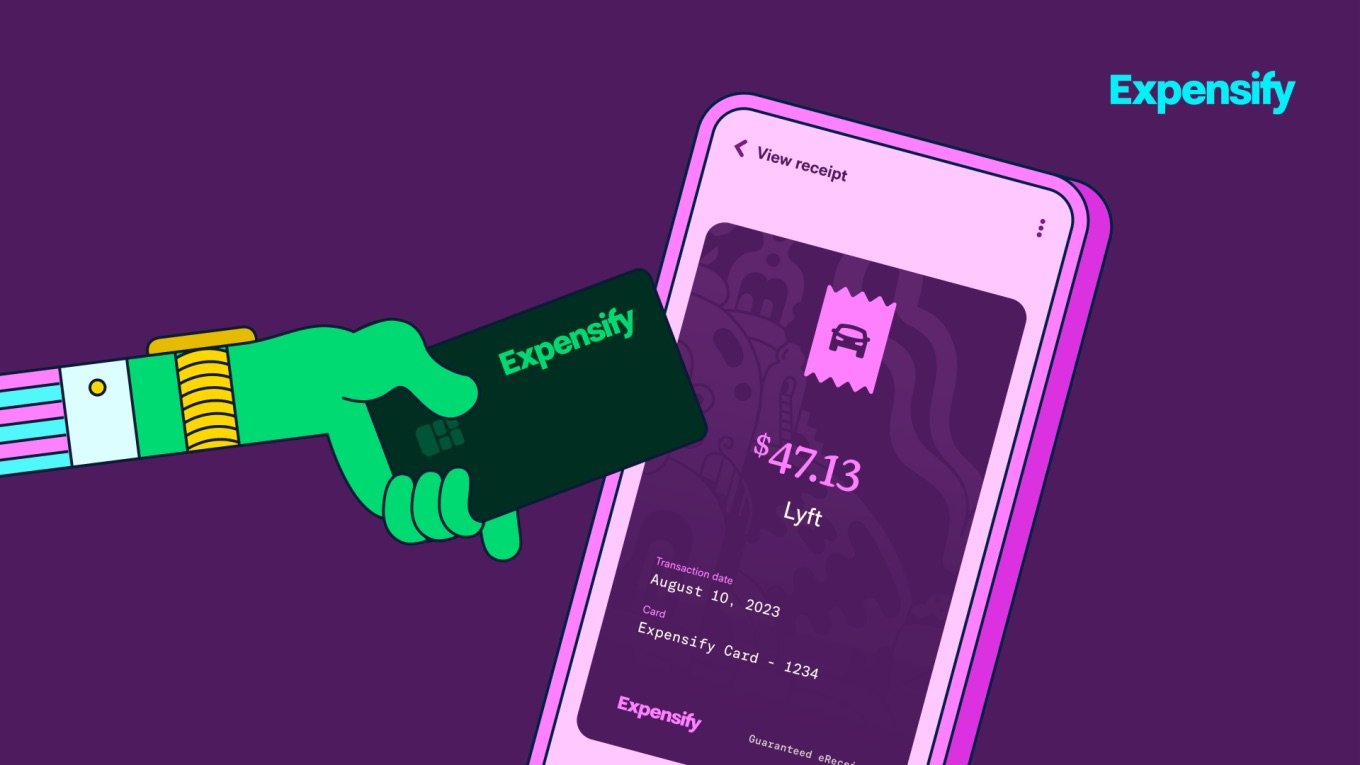

eReceipts: Everything you need to know & more!

E-receipts are more common than ever and offer plenty of benefits that their paper counterparts don’t. But what happens when tax season rolls around? And how can you convert a pesky paper receipt into a convenient digital receipt?