What you need to know about Ireland Revenue's enhanced reporting requirements

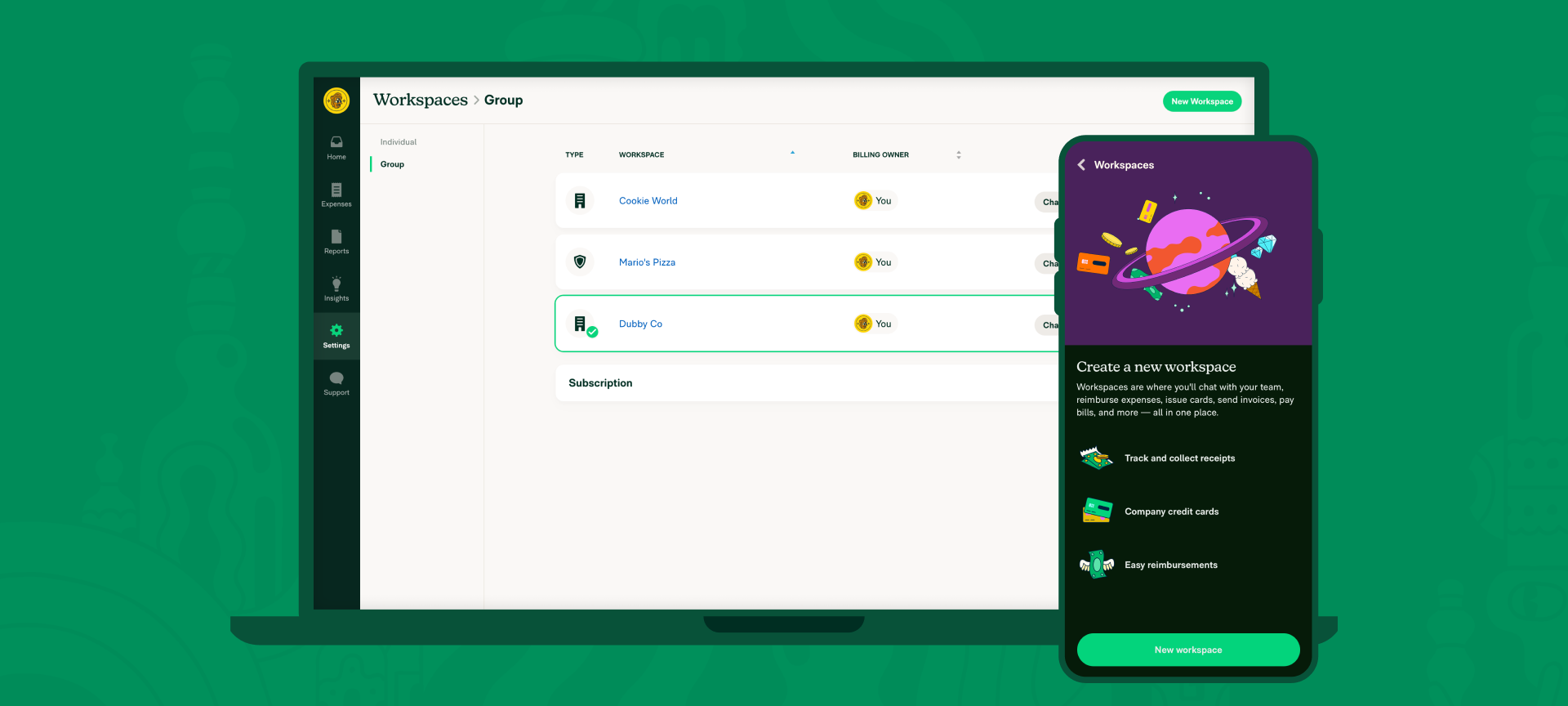

This blog explains how finance teams can leverage Expensify as part of their accounting ecosystem to ensure that they report on their T&E spend to Ireland Revenue correctly.