Solving common employee problems with receipt reimbursement

Sarah returns from a business trip clutching faded receipts like winning lottery tickets. Half are unreadable thermal paper ghosts, while the rest vanished somewhere between the airport and her desk. Now she's squinting at blank paper, Googling "how to read faded receipts," and facing the dreaded incomplete expense report email.

Receipt reimbursement doesn't have to be this painful. It's simply how companies pay employees back for business expenses using proper documentation.

In this guide, we’ll break down why traditional receipt processes make everyone miserable, what actually makes a reimbursement receipt valid, and how to ditch the paper trail nightmare for something that actually works.

Key takeaways

- Manual receipt tracking often delays employee payouts by weeks

- One in five expense reports contains errors or missing information

- Poor documentation puts companies at risk for IRS audit failures and lost tax deductions worth thousands

- Modern expense report software with receipt management eliminates lost receipts through automated capture and realtime processing

- Smart receipt reimbursement apps like Expensify auto-scan, categorize, and match receipts to transactions instantly

What is receipt reimbursement?

Receipt reimbursement is how companies pay employees back for approved business purchases they made with personal funds. The receipt serves as proof the expense happened and validates the amount, making it essential for company policy compliance and tax deductions.

Think of it as the corporate equivalent of your friend paying you back for picking up their coffee, except with way more paperwork and IRS rules involved.

Receipt reimbursement vs other types of reimbursement

Unlike mileage reimbursement which uses standard rates or per diem that gives fixed daily amounts regardless of spending, receipt reimbursement requires actual proof of purchase.

Companies need to see exactly what employees bought, when they bought it, and how much they spent.

No receipts? No reimbursement.

Examples of reimbursable expenses that require receipts

The usual suspects for receipt for reimbursement include:

Business meals with clients or colleagues

Travel expenses like flights and hotels

Office supplies purchased for work

Professional development and training costs

Client gifts under IRS limits

Conference registration fees

IRS expense reimbursement receipt requirements kick in for any business expense over $75, though smart companies often set lower thresholds to keep better track of spending and maintain employee expense reimbursement compliance.

Why receipts matter for reimbursements

Receipts aren't just crumpled pieces of paper cluttering your wallet. They're legal proof that business transactions happened. They prevent fraudulent claims, create audit trails, and let companies claim legitimate tax deductions. Without them, reimbursement expense receipts become worthless pieces of paper.

The IRS receipt rule ($75 threshold)

The IRS requires businesses to keep receipts for any expense over $75, with some exceptions. Lodging always needs receipts regardless of amount, and certain transportation costs have different rules. Digital receipts and e-receipts count just as much as paper ones, as long as they show merchant name, date, amount, and business purpose.

Receipts help prevent fraud and budget leakage

According to the Association of Certified Fraud Examiners' 2024 report, organizations lose an estimated 5% of annual revenue to fraud. Proper receipt documentation significantly reduces opportunities for dishonest expense claims by verifying purchases actually happened, confirming amounts weren't inflated, and providing the detail needed to spot suspicious spending patterns.

Read more on the blog: Strategies to prevent expense fraud

Receipts create audit-proof documentation

When auditors come calling, receipts become your financial lifeline. They back up expense deductions, prove business purposes, and show your company maintains proper controls. Without solid receipt documentation, companies risk losing valuable tax write-offs and facing penalties. E-receipts carry the same legal weight as paper ones, making digital capture both convenient and compliant.

Common receipt reimbursement problems employees face

Traditional receipt tracking creates a perfect storm of frustration that makes employees dread expense reporting more than root canals.

Lost receipt for expense report disasters

The most universal problem? Keeping track of tiny pieces of thermal paper. Employees forget to ask for receipts, lose them in the daily shuffle, or accidentally toss them with lunch trash. Business travelers get hit especially hard, juggling receipts from multiple vendors while managing actual work responsibilities.

Paper receipts fade faster than summer tans

Thermal paper receipts start fading the moment they're printed. Heat, sunlight, or even wallet friction makes them disappear completely. Employees return from trips with perfectly organized receipts that become illegible ghosts by submission time.

Unclear policies create reimbursement roulette

Many employees operate in policy gray areas, uncertain about what's reimbursable, when receipts are required, or submission deadlines. This uncertainty leads to delayed claims, rejected expenses, and frustrated workers who feel penalized for spending personal money on company business.

Manual tracking wastes everyone's time

Research shows it takes 20 minutes to complete one expense report, with corrections adding another 18 minutes. Employees waste hours on administrative busywork instead of revenue-generating activities. Paper receipt organization requires dedicated systems most people don't have time to maintain.

What should a receipt for reimbursement include?

Valid reimbursement receipts need specific information to satisfy company policies and IRS requirements. Missing elements can torpedo reimbursement requests.

Standard info to look for on receipts

Every legitimate receipt for reimbursement of expenses should include:

Merchant or vendor name

Purchase date

Total amount paid

Itemized breakdown of purchases

Payment method details

Missing any of these elements can delay reimbursement or trigger expense rejection faster than you can say "lost receipt for expense report."

Digital receipts and screenshots that actually work

Digital receipts from email confirmations or apps work perfectly, often better than paper since they don't fade or get damaged. Screenshots of mobile payments count too, as long as they show required information clearly. The key is ensuring digital receipts remain legible and contain the same details found on paper versions.

When a receipt is not required

The IRS allows businesses to reimburse expenses under $75 without receipts, though companies can set stricter policies. Lodging expenses always require receipts regardless of amount. Some mileage and per diem arrangements eliminate receipt requirements entirely by using standard rates. Itemized receipts for reimbursement become crucial when you need to prove exactly what was purchased for tax purposes.

How to improve your receipt reimbursement process

Smart companies eliminate receipt chaos by automating tedious manual steps and making expense policies crystal clear.

Create bulletproof expense policies

Start with comprehensive policies that eliminate guesswork:

What expenses qualify for reimbursement

When receipts are required vs. optional

Submission deadlines that actually make sense

Clear approval workflows

Employees should never have to play "guess the policy" when submitting expenses. Clear rules reduce confusion, speed approvals, and create consistency across your organization.

Standardize workflows to eliminate bottlenecks

Centralize expense approvals through designated managers and establish realistic processing timelines. Employees should know exactly where to submit expenses, who reviews them, and when they'll get paid. Standardized workflows prevent expenses from disappearing into bureaucratic black holes.

Ditch manual processes for expense report software with mobile receipt upload

Manual receipt tracking belongs in the corporate museum of terrible ideas. Modern expense report software with receipt scanning automatically captures receipts, extracts data, and syncs everything to accounting systems in realtime. Digital automation eliminates lost receipts, reduces processing time, and creates better audit trails than manual paper-shuffling.

The Expensify solution: receipt reimbursement that actually works

Expensify transforms receipt reimbursement from a soul-crushing administrative nightmare into seamless background automation that works while employees focus on actual business.

Faster: Everything syncs in realtime

With Expensify's Visa Commercial Card® and automated expense tracking, transactions and receipts match instantly as purchases happen. Realtime sync means current books, faster reimbursements, and month-end reports that close without chasing missing documentation. Global reimbursements happen automatically once expenses get approved.

Easier: The ultimate receipt reimbursement app

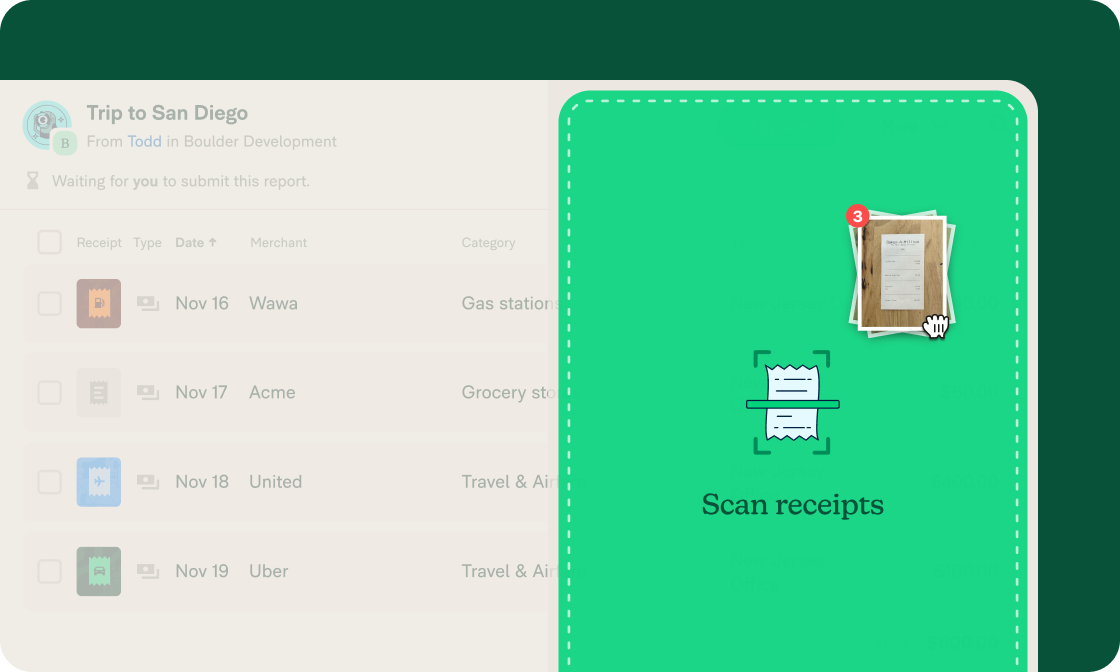

SmartScan technology reads receipts instantly, extracting merchant names, dates, amounts, and categories without manual data entry. Employees can:

Snap photos with the mobile app

Forward email receipts automatically

Text receipts to 47777 (US numbers only) for instant processing

The receipt scanning app turns smartphones into powerful expense tracking tools that capture receipts faster than they can get lost.

Smarter: E-receipts eliminate receipt stress

Expensify's integrations automatically pull receipts from Uber, Lyft, and other major vendors without employees lifting a finger. These e-receipts populate expense reports automatically through seamless integrations, eliminating the need to save and organize paper receipts. When receipts appear instantly in your expense system, there's zero opportunity for them to vanish.

What to do if you lose a receipt for an expense report

Lost a receipt? Don't panic. Many companies accept credit card statements, email confirmations, or sworn statements for smaller amounts. The key is notifying finance teams quickly and providing alternative documentation when possible. Better yet, use mobile apps to photograph receipts immediately after purchases to prevent loss in the first place.

Say goodbye to receipt reimbursement headaches

Employees shouldn't lose money or waste time because of archaic manual processes and missing paper receipts. Expensify automates receipt capture, streamlines reimbursement workflows, and eliminates administrative guesswork – no delays, no lost paperwork, no headaches. Get started today by clicking on the button below.

FAQs about receipt reimbursement

-

The IRS requires receipts for business expenses over $75, but companies can set stricter policies requiring receipts for smaller amounts. Even when receipts aren't legally required, having them strengthens expense documentation and simplifies audit defense. Lodging expenses always need receipts regardless of amount.

-

Don't panic – lost receipts aren't career-ending disasters. Many companies accept credit card statements, email confirmations, or sworn statements for small amounts. Notify your finance team immediately and provide alternative documentation when possible. Prevention works better: use mobile apps to photograph receipts right after purchases.

-

Valid receipts include merchant name, purchase date, total amount, itemized list of purchases, and payment method. Digital receipts, email confirmations, and mobile payment screenshots all count as long as they contain this information clearly. Faded, illegible, or incomplete receipts may get rejected during approval.

-

Screenshots of digital receipts work perfectly as long as they show all required information clearly. Credit card statements alone usually aren't sufficient because they don't show what was purchased, but they can supplement other documentation when proving legitimate business expenses occurred.

-

Absolutely. Digital receipts carry identical legal weight to paper ones and often provide better documentation because they don't fade or get damaged. Email receipts, app confirmations, and PDF invoices are all acceptable. Many companies prefer digital receipts because they're easier to store, search, and audit.

-

Foreign receipts work fine as long as they contain required information. You may need to provide currency conversion rates for purchase dates. Many expense management systems handle currency conversion automatically, making international receipt processing seamless for global teams.

-

Uber automatically emails receipts after each ride, and these digital receipts work perfectly for reimbursement. With Expensify, Uber receipts import automatically without manual work. Email receipts contain all required information: date, amount, trip details, and payment method.

-

No, an expense report summarizes multiple expenses while receipts prove individual purchases occurred. Expense reports compile receipts for submission and approval, but the underlying expense report receipt provides actual documentation supporting each expense claim. Think of expense reports as the cover letter and receipts as the supporting evidence.

-

Proof of expenses includes original receipts, email confirmations, invoices, credit card statements (when paired with receipts), and digital payment confirmations. The strongest proof shows exactly what was purchased, when, how much it cost, and that payment occurred. Multiple documentation forms strengthen expense claims.

-

Expensify handles both expense tracking and client invoicing in one integrated platform. Track business expenses with automated receipt capture, then create professional invoices for clients. The integrated approach means expense data flows directly into client billing, eliminating duplicate data entry and keeping everything organized.

-

The best expense report software with receipt management automates the entire process from capture to reimbursement. Look for mobile receipt scanning, automatic data extraction, realtime categorization, and seamless accounting integrations. Expensify leads with SmartScan technology, e-receipt automation, and the industry's fastest processing times.

-

Modern expense platforms combine receipt tracking with automated reporting in single solutions. The key is finding expense report software with mobile receipt upload that captures receipts instantly, processes them automatically, and generates reports without manual data entry. This integrated approach eliminates traditional disconnects between receipt collection and expense reporting.

-

Corporate travel requires specialized expense management with complex approval workflows, travel policy enforcement, and detailed compliance reporting. Expensify's travel expense reimbursement features handle business travel specifically, with automatic receipt matching, policy violation detection, and comprehensive audit trails that satisfy corporate compliance requirements.