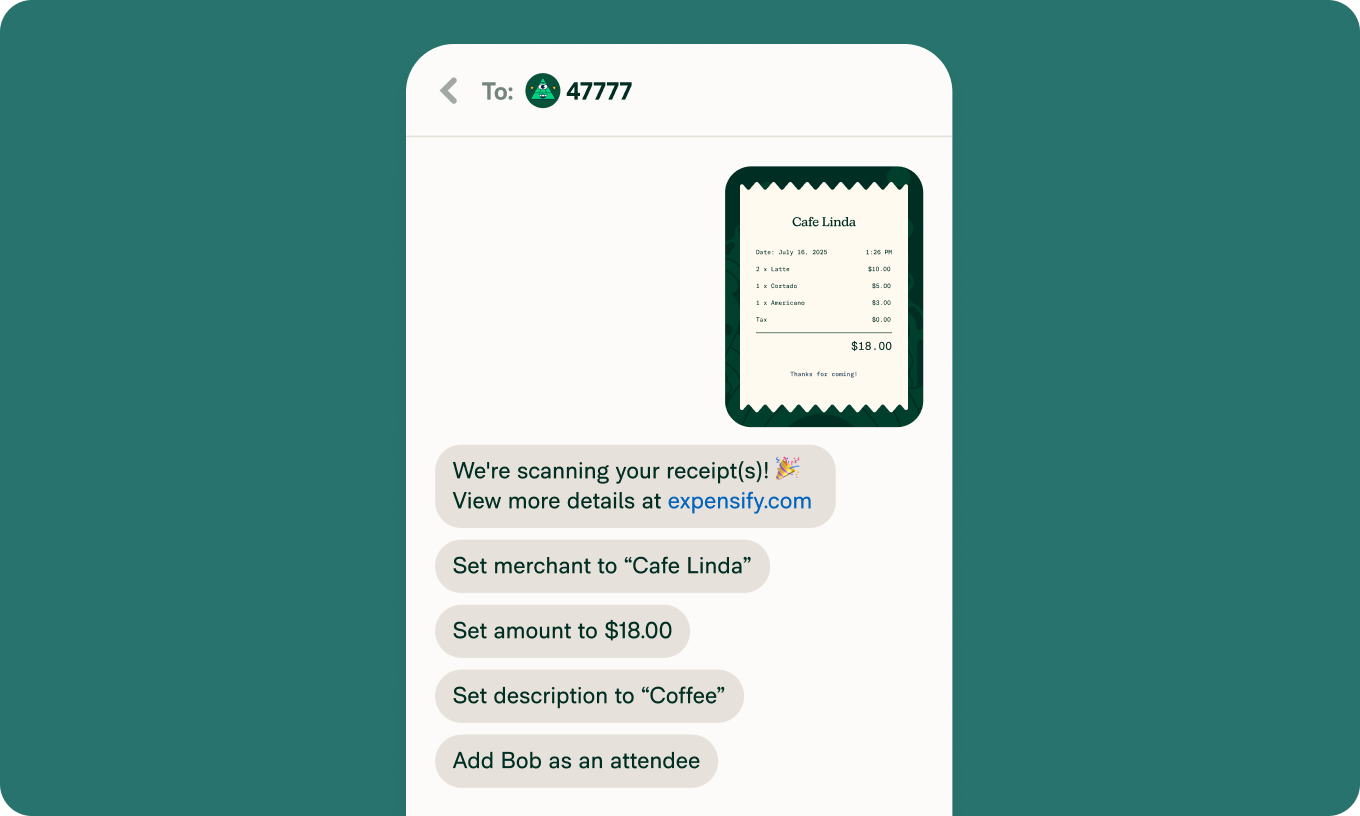

Forget fumbling with apps when you're buying that emergency USB cable or grabbing coffee during a client meeting. With Expensify, you can text photos of receipts directly to 47777 from your US phone number. The receipt gets automatically processed, categorized, and added to your expense report, even if you're knee-deep in a project and can't open the app.

This is perfect for those scattered miscellaneous purchases that happen throughout the day. James from our IT consulting example could text his parking receipt while walking back to his car, and Maria could snap her font purchase receipt between client calls.

SmartScan eliminates guesswork

Expensify's SmartScan technology doesn't just read receipts. It learns your spending patterns. After processing a few miscellaneous expenses, it starts recognizing when you buy office supplies versus professional development materials and suggests the right categories automatically.

The system gets smarter over time, reducing the mental load of categorizing those random purchases that used to eat up your time during monthly reconciliation.

Realtime expense tracking

See your miscellaneous spending as it happens rather than getting surprised at month-end. Expensify's realtime reporting shows exactly where your "other" expenses are going, helping you spot patterns and make better budgeting decisions.

Integration that actually works

Expensify syncs seamlessly with accounting software, so those multiple small miscellaneous transactions don't become a data entry nightmare. Each categorized expense flows directly into your books with the proper documentation attached.

The platform handles everything from receipt capture to reimbursement, making it easy to maintain the detailed records you need for tax deductions while keeping the process fast enough for busy business owners.

Take control of all your expense categories with Expensify

Miscellaneous expenses don't have to be mysterious or unmanageable. With the right approach and tools, these scattered costs become just another organized part of your expense management process. Stop letting small, uncategorized expenses create big headaches during tax season.

Expensify simplifies tracking miscellaneous expenses with automated categorization, mobile receipt capture, and realtime reporting. Whether you're managing a few dozen expenses per month or handling complex multi-location spending, the platform scales to meet your needs while maintaining the accuracy and documentation you need for taxes and financial reporting.

Ready to transform your expense management from chaos to clarity? Enter your information below, and we'll take it from there.

FAQs about miscellaneous expenses

-

The meaning of miscellaneous expenses refers to the "everything else" bucket for legitimate business expenses that are typically infrequent, small-dollar amounts, or one-off purchases.

-

Use specific, consistent subcategories that align with IRS business expense categories. Instead of generic "miscellaneous," try categories like "office supplies," "professional development," or "business gifts." This makes tax preparation easier and provides better audit documentation. Consider using expense codes or tags that match your accounting software's chart of accounts.

-

The most effective approach combines three elements:

Mobile receipt capture: Use your phone to photograph receipts immediately

Consistent categorization: Add brief notes about business purpose

Regular review: Categorize expenses within a few days while details are fresh

Set up automatic syncing with your accounting software to eliminate manual data entry.

-

Most miscellaneous business expenses can be reimbursed if they're pre-approved and follow company policy. The key is getting approval before making purchases when possible and providing clear documentation of business necessity. Some companies set dollar limits for miscellaneous reimbursements or require manager approval above certain amounts.

-

Most small businesses find that miscellaneous expenses represent up to 20% of their total operating expenses. Start by tracking these expenses for a few months to establish patterns, then budget slightly above your average to account for unexpected needs. Review and adjust your budget quarterly based on actual spending patterns.

Consider setting aside a specific amount for miscellaneous expenses per month based on your historical data. For example, if your average monthly miscellaneous spending is $200, budget for $250 to provide a cushion for unexpected purchases.

-

Look at the past 12 months of miscellaneous spending, identify seasonal patterns, and add a 10% to 15% buffer for unexpected expenses. Break down spending by subcategory to identify trends. You might find that "office supplies" happens quarterly, while "professional development" clusters around industry conference seasons.

-

In accounting terms, miscellaneous expenses are legitimate business costs that don't fit into major expense categories but are necessary for business operations. They're typically recorded as operating expenses and can be deducted from taxable income when properly documented. The key is ensuring they meet the "ordinary and necessary" business expense criteria.